Highlights

- Brazil's mining investments are projected to reach $68.4 billion by 2029.

- Rare earth elements in Brazil are expected to see the sharpest growth at 49%.

- This growth is driven by demand from the EU and U.S. for non-Chinese supply alternatives.

- Despite optimistic projections, Brazil claims to hold the world's second-largest reserves.

- Brazil lacks integrated mine-to-magnet capabilities.

- Environmental permitting hurdles could limit Brazil's actual output.

- Without domestic separation and refining infrastructure, Brazilian rare earths risk becoming export commodities for Chinese processors.

- Unlike Brazil, projects focused on vertically integrated operations exist in Angola and the U.S.

When Agência Brasil reports (opens in a new tab) that Brazilian rare earth investments will surge 49% by 2029, it’s more than a statistic—it’s a signal. Latin America’s largest economy, long defined by iron ore and niobium, is now positioning itself as a major player in the global race for strategic minerals. Yet behind the bullish headline lies a more nuanced story—one part ambition, one part geopolitical necessity.

The Headline vs. the Bedrock

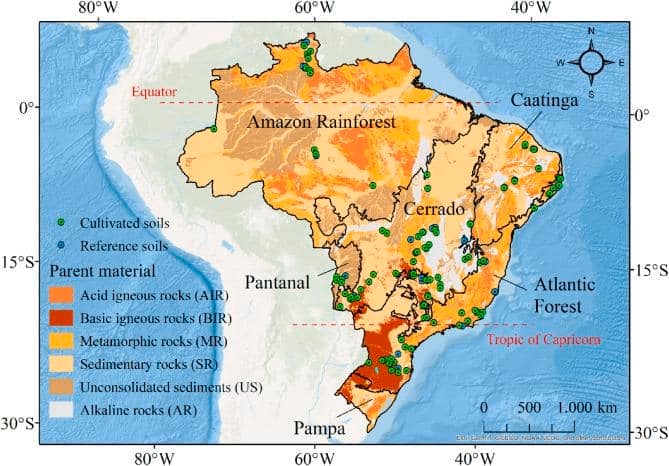

According to the Brazilian Mining Institute (IBRAM), total mining investment from 2025–2029 will reach $68.4 billion, with rare earths seeing the sharpest percentage growth. That figure likely reflects early-stage exploration and feasibility studies in Minas Gerais, Goiás, and Bahia, not yet large-scale production. Director Julio César Nery Ferreira’s assertion that demand projections from the EU and U.S. justify this expansion is credible—both regions are pushing for non-Chinese supply—but the claim that Brazil holds the “world’s second-largest reserves” remains unverified and open to interpretation. Geological estimates vary widely, and Brazil’s deposits are scattered, often in complex, monazite-heavy formations that are costly to process.

What’s Real—and What’s Rhetorical

There’s substance here: Brazil is finally waking up to its rare earth endowment. Several mid-tier miners and research consortia are exploring monazite and ionic clay resources, and the government has begun eyeing critical minerals as a pillar of industrial sovereignty. Yet Agência Brasil, as a state-owned outlet, paints a predictably optimistic picture—one that glosses over environmental permitting hurdles, refinery bottlenecks, and the absence of any integrated mine-to-magnet pathway.

Rare Earth Deposits Brazil

See Rare Earth Exchanges (REEx) coverage of the proposed mine-to-magnet integrated value chain in Minas Gerais. Or there is the tremendous promise with Brazilian Rare Earths (opens in a new tab) and its processing deal with processing expert Carester. Serra Verde ranks high on the REEx Light Rare Earth Element Project/Deposit Ranking database.

By contrast, countries like Angola, via Pensana Plc, and the U.S., through VAC’s Sumter, South Carolina project, are already establishing such vertically aligned chains—something Brazil has yet to execute. Without domestic separation and alloying capabilities, Brazilian rare earths risk becoming just another export commodity bound for Chinese refiners.

The Investor’s Lens

For global investors, the real question is whether Brazil’s 49% rise in projected spending translates into output—or just optimism. While the numbers excite, the infrastructure and policy framework lag. Still, if Brazil can replicate its success in niobium (where it dominates 85% of global supply), it could anchor South America’s contribution to the Western rare-earth realignment.

The story isn’t false—it’s just unfinished.

Source: Rafael Cardoso, Agência Brasil, Oct. 22, 2025.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments