Highlights

- Colorado School of Mines' Kroll Institute licensed four REE processing patents to Australia's Bayan Mining, granting exclusive worldwide rights for bastnaesite-dominant ores.

- The technologies target midstream processing—leaching, flotation, ion exchange, and separation—where China's dominance is strongest and Western projects typically fail.

- While technically credible and DOE-funded, commercial success depends on scaling lab results to industrial operations, with midstream IP representing the true strategic asset for supply chain independence.

Colorado School of Mines, Kroll Institute for Extractive Metallurgy (KIEM) at Mine (opens in a new tab)s has licensed a suite of four rare earth element (REE) processing patents to Australia-based Bayan Mining and Minerals (opens in a new tab), granting exclusive worldwide rights tied to bastnaesite-dominant ores. On its face, this is a familiar and welcome headline: U.S. university research migrating from lab benches toward commercial deployment, backed by Department of Energy funding and aligned with domestic “mine-to-magnet” ambitions.

Table of Contents

The technologies target leaching, flotation and beneficiation, ion exchange, and ancylite recovery

All squarely midstream, where the rare earth supply chain routinely breaks down. That focus alone makes the deal notable. Midstream processing, not mining, is where China’s dominance is most entrenched and where Western projects most often fail.

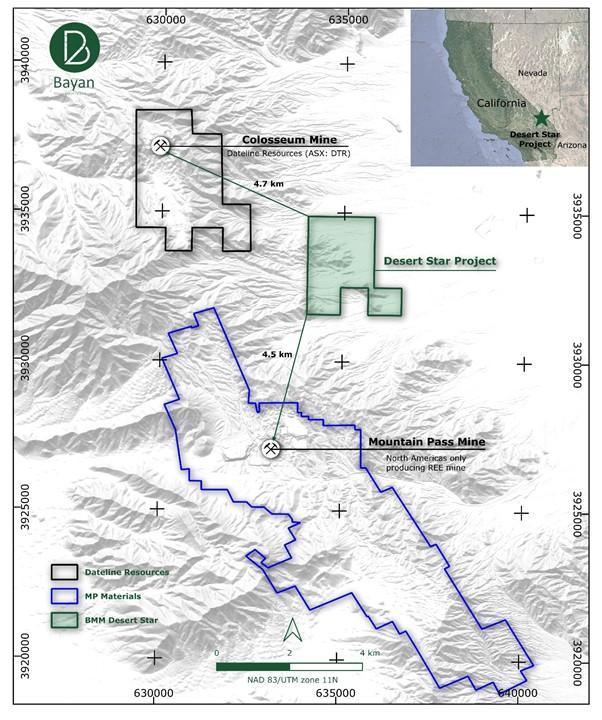

The company’s asset in California is near MP Materials' claim, known as the Bayan’s Desert Star Project (opens in a new tab). Bayan’s Desert Star Project is described as geographically proximate to Mountain Pass and geologically similar, which increases the relevance of the bastnaesite-focused technologies.

What Holds Up Under Scrutiny

Several elements of this announcement are solid and consistent with known facts:

- Bastnaesite relevance: Bastnaesite is indeed the backbone of U.S. rare earth production, most notably at Mountain Pass. Improving recovery and separation from this mineral directly addresses a real bottleneck.

- Institutional credibility: The Kroll Institute for Extractive Metallurgy has decades-long credibility in metallurgical process development. This is not speculative garage science.

- DOE involvement: Partial funding via the DOE Critical Materials Institute aligns with Washington’s long-standing recognition that separation and refining — not ore access — define strategic vulnerability.

- Midstream emphasis: The framing around beneficiation, separation, and refining is accurate and refreshingly honest about where value is created.

Where Optimism Quietly Leaps Ahead of Evidence

Still, investors may separate technical promise from commercial inevitability.

- “>90% recovery” claims refer to initial gravity recoveries under controlled conditions, not integrated, continuous, industrial-scale flowsheets.

- Exclusive worldwide licensing does not guarantee deployment, financing, permitting, or operational success — all of which have derailed similar efforts before.

- Geological proximity to Mountain Pass does not automatically translate to metallurgical equivalence. “Similar” ore bodies often behave very differently once scaled.

Why This Actually Matters for the Supply Chain

What’s genuinely notable is not Bayan, or even the patents themselves. It’s the quiet acknowledgment that midstream IP — not mines — is the real strategic asset. If these technologies mature, they could lower barriers for multiple bastnaesite projects, reduce reliance on Chinese separation capacity, and create optionality across North America.

That’s a big “if.” But it’s the right if.

Citation: Mines Newsroom (opens in a new tab), Dec. 16, 2025.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments