Highlights

- Myanmar's #1-ranked heavy rare earth deposits are controlled by the Kachin Independence Army (KIA), not nation-states, making non-state armed groups the true power brokers in global HREE supply.

- China monopolizes every stage of Myanmar's rare earth value chain from extraction to magnet production, while U.S. entry remains speculative with no verified negotiations or ground infrastructure.

- The rare earth sector in Myanmar operates through informal authorities, militias, and unregulated cross-border commerce—where logistics and control trump geopolitics in determining market dynamics.

The Eurasia Review paints Myanmar as Donald Trump’s next battleground in the global rare earth rivalry—a dramatic narrative, but one that requires careful correction and grounding. Yes, Myanmar is central to global heavy rare earth element (HREE) supply. But the true power brokers are not nation-states alone—they are non-state armed groups controlling the most valuable deposits on earth.

Table of Contents

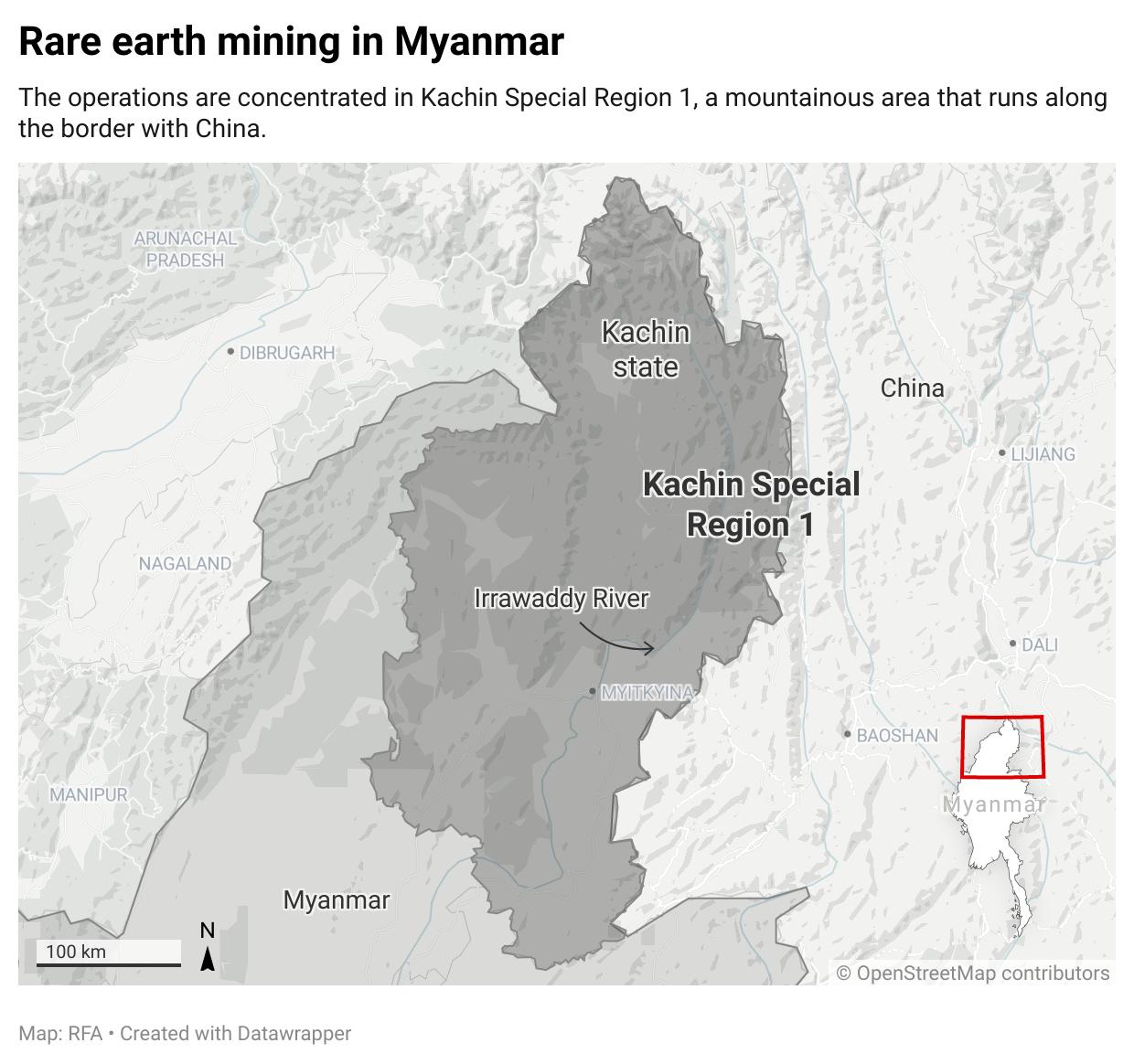

Nowhere is this clearer than in Kachin State

Where the Kachin Independence Army (KIA) oversees large swaths of HREE-rich ion-adsorption clays. On Rare Earth Exchanges’ HREE Projects Database & Rankings, the Kachin-controlled operations rank #1 globally. Investors already know: if you want dysprosium and terbium today, you pass through Kachin tomorrow.

The Eurasia Review article hints at this dynamic but never confronts the full truth: Myanmar’s rare earth sector is not merely a geopolitical chess match—it is a supply chain run through informal authorities, militias, bordering Chinese buyers, and unregulated tributaries of commerce. It just so happens many of the ethnic minorities fighting for their liberties also happen to be Christians. Why does that not make it into the media too often?

Sorting Fact from Fiction: The Realities of the Kachin–China–U.S.Triangle

The article accurately notes China’s deep entanglement in Myanmar’s rare earth extraction, particularly in Kachin State. China’s comprehensive control over transport routes, refining hubs, and border trading posts is factual and well-documented. Yes Chinese agency is ubiquitous.

But speculation enters when the author suggests the U.S. may “enter the Myanmar deposits” or that both the junta and Kachin rebels are courting Washington for access. Rare Earth Exchanges has interfaced to some extent with spokespersons in Kachin State or affiliated with the Kachin, and we have seen no credible, verifiable evidence of active U.S. negotiations. Now that could be happening via covert intelligence agency operations for instance. It’s possible but not apparent at this stage.

The U.S. lacks on-the-ground access, infrastructure, or trusted partners in the conflict zone—all preconditions for any rare earth engagement. The piece also frames the potential U.S. entry as a “new battlefield,” yet omits the central commercial truth: China doesn’t just extract Myanmar’s HREEs—it monopolizes every downstream step from separation to magnet production. Even if the U.S. gained upstream access, without midstream separation and downstream magnet manufacturing, value would still flow east across the Yunnan border.

Where the Real Action Is (and Isn’t)

The article rightly highlights environmental harm and displacement—catastrophic issues Rare Earth Exchanges has chronicled in multiple deep-dive reports. These are not peripheral concerns; they are core structural liabilities for any future Western engagement. But most crucially, the Eurasia Review misses the biggest question:

Myanmar’s #1-ranked HREE deposits are controlled by actors who answer to neither Washington nor Naypyidaw.

This is the defining feature of the HREE market today—China sources its most critical magnet feedstock from someof the world’s least regulated zones, pushing global pricesdownward and keeping Western producers on the sidelines.

Until that changes, geopolitics is noise. Logistics is king. And Kachin still sits atop the throne.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments