Highlights

- China's April 4 export controls on neodymium magnets now require case-by-case licenses.

- European distributors like Spain's Aiman GZ must navigate complex documentation including:

- Tariff codes

- Specifications

- End-use declarations

- Documentation is necessary to prevent manufacturing delays.

- Madrid-based Aiman GZ acts as a technical integrator between Chinese magnet producers and European industries such as:

- Automotive

- Robotics

- Aerospace

- Medical devices

- Supply continuity is mission-critical for these sectors.

- Aiman GZ competes in a crowded European magnet distribution market against:

- IMA (Spain)

- e-Magnets UK

- FIRST4MAGNETS

- Magnosphere

- Aiman GZ differentiates itself by:

- Reliable export-license navigation

- Local inventory with engineering support

Founded in 1995, Aiman GZ S.L. (opens in a new tab) has grown into one of Spain’s most specialized B2B distributors of high-performance magnetic materials and precision magnet-based technologies. Operating from Madrid, the company serves European manufacturers across automotive, robotics, aerospace, medical devices, metrology, and industrial automation—sectors where neodymium magnets are not optional components but critical enablers of torque, sensing, motion control, and miniaturized design.

Table of Contents

Aiman GZ positions itself not merely as a supplier but as a technical integrator, bridging the gap between magnet producers—primarily in China—and European engineering teams who depend on consistent grades, dimensions, coatings, and magnetic tolerances. Their core value proposition: make sure the magnet never becomes the bottleneck.

A Message Rooted in Supply-Chain Reality

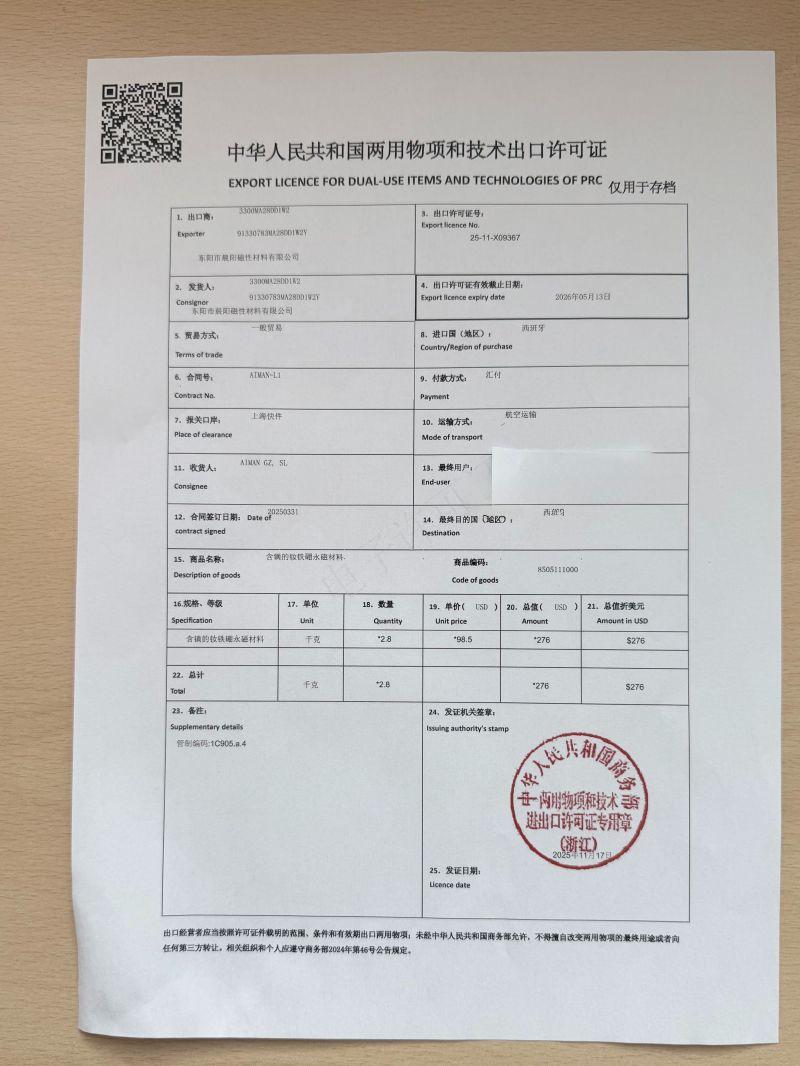

In comments released by the company, Aiman GZ addresses the new geopolitical reality head-on: as of April 4, China has tightened export controls on neodymium magnets, requiring product-specific export licenses reviewed case by case by Chinese customs authorities. On the company’s LinkedIn account they shared the official documentation from China.

For Aiman GZ, this is not a bureaucratic footnote—it is a direct exposure point in Europe’s advanced manufacturing ecosystems. Any delay in licenses can halt final assembly lines, stall R&D programs, or compromise precision-dependent applications that require custom magnet solutions.

The company shared an image of one such export license to underline the complexity:

weeks of coordination between its Purchasing department, Chinese suppliers, customs specialists, and the technical teams of European customers. Every shipment now requires meticulous verification of:

- Tariff codes

- Specifications and magnet grades

- Contract and purchasing documentation

- End-use declarations

- Compliance with evolving Chinese export-control parameters

This is no small task. And it has become part of the everyday operating burden for companies dependent on rare-earth magnet imports.

Aiman GZ’s Positioning: Stability in an Unstable Market

The company’s closing message is clear and consistent with its 30-year identity:

“Since 1995, our priority has been the same: that the magnetic part of your projects does not stop—even when the rules of the game change thousands of kilometers away.”

Aiman GZ commits to:

- Anticipating regulatory shifts

- Adjusting its purchasing-planning models

- Working closely with every customer to ensure the highest possible legal certainty

- Preserving continuity of supply in an increasingly disrupted rare earth market

At a moment when China’s export-control environment is reshaping global magnet flows, Aiman GZ is positioning itself as one of Europe’s key intermediaries—navigating documentation, compliance, and logistical friction so manufacturers can keep building without interruption.

The Market

Aiman GZ S.L. is one node in a pretty crowded European magnet middle-market. They sit in that space between Chinese/Western producers and European OEMs/SMEs that need neodymium and other permanent magnets in reliable, engineered form. Nobody publishes a neat “competitor list,” but we can infer the main peer group from similar product mix and business model.

Where Aiman GZ Sits in the Value Chain

Aiman GZ is essentially a magnet intermediary: a Spanish-based importer/distributor and solutions provider for permanent magnets (NdFeB, ferrite, etc.), supplying B2B customers across Spain and the EU, plus some online/B2C channels.

They compete with other companies that:

- Import magnets (often from China or other Asia hubs)

- Hold EU stock

- Offer custom sizes, assemblies, engineering help, and short lead times

Direct/Closest European Peers (Online + B2B Distributors)

These are the most Aiman-like players:

| Company | Location | Summary |

|---|---|---|

| IMA / IMAMagnets | Spain & EU | Spanish-headquartered manufacturer and distributor of neodymium and other permanent magnets with custom-engineering capability. Strong industrial B2B focus, very close to Aiman GZ’s sweet spot. |

| e-Magnets UK | UK | Long-established specialist supplier/manufacturer with EU-wide reach and deep catalog of NdFeB and assemblies; strong technical support for B2B. |

| FIRST4MAGNETS | UK/EU | High-volume online supplier of neodymium and other magnets, serving both industrial and prosumer markets, shipping all over Europe. |

| Magnosphere | Germany/UK/EU | Online “super-store” for rare-earth magnets and custom assemblies, explicitly Europe-wide. |

| SuperMagneticShop | EU | Online magnet specialist focusing on ferrite, neodymium, custom parts and assemblies with EU shipping. |

| dhit.pl | Poland | Direct importer and wholesaler of neodymium magnets and magnetic separators, serving EU industry with fast delivery and large catalog |

| Magfine | Italy | – Italian supplier of neodymium and other magnets, including coatings and treatments; works as both distributor and technical partner |

These firms, at least in some cases, compete with Aiman GZ on price, lead time, engineering support, and ability to navigate Chinese export licenses and customs for NdFeB.

Higher-End / OEM Magnet Players That Still Overlap

While more on the manufacturing/OEM side, these companies also act as suppliers to European customers and therefore overlap with Aiman GZ in some accounts:

- RHEINMAGNET, Magnetfabrik Bonn, MS-Schramberg, GMB Magnet, Wagner Magnete (Germany) – strong in industrial magnets and assemblies.

- VACUUMSCHMELZE (VAC, Germany) – high-end NdFeB (VACODYM®) and SmCo magnets with Western-supply positioning; more upstream, but still a competitor at the project level for engineered magnet solutions.

Bottom Line for Aiman’s Competitive Set

Aiman GZ is effectively competing in a pan-European network of magnet intermediaries: online catalog houses + engineering distributors + some OEM producers with EU stock.

For an investor or customer, the differentiation levers are:

- Who can actually get export-licensed Chinese NdFeB through customs reliably

- Who holds local inventory and can machine/assemble to spec

- Who can support compliance and documentation (end-use, tariff codes, defense restrictions) as China tightens controls

That’s the real battleground where Aiman GZ, IMA, e-Magnets UK, FIRST4MAGNETS, Magnosphere, dhit.pl, and others quietly fight for Europe’s magnetic middle tier.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments