Highlights

- The U.S. imports 80-100% of critical minerals including manganese, chromium, gallium, graphite, and rare earths, creating structural dependence on foreign suppliers.

- Mineral endowment alone doesn't equal strategic power—countries must build downstream processing, refining, and manufacturing capacity to leverage resources effectively.

- Southern Africa controls key supplies of manganese, PGMs, chromium, and cobalt, but realizing strategic leverage requires stable infrastructure, capital access, and value chain integration.

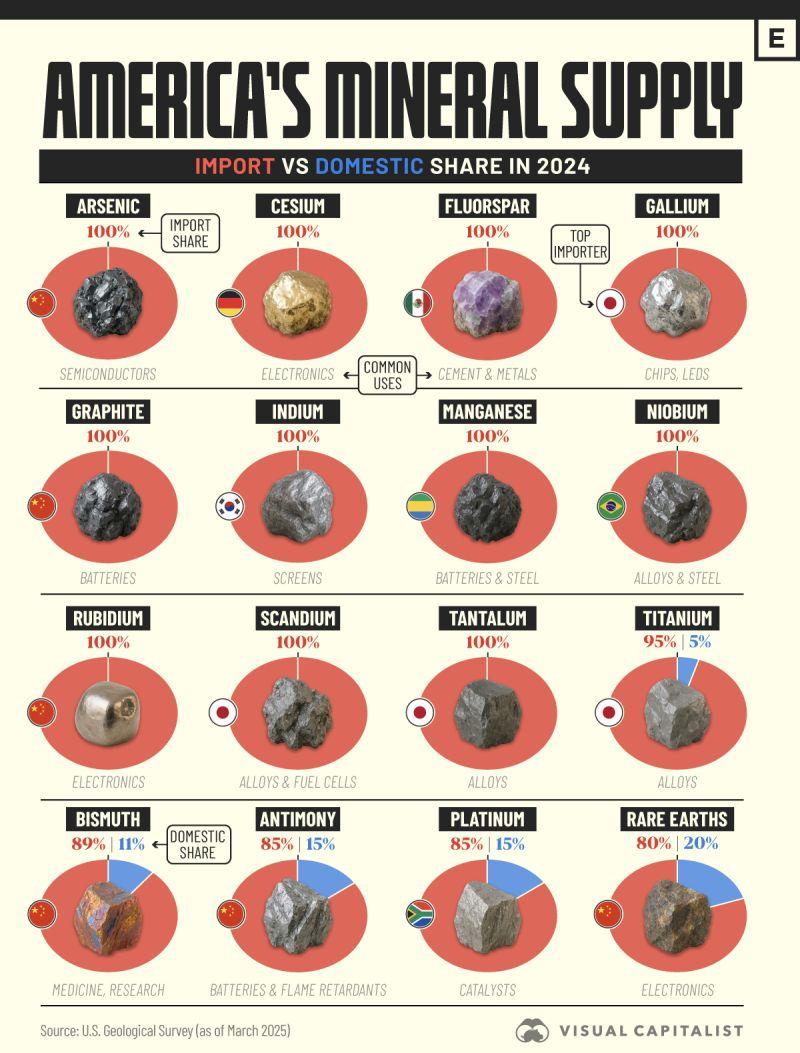

An infographic shared online and sourced from the U.S. Geological Survey (2025) via Visual Capitalist captures a hard truth: the United States is structurally dependent on foreign supply chains for critical minerals that underpin modern technology, defense systems, and energy transition goals. From gallium and graphite to rare earths and platinum group metals (PGMs), import reliance ranges from 80% to 100% across much of the critical minerals spectrum.

Underlying Premise: Largely Accurate, But Incomplete

The core claim—that mineral suppliers wield strategic power—is factually sound. The U.S. imports:

- ~100% of manganese, chromium, gallium, graphite, cesium, tantalum, and several specialty metals

- ~80% of rare earth elements

- ~85–90% of PGMs, antimony, and bismuth

Southern Africa, particularly South Africa and the DRC, is indeed central to global supply for manganese, PGMs, chromium, and cobalt. These materials are essential for steel, batteries, catalysts, semiconductors, EVs, and defense applications.

Where the narrative overreaches is in implying that mineral endowment alone equals leverage. Geology creates potential power; processing, logistics, finance, and governance determine whether that power is realized.

The Strategic Reality: Value Chains Matter

The article correctly identifies the next battlefield: beneficiation and downstream integration**.** The era of simple ore exports is ending. However, moving up the value chain requires:

- Stable power and water infrastructure

- Chemical processing expertise

- Environmental permitting regimes

- Long-term offtake contracts

- Access to Western capital markets and customers

This is where many mineral-rich regions still face constraints, as Rare Earth Exchanges™ reports on frequently.

Rare Earth Exchanges Takeaway

This chart is not just a warning to Washington—it is also a reality check for supplier nations. Strategic power is not automatic. It must be built. Countries that pair resources with processing, refining, and manufacturing capacity will define the next phase of the global industrial order.

Minerals are leverage. Value chains are powerful. How does your nation’s value chain rank?

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →