Highlights

- India aims to become a democratic alternative to China in rare earth mineral supply.

- India has 6.9 million metric tonnes of proven rare earth mineral reserves.

- Government initiatives and public-private partnerships are advancing green extraction and magnet recycling technologies.

- Quad alliances position India as a potential diversification node in the global rare earth market.

- Commercial-scale production remains a future goal for India.

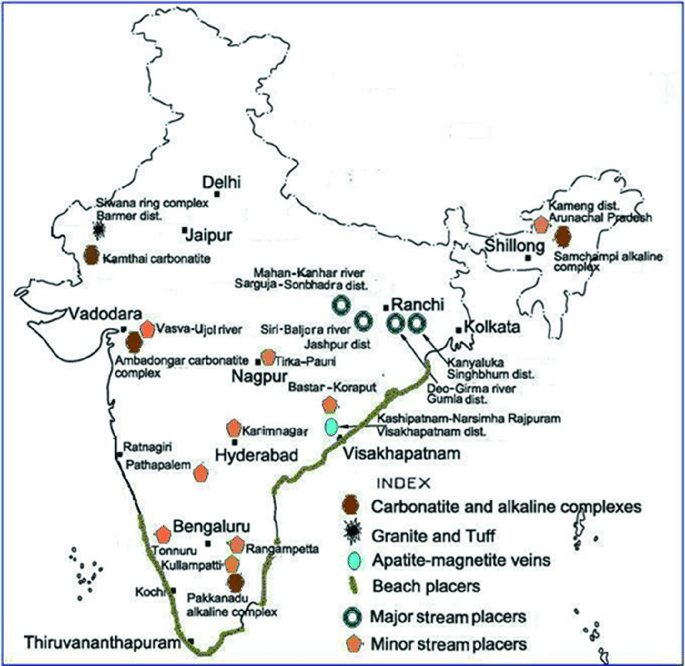

Is there a new contender in the mineral chessboard? Upasna Mishra’s Telegraph op-ed (opens in a new tab), “A Quiet Revolution: India is Emerging as an Alternative in the Global Supply Chain of Rare Earth Elements” (October 8, 2025), reads as a strong, data-driven narrative about India’s ascent in the global rare earth value chain. She lays out a compelling case: India’s 6.9 million metric tonnes of proven reserves, spanning the monazite-rich sands of Kerala and Odisha to potential heavy rare earths in Rajasthan, position the nation as a “democratic alternative” to China’s dominance.

Much of this is accurate — India does possess significant monazite and bastnäsite-bearing coastal deposits. The government’s National Critical Mineral Mission and the expanded role of Indian Rare Earths Limited (opens in a new tab) (IREL) are legitimate developments. So are the reported public-private initiatives — such as Tata Chemicals’ partnership with IIT Madras (opens in a new tab) (inked back in 2021 to start) — targeting green extraction and magnet recycling technologies.

Between Strategy and Sales Pitch

Where the article leans more aspirational is in its timeline and industrial feasibility. Mishra writes that India aims to meet 15% of global light REE demand and 7% of heavy REE demand by 2030 — an ambitious projection given current refining capacity, which remains well below 2% of global output. While policy momentum is undeniable, processing infrastructure and environmental compliance hurdles could stretch this target into the 2035 horizon.

Her portrayal of sweeping “regulatory rationalisation” also deserves context: India has indeed shortened approval windows and launched incentives, but waste-handling reforms and radiation safety oversight in monazite-rich regions remain bureaucratically complex. The op-ed’s upbeat framing softens these frictions.

India Rare Earth Deposits

Diplomacy Meets Geology

Mishra rightly highlights the Quad’s critical minerals cooperation, with Australia, Japan, and the U.S. co-funding exploration and magnet manufacturing initiatives. These alliances are factual and geopolitically significant — positioning India as a counterbalance in the Indo-Pacific REE network. What’s less certain is the pace of domestic value-chain integration; co-funding and pilot plants don’t yet equate to commercial-scale magnet production.

Why It Matters for Investors

For the global rare earth market, India’s narrative represents more than national pride — it’s a signal. If even part of this roadmap materializes, India could become a vital diversification node between Australian mines and Japanese downstream users. Yet, investors should temper their enthusiasm: the op-ed’s confident tone understates how long it takes to transition from laboratory separation to scalable production.

In short: India’s rare earth revolution is real, but still in rehearsal.

Citation: Upasna Mishra, “A Quiet Revolution: India is Emerging as an Alternative in the Global Supply Chain of Rare Earth Elements,” The Telegraph, October 8, 2025.

©!-- /wp:paragraph -->

0 Comments