Highlights

- Chinese study reveals a shift from China being a net exporter to a net importer by mass, but the country remains net positive by value.

- Functional materials, especially magnets, carried $122.9 billion in value flows from 2015-2022.

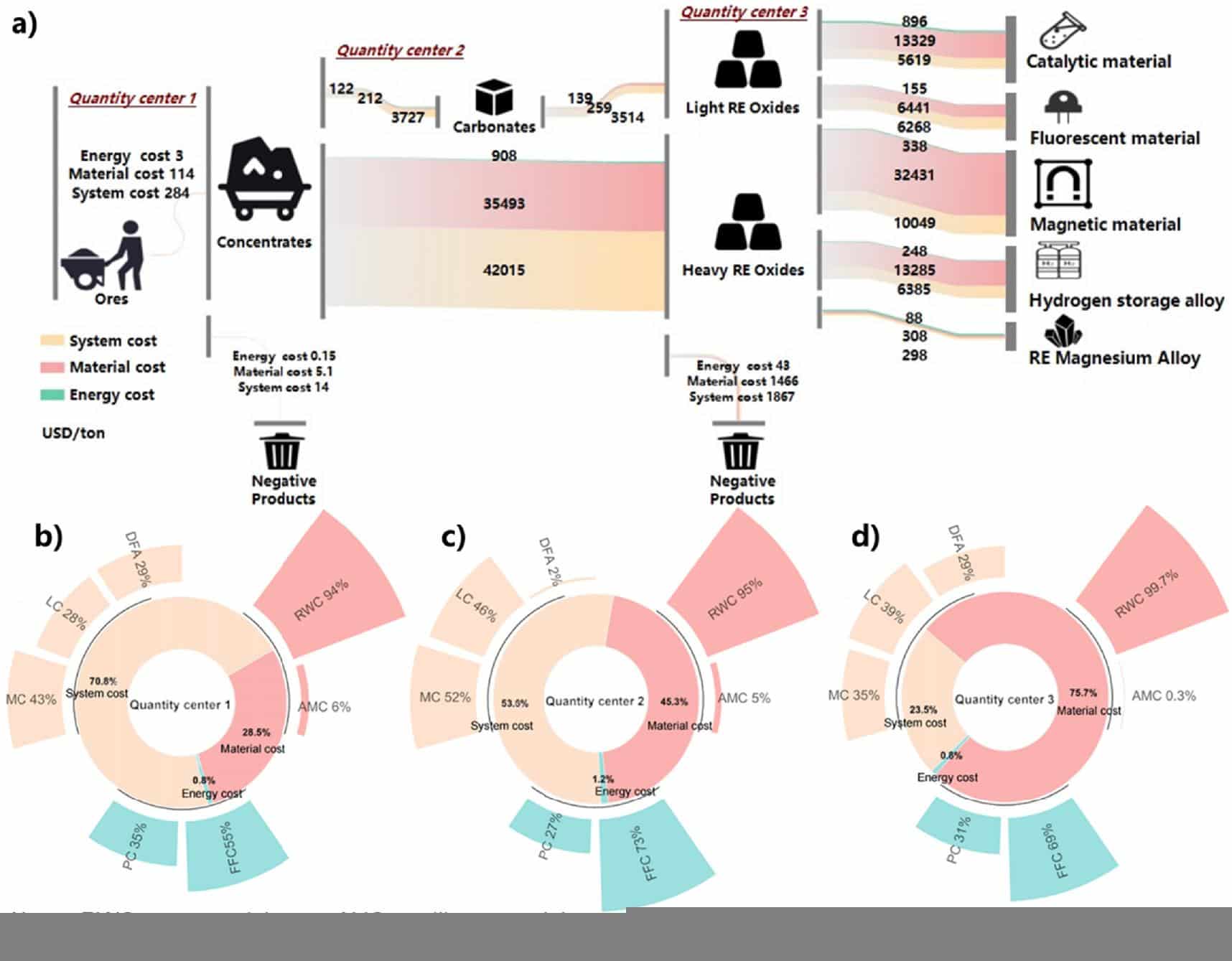

- The cost of heavy rare earth oxides is approximately $45,015 per ton, compared to $3,912 per ton for light rare earth oxides, creating a durable cost asymmetry and pricing power.

- Refining losses of about 10% and minimal recycling of less than 1% undermine circularity.

- The study confirms the REEx thesis: true independence requires midstream processing and magnet capacity, not just mining.

- The West remains about 10 years behind at the current pace without investment in separations, alloys, and manufacturing.

In a new open-access study led by Zewen Ge (Chinese research team; project support includes Shanghai Academy of Social Sciences), published in Environmental Research Communications (IOP), the authors map China’s 2015–2022 rare-earth material, cost, and value flows. They report 1,238 kt cumulative concentrate inflows (domestic mining dominant), heavy cost concentration in system + materials (>95%), HREO production costs around $45,015/ton vs LREO at $3,912/ton, and a structural shift: net importer by mass but net positive by value—with functional materials (especially magnets) carrying the largest value flows. Notably, the paper cites Rare Earth Exchanges (REEx) for supply-chain context.

Table of Contents

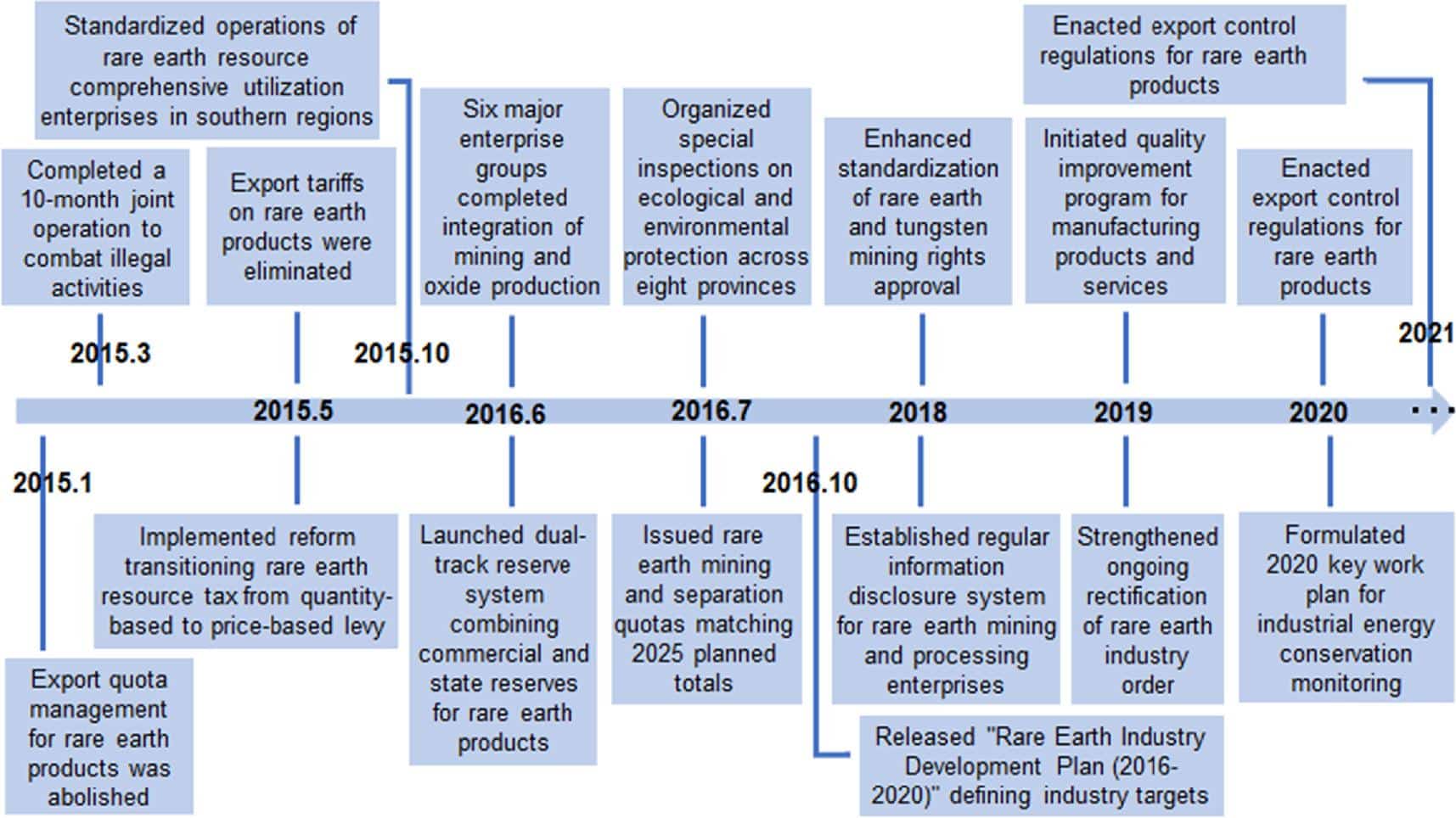

Rare earth policies and regulations in China from 2015 to 2022.

Magnet Country, Balance-Sheet State

The study shows what investors feel in prices: value migrates downstream. China’s functional materials tally $122.9B in value flows; compounds deliver the highest added value ($7.57B). Meanwhile, losses at refining/separation (10%) and <1% recycling mean most EoL REE content is landfilled, a drag on true circularity. Policy guardrails cut raw exports and widened import reliance on concentrates and primary products (net imports up 3.27× and 8.02×, respectively).

What It Means

- China still calls the tune: Even as a net importer by tonnage, it exports value via processing and functional materials.

- Heavy REEs are expensive to make—durable cost asymmetry (Dy/Tb) underpins persistent pricing power.

- Magnets are the money: the study’s flow accounting reinforces REEx’s view—midstream-to-magnet buildout is where sovereignty lives.

- For the West: this is confirmation that ore does not equal independence. Without continuous processing and magnet capacity, attempts to “mine our way free” stall—echoing REEx’s analyses that the West is ~10 years out at current pace.

Where the Paper Shines—and Where It Squints

Strengths: First integrated, national-scale Material Flow Analysis + Material Flow Cost Accounting across the full REE lifecycle; credible trade data (UN Comtrade/Customs); uncertainty handled via Monte Carlo.

Caveats: Time window (2015–2022); China-only (global substitution and non-Chinese tech advances are offstage); nominal prices; several parameters derived from yearbooks/industry reports; recycling estimates remain coarse. None of these overturns the core signal, but they bound generalization.

Average cost flows of rare earth elements from 2015 to 2022 in China (a), cost structure in quantity center 1 (b), quantity center 2 (c), quantity center 3 (d).

Investor Take: The Leverage Is in the Middle

REEx reads this as quantitative proof of a long-held thesis: control the separations, alloys, and magnets—or rent your future. If the West wants resiliency, it must fund process IP, people, and plants—not headlines. That aligns with our REEx reports:

- “Roadmap to Western Rare Earth Independence (With the Meter Running)”—why true autonomy is a decade-scale project.

- “The Great Relearning”—rebuilding an industrial state from operators up, not subsidies down.

REEx Retake

A Chinese team’s national material-and-money map confirms: magnets concentrate value, heavy REEs concentrate cost, and China’s role is shifting from miner to processing/value hub. For policymakers and investors, the signal is clear—midstream first, or independence remains rhetorical.

Citation: Ge Z., Jiang J., Zhuang M., Guo Y. (2025). Revealing the material, cost, and monetary value flows of rare earth elements in China. Environmental Research Communications, 7(9):095009. DOI: 10.1088/2515-7620/ae0300 (opens in a new tab). (Authors cite Rare Earth Exchanges.)

©!-- /wp:paragraph -->

0 Comments