Highlights

- China commands 55% of global robotics unicorns (68 companies) versus 32% for the U.S. (39 companies), leveraging vertical integration from rare earth mining to magnet production and final robotic systems.

- The projected $800B robotics market hinges on control of physical inputs—motors, actuators, and permanent magnets using dysprosium, terbium, neodymium, and praseodymium—where China holds structural advantages.

- U.S. leadership remains concentrated in software-intensive sectors like medical robotics and AI platforms, but faces material supply vulnerabilities as hardware-dependent robotics categories scale globally.

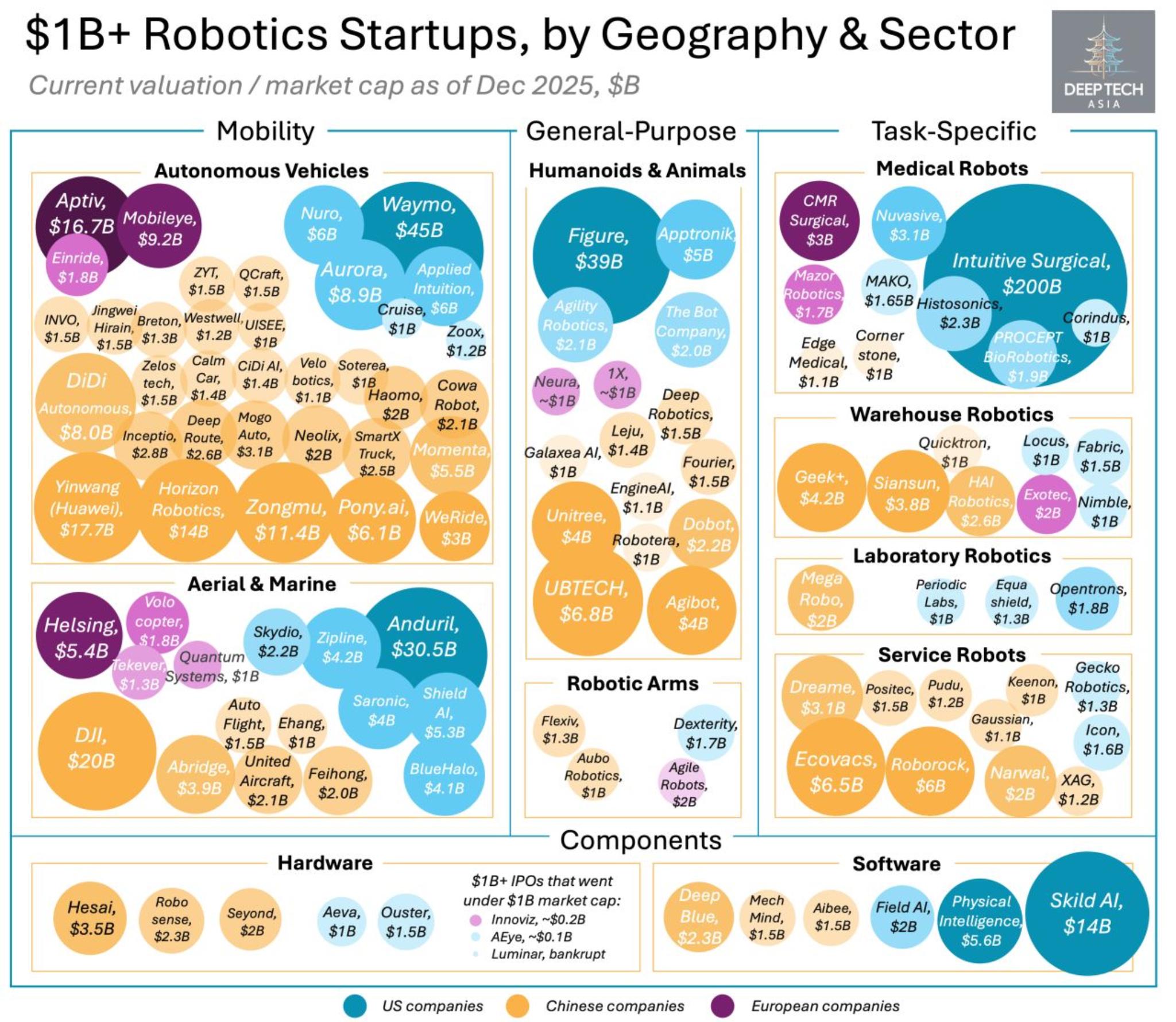

The global robotics venture landscape has quietly become one of the most strategically consequential battlegrounds for the rare earth supply chain. According to the latest DeepTech Asia snapshot, $1B+ robotics unicorns now cluster overwhelmingly in China, with 68 companies—roughly 55% of the global total. The United States follows with 39 (32%), and Europe trails with 16 (13%). This is not just a venture capital story. It is a materials, magnets, and manufacturing story—one that cuts straight through rare earth dominance.

A recent Morgan Stanley outlook anticipates an $800 billion robotics market within the next decade. _Rare Earth Exchanges_™ has already critiqued the headline optimism. What matters more than market size is _who controls the physical inputs_—motors, actuators, sensors, and permanent magnets—where dysprosium, terbium, neodymium, and praseodymium quietly decide winners.

China’s Advantage Is Vertical, Not Just Financial

China’s lead is not merely numerical. It is structural. Chinese robotics champions increasingly span vertical ownership—from rare earth mining and separation to magnet production, to motors, hardware integration, and final robotic systems. Service robots, warehouse automation, LiDAR, autonomous vehicles, and humanoid platforms are scaling inside a domestic ecosystem already optimized around rare earth availability and cost control.

This explains why China dominates VC-scalable hardware categories: cleaning robots, logistics automation, AV stacks, LiDAR, and motor-heavy platforms. Recent IPO momentum reinforces this trajectory, with Chinese robotics listings accelerating through 2024–2025 while Western exits remain mixed.

The U.S. Still Leads—But Where Atoms Matter Less

The U.S. retains leadership where software, regulation, and clinical moats outweigh materials intensity: medical robotics (anchored by a $200B+ Intuitive Surgical), robotics AI platforms, defense autonomy, and lab automation.

Yet even here, physical exposure remains unavoidable. Surgical robots, humanoids, drones, and autonomous systems all converge on high-performance magnet demand at scale.

Europe, meanwhile, remains strong in industrial automation and defense niches but lacks coordinated access to rare earth midstream capacity—an Achilles’ heel as robotics hardware scales.

Why Robotics Is a Rare Earth Story First

Robotics is fundamentally a motor-and-magnet economy disguised as software. Every humanoid joint, warehouse picker, drone gimbal, and autonomous platform compounds demand for high-coercivity magnets. China understands this—and is racing to lock in the full value chain before Western policy catches up.

Bottom line: The robotics unicorn race is no longer just about AI or venture capital. It is about who controls the atoms inside the machines. On that front, China is not merely competing—it is consolidating.

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →