Highlights

- Appia Rare Earths signs binding term sheet to sell 50% of Brazilian PCH rare earth project to Ultra Rare Earth Inc.

- Initial mineral resource estimate reveals 6.6 million tonnes of Indicated resources and 46.2 million tonnes of Inferred resources in Goiás State.

- U.S. investment aims to strategically position itself in the global rare earth supply chain outside of China.

Appia Rare Earths & Uranium Corp. has signed a binding term sheet to sell nearly half of its Brazilian subsidiary—holder of the PCH rare earth project in Goiás State—to a newly created U.S. entity called Ultra Rare Earth Inc. The transaction, if completed, shifts 50% ownership of the project into U.S.-aligned hands: Ultra at 50%, Appia at 25%, and local partner Antonio Vitor Junior at 25%. The plan is for Ultra to inject $6 million directly into project exploration, plus $2 million into Appia stock, funding work through to a prefeasibility study (PFS).

The Project

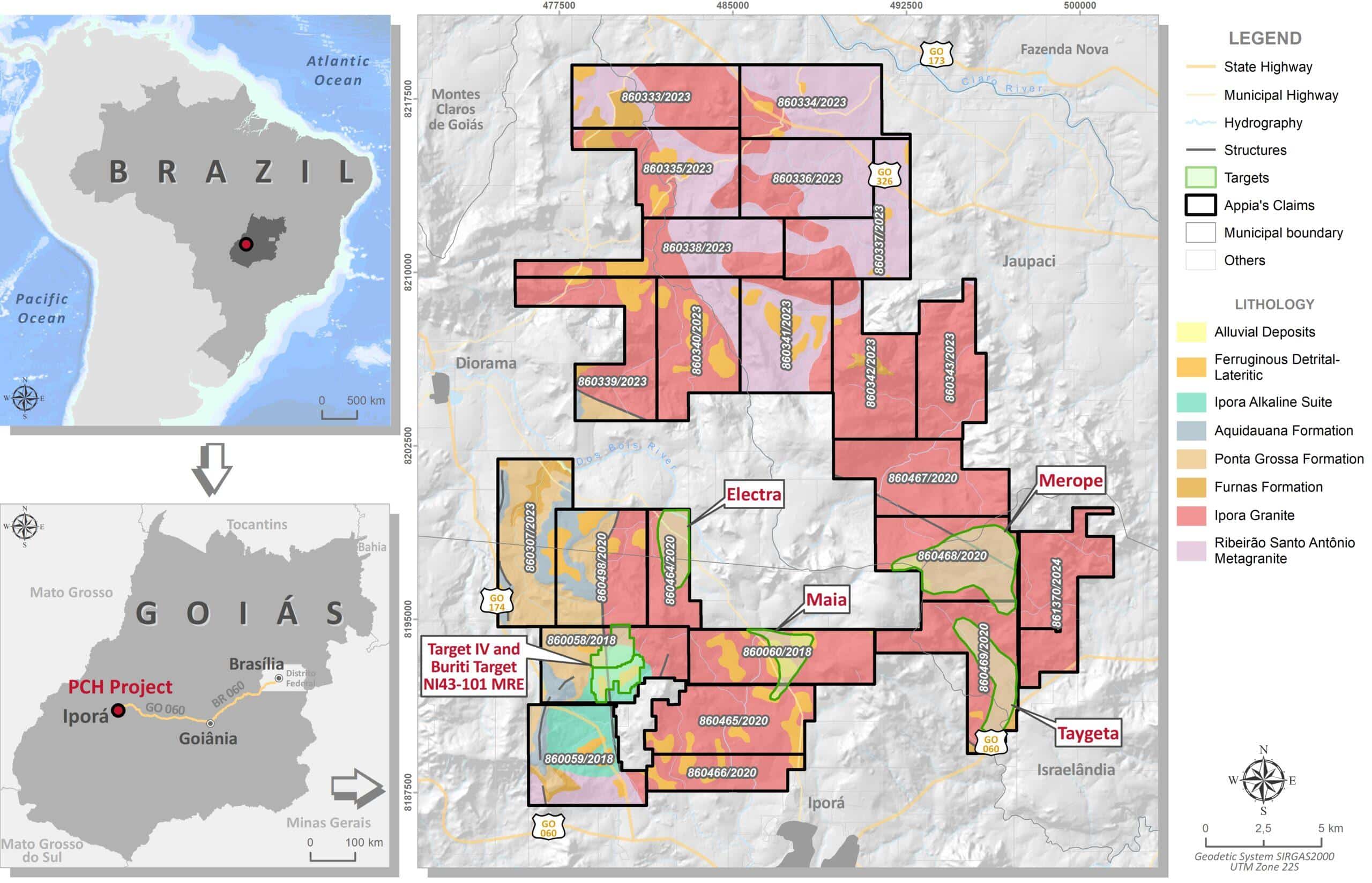

Appia Rare Earths’ PCH Project in Goiás, Brazil, continues to advance with exploration that has revealed diverse mineralization styles, including a newly identified high-grade zone at Target IV. The project’s initial mineral resource estimate, released in March 2024, outlined 6.6 million tonnes of Indicated resources grading 2,513 ppm TREO and 46.2 million tonnes of Inferred resources grading 2,888 ppm TREO, based on 147 RC holes and one DDH.

Subsequent work has confirmed encouraging rare earth oxide recoveries at new targets—Maia, Electra, Taygeta, and Merope—located on the Ipora Granite unit, where additional auger drilling is underway. Under an earn-in agreement, Appia aims to secure up to a 70% stake by 2028, reinforcing its long-term commitment. Strategically positioned just 216 km from Goiânia and 410 km from Brasília, and only 30 km from Iporá with its skilled workforce and infrastructure, the project benefits from excellent road access, power, and water resources. Beyond rare earths, the property also holds potential for niobium and scandium, broadening its economic significance and growth potential.

Just the Facts

The structural details are straightforward: Ultra’s $6 million exploration commitment, the private placement, and the rebalancing of ownership stakes are spelled out with precision in Appia Rare Earths & Uranium’s latest news account. The technical committee governance structure—including an independent geologist as tie-breaker—also reflects standard practice. These are verifiable facts that signal a genuine, arms-length investment transaction.

Some Details

CEO Tom Drivas stresses that U.S. ownership will “better access” American capital markets and unlock value for shareholders. That’s a sales pitch more than a proven fact. Ultra is essentially a financing vehicle set up by mining investors Regent Advisors (opens in a new tab) and Regent Mercantile Holdings (an investment arm of the Dattels family (opens in a new tab) and involved in a 2023 ownership change with mineral and metals dealer Traxys); whether it can tap deeper U.S. capital pools remains to be seen. Investors should also note the heavy use of forward-looking language—“better realization of value,” “favorable markets”—that points more to aspiration than guarantee.

The Subtext Investors Should Catch

This deal is not just about Appia raising money. It underscores a strategic undercurrent: U.S. financial actors are moving into Brazilian ionic clay rare earths, seeking security of supply outside China. Ionic clays—known for easier processing—are rare outside Asia. That makes PCH geopolitically relevant, even if it’s still years from commercial output. Also, we note groups such as Appia see the United States as the nexus of the ex-China rare earth market, seeking more access.

The release does not cross into misinformation, but it does lean on marketing gloss. The idea that shifting equity into a Delaware corporation automatically ensures superior capital access is speculative. Likewise, the implied inevitability of a PFS and Ultra’s potential to consolidate 100% control are highly conditional.

Why This Matters to the Supply Chain

The notable piece here is the U.S. footprint. If Ultra succeeds in funding PCH to PFS, Washington, via U.S.-based investors, gains indirect influence over a Brazilian ionic clay project. In today’s geopolitical chessboard, that’s more than a footnote—it’s a potential lever in the global rare earth supply chain.

Appia—Ultra PCH Deal: Key Terms at a Glance

| Category | Details |

|---|---|

| Project | PCH Ionic Adsorption Clay REE Project, Goiás State, Brazil |

| Ownership Post Deal | Ultra Rare Earth Inc. – 50% Appia Rare Earths – 25% Antonio Vitor Junior – 25% |

| Funding Commitment | Ultra to deposit US$6M in Brazil for exploration through PFS |

| Private Placement | US$2M in Appia units at C$0.50 each; half-warrant exercisable at C$0.70 (24 months) |

| Use of Funds | US$6M earmarked for drilling & studies to PFS US$2M for Appia working capital |

| Governance | 5-person Technical Committee: 2 Ultra reps, 1 Appia, 1 Antonio, plus independent geologist tie-breaker |

| Next Milestone | Completion of prefeasibility study (PFS) |

| Future Option | Upon PFS, Ultra may acquire 100% of project by issuing 25% equity stakes in Ultra to Appia and Antonio |

| Closing Conditions | Regulatory approvals, definitive agreements, due diligence (by Sept. 30, 2025) |

| Scheduled Closing | On or before October 31, 2025 |

©!-- /wp:paragraph -->

0 Comments