Highlights

- Niron Magnetics and Stellantis are developing rare-earth-free electric motors using Iron Nitride (Fe₁₆N₂) technology.

- The project is backed by $2.7M in DOE funding.

- The Minnesota facility will produce 1,500 tons of magnets annually.

- The production will utilize abundant iron and nitrogen.

- This initiative will create 175 jobs.

- It aims to reduce foreign supply chain dependence.

- If successfully scaled, Iron Nitride magnets could rival neodymium-iron-boron performance.

- The technology has the potential to reshape magnet manufacturing across EVs, wind turbines, and aerospace sectors.

In a year defined by tariff tantrums and export controls, one headline cuts against the grain: Niron Magnetics has teamed up (opens in a new tab) with Stellantis (opens in a new tab) to build electric motors without rare earths. Backed by $2.7 million from the U.S. Department of Energy’s Advanced Materials and Manufacturing Technologies Office (opens in a new tab) (AMMTO), this Minnesota-based venture aims to commercialize Iron Nitride magnets—a technology that could loosen Beijing’s near-total grip on the permanent magnet market.

At first glance, this might sound like déjà vu. Many companies have claimed to “replace rare earths.” Few have managed to do so while matching performance, scalability, and efficiency. Yet Niron’s Iron Nitride (Fe₁₆N₂) material isn’t alchemy—it’s a genuine metallurgical breakthrough, combining high magnetic saturation with stable performance at elevated temperatures.

The Facts Behind the Flash

Here’s what’s real: Niron’s Sartell, Minnesota facility—now under construction—will produce 1,500 tons of magnets annually, creating 175 full-time jobs. These magnets will be made from abundant iron and nitrogen, elements the U.S. can easily source domestically. The collaboration with Stellantis builds on a 2023 investment via Stellantis Ventures (opens in a new tab), a move that signaled early confidence in Niron’s rare-earth-free promise.

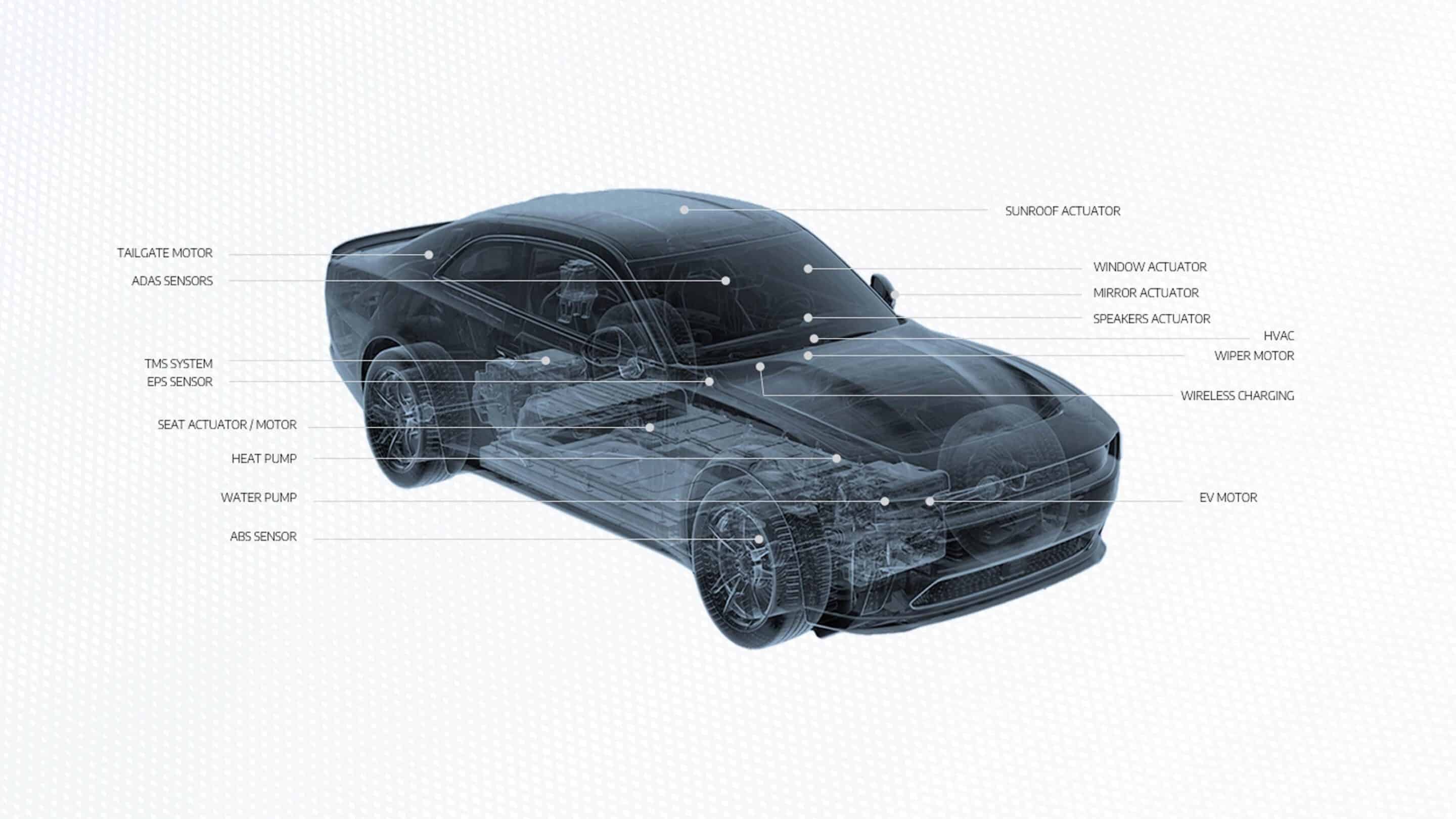

The project’s scope—developing “variable flux field intensifying motors”—suggests Stellantis sees this as more than a PR exercise. It’s a technical bet that these magnets can outperform or at least rival the neodymium-iron-boron standard in key EV systems like traction motors and steering units.

Speculation and Spin Control

The tone of the original report leans optimistic but not delusional. There’s no overt misinformation—though the phrase “reducing dependence on foreign-dominated supply chains” glides over a complex reality. Even a rare-earth-free magnet must compete with Chinese firms that dominate motor design, coating chemistry, and downstream integration. Replacing the magnet alone doesn’t decouple the value chain overnight.

Still, what makes this story credible is timing. As Beijing tightens export licensing on NdFeB magnets, Washington’s R&D dollars are finally backing serious alternatives.

Why It Matters

If Iron Nitride scales successfully, it won’t just diversify supply—it could redraw the map of magnet manufacturing. For investors, the takeaway is clear: Niron isn’t simply a lab curiosity—it’s the tip of a U.S. industrial pivot toward de-risked electrification. A successful rollout could ripple far beyond Stellantis, touching sectors from wind turbines to aerospace.

The magnet wars have a new contender—and this one runs on iron, not fear.

©!-- /wp:paragraph -->

0 Comments