Hightlights

- Critical Metals Corp secures licensing extension for Tanbreez project.

- Exploration and closure plans due by 2025; mining to begin by 2028.

- Tanbreez project aims to supply rare earth elements to Europe and North America.

Europe-focused Critical Metals Corp. (Nasdaq: CRML) said on Tuesday (opens in a new tab) it had obtained an extension for the exploitation license of its majority-owned Tanbreez project (opens in a new tab) in Greenland, purportedly the world’s largest rare earth deposit.

Exploration and closure plans must now be submitted by the end of 2025. Plus, the company must provide financial security, and a company guarantee by June 30th, 2026, and begin mining by the end of 2028.

According to the company press release chairman and CEO Tony Sage reports “The extension is a significant milestone, demonstrating strong local support for our project, which is expected to create numerous local jobs.”

With the drilling program announced in September concluded, all rare earth material extracted has been secured in storage. A portion of the materials has been sent to be analyzed by ALS laboratory in Ireland. Critical Metals Corp said it expects to receive the test results in the coming months.

The operation

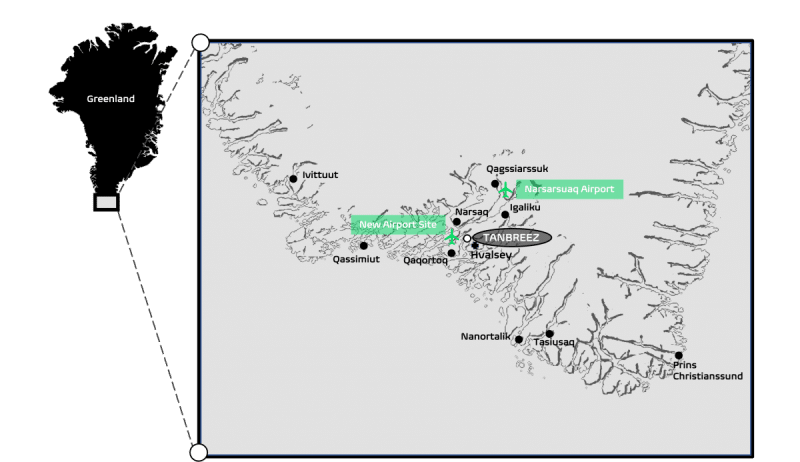

The Tanbreez project is in Southern Greenland and is purportedly to include 27% heavy rare earth elements (HREE), which carry higher value than light rare earth elements. Once operational, the mine could supply rare earth elements to Europe and North America combined. Of course, such a supply would certainly help shake up the current market dynamics.

Source: Green Car Congress

The project is expected to have access to key transportation outlets as the Tanbreez area features year-round direct shipping access through deep-water fjords that lead directly to the North Atlantic Ocean. Called Kakortokite, (opens in a new tab) the outcropping orebody covers an area of 8 km by 5 km and is about 400 meters thick.

The Player

Critical Metals Corp has secured the licenses to mine Tanbreez. The company operates as a metal mining company. The Company specializes in the secure and sustainable supply of lithium metals and minerals. Critical Metals serves customers worldwide. They own Europe’s the Wolfsberg lithium project in Austria.

Upon completion of construction at Wolfsberg by 2026, Critical Metals has committed to supplying BMW by 2027. The company inked a deal (opens in a new tab) with Obeikan Investment Group (opens in a new tab) to build a lithium hydroxide plant in Saudi Arabia.

The company stock now trades on NASDAQ. Critical Metals Corp. began trading on the Nasdaq on February 28, 2024, under the ticker symbol “CRML. With a market capitalization of $628.58 million they trade as of this writing at $6.93. 83% of the shares are held by insiders.

Top institutional investors include the following:

| Holder | Shares | Date Reported | % Out | Value |

|---|---|---|---|---|

| Cantor Fitzgerald, L.P. | 1.25M | Jun 30, 2024 | 1.53% | 8,649,678 |

| Polar Asset Management Partners Inc. | 730k | Jun 30, 2024 | 0.89% | 5,062,549 |

| Blackrock Inc. | 346.3k | Jun 30, 2024 | 0.42% | 2,401,583 |

| Geode Capital Management, LLC | 99.75k | Jun 30, 2024 | 0.12% | 691,800 |

| Rivernorth Capital Management, LLC | 91.47k | Jun 30, 2024 | 0.11% | 634,372 |

| State Street Corporation | 54.88k | Jun 30, 2024 | 0.07% | 380,613 |

| Vanguard Group Inc | 46.57k | Jun 30, 2024 | 0.06% | 322,990 |

| Morgan Stanley | 37.01k | Jun 30, 2024 | 0.05% | 256,629 |

| Bank Of New York Mellon Corporation | 16.39k | Jun 30, 2024 | 0.02% | 113,650 |

| Charles Schwab Investment Management, Inc. | 17.31k | Jun 30, 2024 | 0.02% | 120,017 |

Source: Yahoo Finance

0 Comments