Highlights

- The Trump administration has fundamentally shifted US policy from market signaling to direct intervention in critical minerals through equity stakes, price floors, and Pentagon-backed loans—marking a clean break from decades of hands-off industrial policy.

- Bilateral resource deals with Australia, Saudi Arabia, DRC, and Ukraine blend minerals access with security guarantees, though partner jurisdictions carry political and infrastructure risks that public finance can soften but not eliminate.

- Pax Silica represents an ambitious but asymmetric coalition framework where the US defines architecture and controls capital while allies contribute capabilities—creating structural tension between partnership rhetoric and leverage reality.

A new analysis (opens in a new tab) from the International Institute for Strategic Studies by Dr. Maria Shagina (opens in a new tab) argues that the Trump administration has crossed a strategic Rubicon in critical minerals. The United States, long allergic to overt industrial policy, is now practicing it openly. Domestic “America First” deals, bilateral resource diplomacy, and the nascent Pax Silica framework together signal a shift from market signaling to market participation—accelerated by China’s April 2025 export controls. Washington is no longer nudging outcomes. It is underwriting them.

From Referee to Player-in-Chief

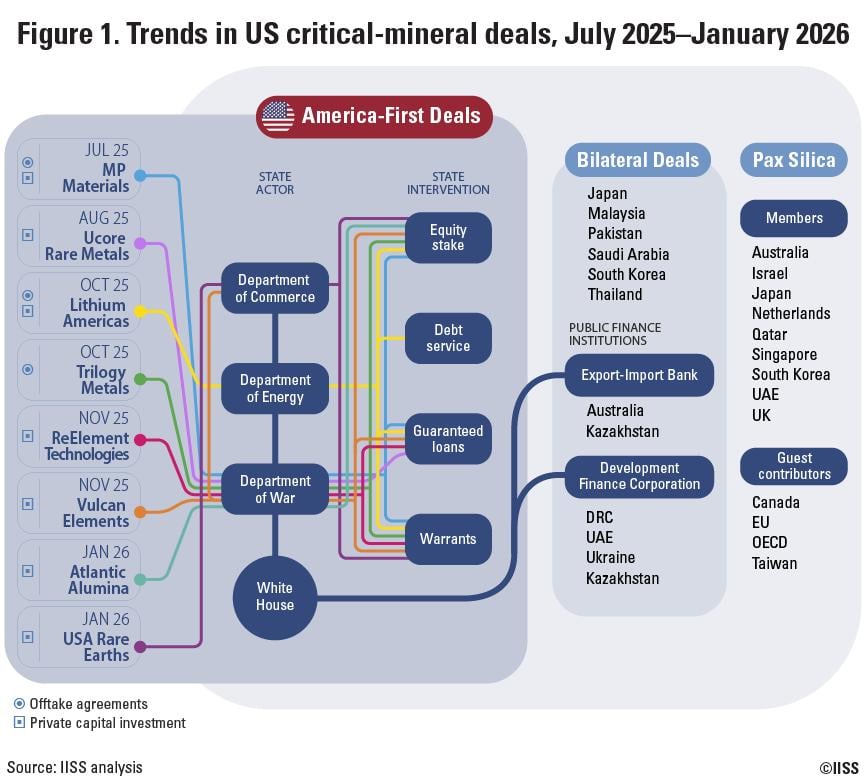

On the core facts, the paper is strong. Executive Order 14241, expanded use of the Defense Production Act, and funding from the One Big Beautiful Bill Act collectively mark a clean break from arm’s-length policy. Equity stakes, price floors, offtake guarantees, and Pentagon-backed loans—once politically radioactive—are now explicit tools. The MP Materials transaction is emblematic: defense-linked equity, subsidized credit, and demand guarantees stitched together to stabilize a structurally fragile rare earth market.

This diagnosis is accurate. Rare earth projects do not fail for lack of geology; they fail because Chinese price discipline and volatility crush long-duration capital. State participation lowers downside risk and pulls forward investment. As an explanation of why Washington intervened, Shagina’s analysis is analytically sound.

Bilateralism With a Strategic Accent

The treatment of bilateral deals—with Australia, Saudi Arabia, the DRC, Ukraine, and others—is also largely correct. These arrangements blend mineral access with security guarantees, reconstruction finance, or geopolitical alignment. The growing role of EXIM and the Development Finance Corporation as de-risking instruments is real and consequential.

The deeper assumption, however, deserves scrutiny: that these deals reliably translate into resilient supply. Many partner jurisdictions carry political, permitting, infrastructure, or governance risks that public finance can soften but not erase. State capital accelerates timelines, but it does not guarantee execution. And Rare Earth Exchanges™ is watching these mine-to-magnet ecosystems very closely.

Pax Silica: Alliance or Architecture of Control?

Where the analysis is most aspirational is Pax Silica. Framed as a “coalition of capabilities,” it is indeed a more systems-level concept than prior initiatives. Yet the asymmetry is underplayed. The United States defines the architecture, controls most of the capital, and sets the conditions of access. Allies contribute nodes—energy, processing, equipment, or capital—but rarely co-author the rules.

This is not a design flaw; it is the design. The tension between partnership and leverage is structural. Coalition-building demands trust and predictability, while tariff threats and unilateral tools erode both. These are some of the contradictions the author avoids.

What the Diagram Shows—and What It Cannot

The IISS deal map usefully visualizes the velocity of U.S. intervention: permits to equity, loans to warrants, domestic to global. What it omits is transparency. Deal terms remain opaque, lobbying pressure is intensifying, and environmental constraints are increasingly subordinated to speed. State capitalism reduces market risk—but raises political, regulatory, and execution risk, and with what could evolve into troubling rumblings around the corner.

Why This Matters Now

For rare earths, this is a watershed. The United States has conceded that market purity will not dislodge China’s dominance. The open question is whether Washington can execute industrial policy without fracturing alliances or over-centralizing control. Pax Silica may prove the most sophisticated framework yet—or the most fragile.

Profile

The International Institute for Strategic Studies (IISS) is a London-based globalstrategic think tank founded in 1958, best known for rigorous,policy-oriented analysis of international security, defense, arms control, geopolitical risk, and geoeconomics. Over more than six decades, it has built substantial credibility among governments, academics, media, and industry through flagship publications such as The Military Balance, regional security assessments, and thematic analyses that sit at the intersection of state power, military capability, economic security, and emerging technologies. IISS frames its mission as delivering independent, evidence-based insight to decision-makers, drawing on a broad network of research fellows and partner institutions across major regions, including the United States, China, Europe, the Middle East, and the Indo-Pacific. Its strengths lie in longevity, analytical rigor, and global reach, with a clear focus on how geopolitical trends shape strategic outcomes rather than near-term commercial returns. That same orientation also defines its limitations: IISS analysis prioritizes national-security logic over granular market economics, often assumes rational state behavior, and can underweight local environmental, Indigenous, or socio-economic impacts, while relying on strategic inference where proprietary deal data are unavailable. For rare earth and critical-mineral stakeholders, IISS provides valuable context on alliance structures, defense-driven industrial policy, and great-power competition over resource access—but its work is best used as a complement to technical, financial, and project-level analysis rather than a standalone guide for investment decisions.

Source: Dr. Maria Shagina, International Institute for Strategic Studies

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →