Highlights

- Japan successfully retrieved rare-earth sediment from 6,000 meters depth near Minami Torishima—a technical first, but commercial viability remains unproven with no disclosed grades, costs, or recovery rates.

- The test is strategically significant for reducing Chinese supply dependence amid export controls, yet China still controls 90% of rare earth refining and two-thirds of mining globally.

- Deep-sea rare earth extraction faces substantial economic and environmental hurdles; this represents exploration and geopolitical signaling, not a near-term market-moving supply breakthrough.

What’s up with Japan’s deep-sea rare earth test recovery near MinamiTorishima? Rare Earth Exchanges™ separates genuine technicalprogress from optimistic reserve narratives. What is verifiable? What remains speculative? Why does this matters for investors tracking geopolitical risk and rare earth supply-chain resilience?

Japan has successfully retrieved rare-earth-bearing mud from 6,000 meters below the ocean surface in a first-of-its-kind test, aiming to reduce reliance on Chinese supplies. While the feat is technologically impressive and geopolitically meaningful, it does not yet change the global rare earth supply. Commercial, environmental, and cost hurdles remain substantial.

What Happened—and Why It Made Headlines

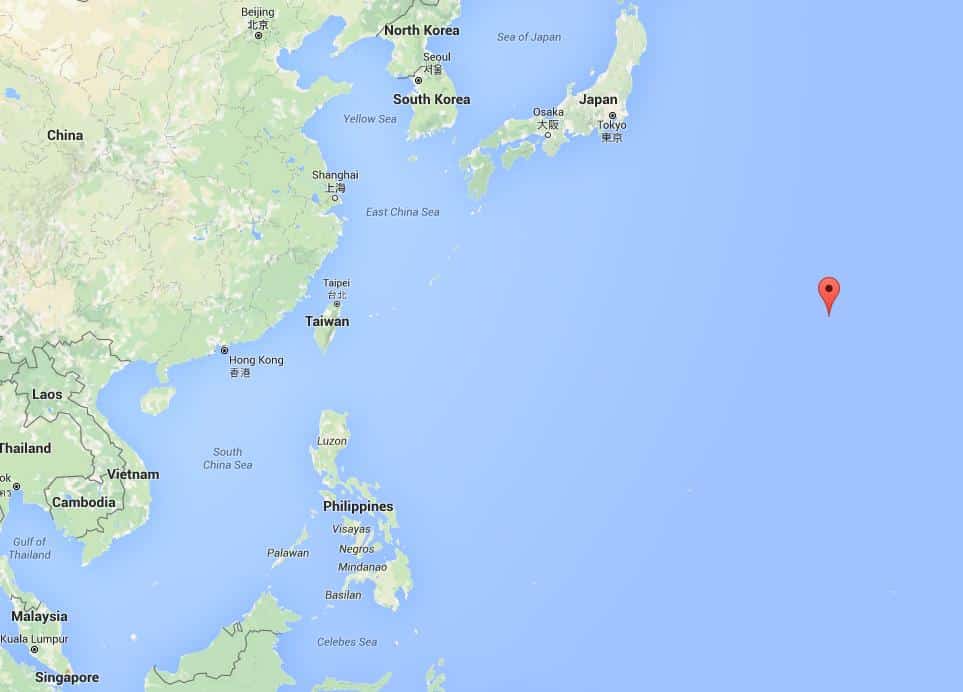

According to France 24 reporting (opens in a new tab) with AFP (Feb. 2, 2026), the Japanese government confirmed it recovered sediment containing rare earths from extreme depths during a test mission near Minami Torishima, a remote Pacific island within Japan’s exclusive economic zone. Officials described the recovery as a “meaningful achievement” for economic security and maritime development, noting that the sample will now be analyzed to determine mineral content and feasibility.

Japan claims this is the first successful deep-sea recovery at such depth, underscoring technical capability rather than commercial readiness.

What’s Solid—and What’s Still Aspirational

The technical achievement is real: retrieving sediment from 6,000 meters is non-trivial and places Japan among a very small group with such deep-ocean drilling capacity. However, claims about scale deserve caution. Estimates cited by Japanese media suggesting tens of millions of tons of rare earths—and centuries of dysprosium or yttrium supply—are geological in nature, not economically proven reserves. No grades, recovery rates, or costs have been disclosed.

Deep-sea mud is dilute, processing is complex, and environmental constraints are unresolved. This is exploration, not production, be sure.

The Geopolitical Subtext Investors Should Read Carefully

This move is less about near-term supply and more about strategic signaling. Japan remains acutely exposed to Chinese export controls, especially as Beijing has restricted “dual-use” materials amid rising regional tensions. Demonstrating an alternative—however distant—strengthens Japan’s negotiating posture and supportsallied narratives around supply diversification.

Yet the economics matter: even optimistic scenarios place commercial deep-sea rare earth extraction many years away, with costs likely far above terrestrial mining and processing.

Why This Matters for the Rare Earth Supply Chain

For now, China still controls roughly two-thirds of mining and over 90% of refining. Japan’s test does not alter that reality. But it does highlight where future competition may emerge—and how supply-chain security increasingly intersects with ocean technology, environmental governance, and geopolitics.

REEx Takeaway: Impressive engineering, important diplomacy, but not a market-moving supply breakthrough.

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →