Highlights

- Lindian Resources achieved Final Investment Decision with:

- US$20M Iluka funding

- 15-year offtake agreement

- A$91.5M placement

Securing full Stage 1 construction funding through Q4 2026 first production.

- Mining license expansion from 900 ha to 2,500 ha enables Stage 2 scale-up to 100,000 tpa monazite concentrate.

- Owner-operator model targets 30% mining cost reduction to US$8.40/t.

- With A$85.1M cash and partnership linking Malawi ore to Australia's government-backed Eneabba refinery, Kangankunde emerges as one of the most advanced ex-China rare earth projects.

A fully funded pathway and expanded mining license position Lindian as a key ex-China rare earth contender.

Table of Contents

A Redefining Quarter for Kangankunde

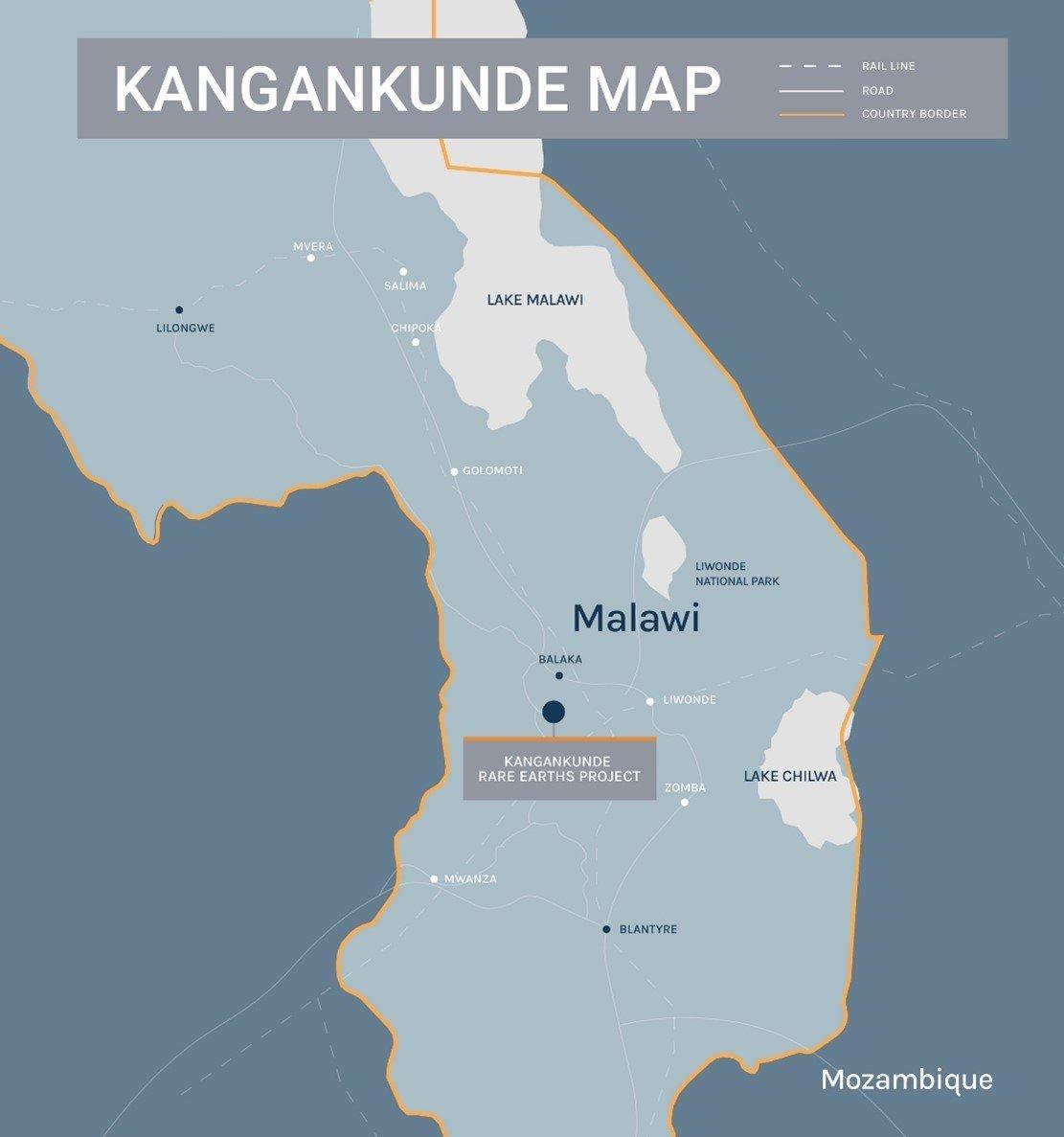

Lindian Resources (ASX: LIN) has declared its September 2025quarter “redefining, (opens in a new tab)” and for good reason. The company achieved a string of project-defining milestones at its flagship Kangankunde Rare Earths Project in Malawi (opens in a new tab), including a Final Investment Decision (FID), a US$20 million funding and 15-year offtake agreement with Iluka Resources, and a successful A$91.5 million institutional placement. These developments collectively secure full funding for Stage 1 construction through first production targeted for Q4 2026.

Lindian’s approved mining license expansion from 900 ha to 2,500 ha creates capacity for a major Stage 2 build-out, now under concept study with DRA Pacific evaluating production of up to 100,000 tonnes per year of monazite concentrate.

De-Risked Financing and Strategic Alignment

The Iluka partnership positions Lindian squarely within Australia’s government-backed rare earths value chain. Iluka’s **Eneabba refinery—supported by Canberra’s Critical Minerals Facility—**is expected to process Kangankunde’s 55% TREO concentrate with roughly 19% NdPr content, linking Malawi’s ore directly into downstream oxide production.

The offtake’s floor pricing and upside participation mechanisms mitigate revenue volatility, while the five-year loan facility—with capitalized interest and no ratio covenants—adds rare financial flexibility for a developer at Lindian’s stage.

Operational Execution and Cost Advantage

The adoption of an owner-operator mining model—forecast to reduce mining costs by about 30% to US$8.40/t—marks a decisive operational pivot toward long-term efficiency. Fleet procurement is underway with Komatsu and Sandvik units due on site by January 2026. Early site works, including a 5.5 km access road and core infrastructure, were completed on time and on budget, reinforcing execution credibility.

Financial Strength and Investor Sentiment

Lindian closed the quarter with A$85.1 million in cash, equating to 20 quarters of operating coverage—a liquidity level rarely seen among junior rare earth developers. The oversubscribed placement at A$0.21 per share underscores deep institutional appetite, particularly from international funds viewing Kangankunde as a near-term addition to ex-China supply.

From a valuation standpoint, the stock remains speculative but strategically leveraged. With Stage 1 fully funded and Stage 2 in study, the project’s low strip ratio (0.2:1) and premium concentrate suggest potential for bottom-quartile operating costs.

Critical Investor Questions

- How robust are NdPr pricing assumptions given global demand softening in 2025?

- Will Iluka’s Eneabba refinery ramp-up stay on schedule to align with Lindian’s Q4 2026 production goal?

- Can Lindian’s owner-operator model scale without unanticipated capital creep in Malawi’s infrastructure environment?

Company

Lindian Resources Limited is an Australia-based mineral exploration company focused on the development of strategic critical resources, primarily rare earths and high-grade bauxite, essential for modern technologies like electric vehicles and renewable energy. The company is listed on the ASX (Australian Securities Exchange) under the ticker symbol LIN.

The company’s top shareholders include a mix of institutional and individual investors. The largest single shareholders are Regal Funds Management Pty Ltd (Australian alternative investment manager founded in 2004, based in Sydney), Kabunga Holdings Pty Ltd (an Australian private company with interests in the mining and IT sectors, led by entrepreneur Asimwe Kabunga (opens in a new tab)) and Prithvi Energy Nigeria Ltd (Prithvi Energy Limited (opens in a new tab) group based in India, which is involved in power generation and other energy-relatedprojects).

REEx Investor Takeaway

Lindian’s progress, as evidenced in its September quarterly report, appears genuine rather than promotional. The combination of full funding, a credible downstream partner, and mining licence expansion places Kangankunde among the most advanced ex-China rare earth projects globally. With China still controlling over 85% of rare earth refining, Lindian’s trajectory signals meaningful diversification for Western supply chains. Execution risk now shifts from financing to delivery—a favorable trade for investors tracking Western rare earth independence. And Rare Earth Exchanges continues to monitor.

©!-- /wp:paragraph -->

0 Comments