Highlights

- Macquarie estimates China's export controls on critical minerals like samarium, terbium, and gallium could cut over $1 billion from US GDP annually.

- China controls approximately 70% of America's rare earth compounds and 90% of global separation capacity.

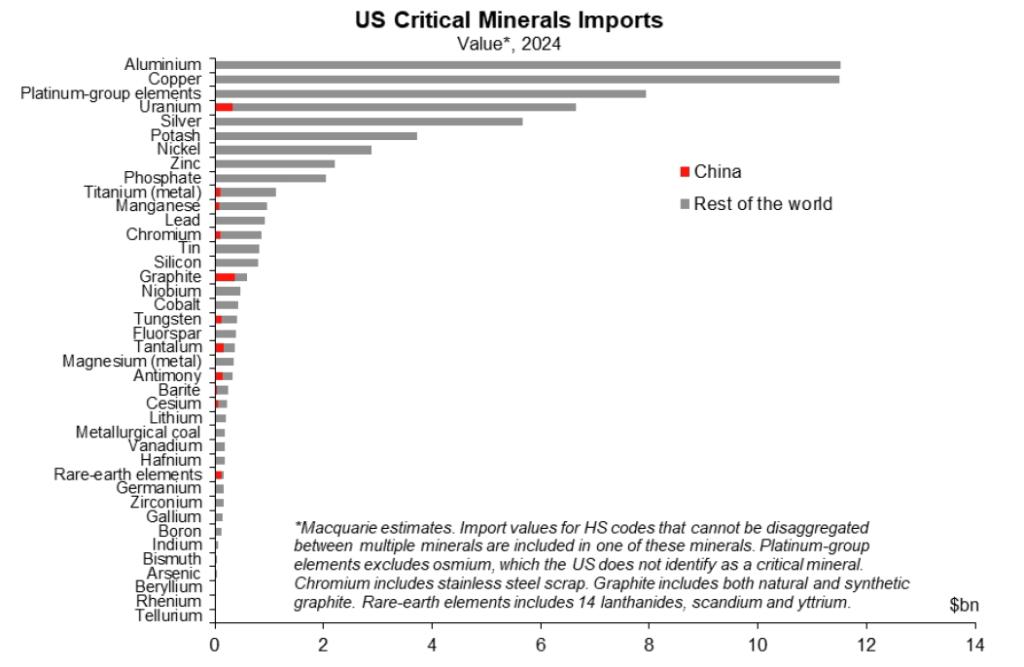

- US dependence isn't on raw minerals (only 3% of $65 billion imports) but on processed rare earths used for defense, EVs, and semiconductors—where supply disruptions can halt entire production chains worth billions.

- Australia cannot yet replace Chinese imports without massive investment in refining and metallization infrastructure; raw ore alone is insufficient to offset China's midstream dominance.

Macquarie Group’s (opens in a new tab) chief economist Ric Deverell (opens in a new tab) and his team have issued a fresh modeling analysis estimating that China’s export controls on a narrow set of critical minerals—samarium, lutetium, terbium, dysprosium, and gallium—could carve more than $1 billion out of U.S. GDP annually. The headline via Indonesia Mining Association, seems shocking, yet the underlying data reveals an even more important story: America’s rare earth vulnerability is not about total import volume from China, but about where the bottlenecks sit in the value chain.

Table of Contents

Even though China directly supplies only about 3% of total U.S. critical minerals imports ($2B of $65B), it supplies ~70% of America’s rare earth compounds and metals, the materials used in defense, EV motors, magnetics, advanced electronics, and semiconductor tooling. In other words, China’s true leverage is not bulk minerals—it is processed rare earths, where it still controls ~90% of global separation and refining capacity.

The Numbers Behind the Narrative—A Closer Look

First, the dependence no one can deny. Macquarie notes the U.S. is 100% import reliant on 12 critical minerals and over 50% reliant on another 33. Rare earth metals remain the soft underbelly: in 2024, the U.S. imported $170M in rare earths, $120M directly from China. For gallium—an essential semiconductor material—the dependency is even more acute.

Where Macquarie Is Right

- A GDP hit of ~$1B is plausible given the high-value industries (defense, semiconductors, EVs) affected by even short-term supply shocks.

- The strategic cost dwarfs the GDP cost. Disruptions in Dy/Tb supply can halt magnet production, defense maintenance cycles, and traction motor manufacturing.

Where the Article Overreaches—or Underexplains

- The GDP figure doesn’t capture cascading effects: loss of magnet production halts entire defense systems, not just commodity flows.

- The suggestion that U.S. reliance on China is “less than publicized” is technically true for raw minerals, but misleading; the dependence exists in refined oxides, metals, and alloys, not ore.

- Australia's “replacing all Chinese imports” is aspirational. The country has reserves—but not yet the processing, refining, or heavy-REE capability to substitute China.

The Real Story for REE Investors: Processing, Not Mining

The U.S. imports approximately only $170M in rare earth minerals—but those dollars underpin billions (even hundreds of billions) in downstream economic value. A single kilogram of terbium can influence a fighter jet program. Gallium affects AI chip production.

Macquarie’s final point—Australia as a replacement source—is interesting but incomplete. Without massive investment in refining, metallization, and magnet plants, raw ore alone cannot offset China’s dominance.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments