Highlights

- China Minmetals and KGHM Polska Miedź are shifting from transactional copper trading toward strategic cooperation in mine construction, project development, and distribution.

- The partnership signals deeper China-EU supply integration.

- The expanded partnership could concentrate copper supply chains toward Chinese processing, enhancing Beijing's market intelligence.

- This development could potentially blunt Western friend-shoring and diversification efforts.

- No binding agreements or financial terms were disclosed; this meeting remains a signals-and-intent situation.

- The situation warrants Western policy scrutiny as copper becomes critical for electric vehicles (EVs), grids, and energy transition infrastructure.

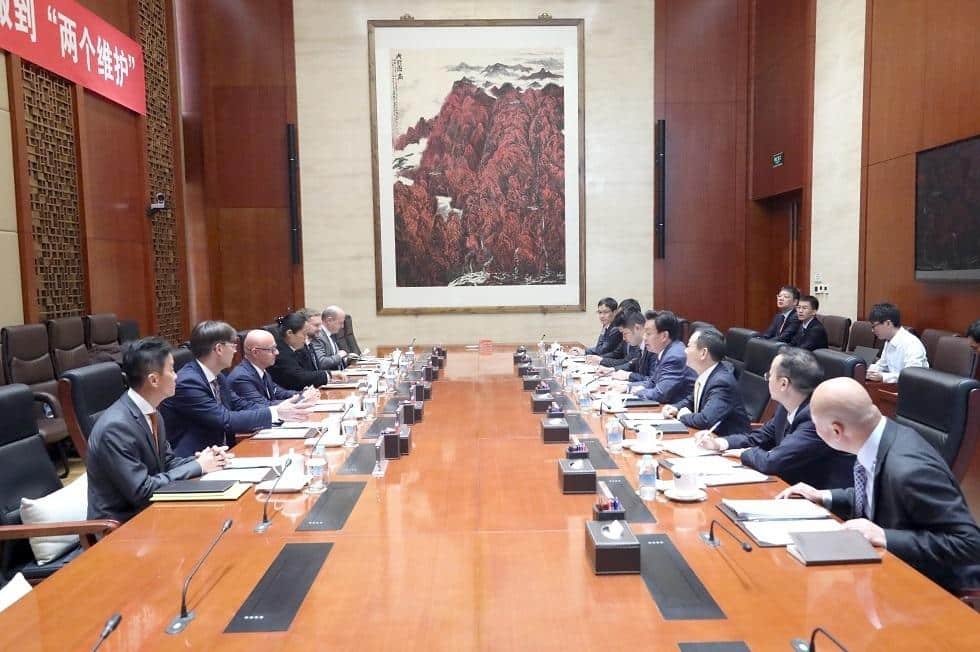

On Oct. 28, China Minmetals (state-owned mining and metals giant) hosted (opens in a new tab) Andrzej Siódmiak, chairman of KGHM Polska Miedź S.A. (opens in a new tab) (Poland’s copper major). Chairman Chen Dexin reviewed a long-running relationship and called for deeper cooperation in four lanes: 1) mine construction, 2) product distribution, 3) project development, and 4) wider strategic coordination. No binding deal was announced, but both sides endorsed expanding beyond existing cathode copper and commodity trading into more integrated ventures.

Table of Contents

Why does this matter?

Copper is the electrical metal of the energy transition. A closer Minmetals–KGHM alignment hints at China–EU supply interlocks across copper feedstocks and distribution at a time of high geopolitical friction. If these talks mature into JVs, construction mandates, or structured offtakes, the flow of European copper units into Chinese processing and end-use could tighten—and so could Beijing’s visibility into European market signals.

Key updates

Scope expansion

From trading and “market infoexchange” toward asset-level collaboration (mine/project construction). That’s a qualitative shift from transactional to strategic.

Channel leverage

Minmetals touted its domestic and international sales channels; KGHM cited “stable cooperation” and wants resource integration and “complementary advantages,” language consistent with offtake, logistics, and capex sharing.

Coordination ask

Both sides flagged “strategic alignment”—code for longer-term planning around volumes, timing, and possibly pricing frameworks.

Implications for the U.S./West

Supply concentration risk

Additional China–EU copper linkages can blunt Western friend-shoring efforts by giving Chinese industry more optionality in European copper supply.

Market intelligence

Expanded “market information exchange” enhances Chinese situational awareness of European demand cycles—useful in pricing and allocation.

Competitive pressure

If Minmetals helps accelerate KGHM project timelines (engineering, EPC, or financing), Chinese-aligned capital velocity could outpace Western workflows, influencing where new cathode ultimately flows.

Policy watch

Any future equity/JV or offtake should trigger Western scrutiny around critical minerals de-risking and EU–U.S. coordination on copper availability for grids, EVs, and defense-adjacent uses.

What’s not here, at least not as of yet? No volumes, no term lengths, no project list, no financials. This is a signals-and-intent meeting—an early marker ahead of potential formal agreements.

Bottom line

China Minmetals and KGHM just moved their relationship from trading comfort toward strategic depth. If formalized, it could nudge more European copper toward Chinese value chains—raising the stakes for U.S. and allied supply diversification.

Disclaimer: This news item originates from the communications of a Chinese state-owned entity. Details should be verified independently by third-party sources.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

Just shocking. What is Poland thinking, and what does the EU have to say about this?!

Forget the EU. I too am surprise at Poland’s move Makes no sense. I hope our government understands the U.S. has no “real” friends and moves quicker with the supply of minerals we have right here! My grandfather always says the only friend you have is the money in your pocket. Boy was he right. As soon as the U.S. tightens its belt the more we see about our so called allies.