Highlights

- New review shows SmCo magnet recycling can achieve >99% samarium and ~90% cobalt recovery in lab conditions, but industrial deployment remains limited due to cost and scale-up challenges.

- Hydrometallurgy delivers highest yields while 'greener' organic acid routes trade recovery (~85%) for lower environmental impact—separation remains the key bottleneck, mirroring China's processing advantage.

- Emerging electrochemical methods using intact magnets as anodes show >85% efficiency with reduced waste, positioning secondary SmCo supply as strategic leverage for defense and aerospace applications.

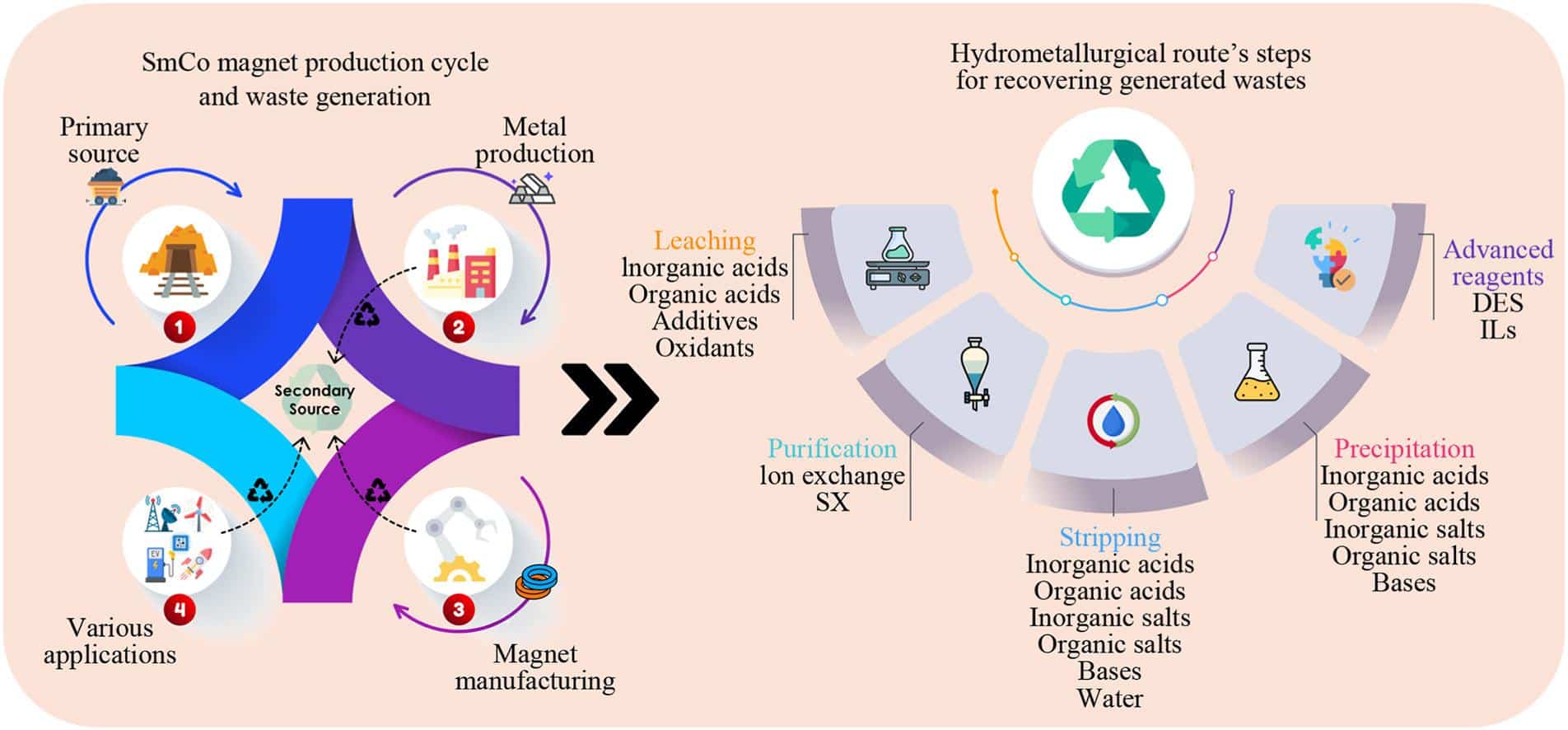

A new open-access review in the Journal of Rare Earths—led by Sara Karimi Moghadam (opens in a new tab) affiliated with Iran University of Science & Technology, and Mehrdad Gharavi, Sharif University of Technology, with co-authors from the University of São Paulo and Luleå University of Technology—argues that recycling samarium–cobalt (SmCo) magnets could become a strategically important pressure valve in a world where China still dominates rare-earth separation and refining. SmCo magnets are a smaller market than NdFeB, but they are essential in high-heat, high-reliability environments (~300°C) such as aerospace, defense, and industrial systems—precisely the places where supply shocks hurt the most. The authors’ core message: the chemistry is strong, the scale is not—SmCo recycling can achieve very high recoveries in the lab, but deployment remains limited.

The Investigation

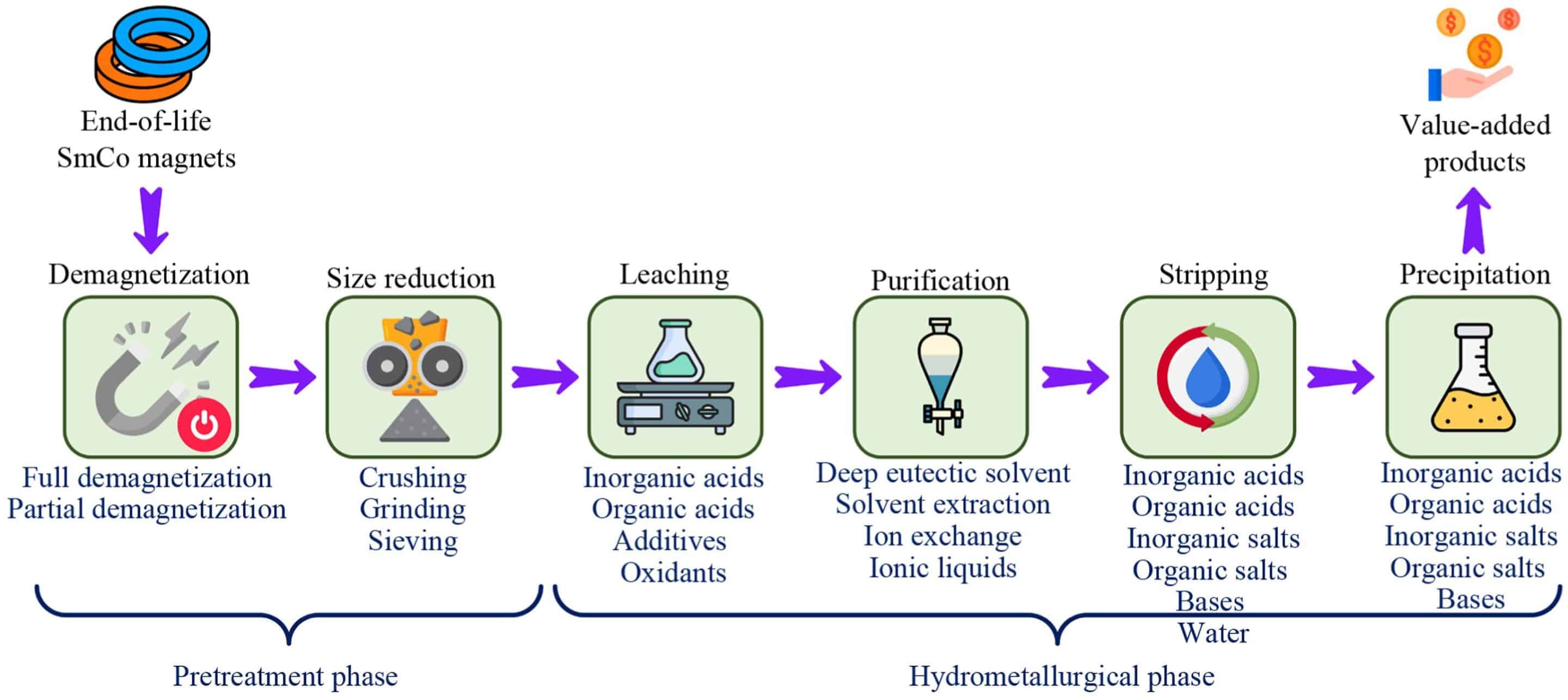

This is a comprehensive review, not a new experimental study. The team surveys published research across the full SmCo recycling “flowsheet”: pretreatment (demagnetization, crushing/milling), leaching, separation/purification, stripping, precipitation, and emerging electrochemical approaches—highlighting what works, what breaks, and what blocks scale-up.

What the authors found:

- Hydrometallurgy can deliver near-total recovery—under controlled conditions. Inorganic acids (notably HCl, but also H₂SO₄ and HNO₃) are reported to enable >99% samarium recovery and up to ~90% cobalt—yet sulfate systems can trigger samarium precipitation, complicating recovery.

- “Greener” leaching trades yield for footprint. Organic acids (with H₂O₂) can reduce environmental burden but typically deliver ~85% recovery—often not enough for defense-grade economics without process improvements.

- Separation is the bottleneck that mirrors China’s advantage. High selectivity is achievable via solvent extraction, ionic liquids, deep eutectic solvents, and ion exchange, but many candidate reagents raise questions about cost, stability, recyclability, and real-waste performance.

- Electrochemical routes look disruptive—but early. Using intact magnets as anodes in non-aqueous systems is summarized as >85% efficient with less acid and waste, but it remains far from industrial standardization.

Implications for REEx readers

SmCo recycling won’t replace primary mining—but it can chip away at processing leverage by creating domestic/ally-controlled secondary supply of samarium and cobalt for mission-critical magnet demand. In practice, this reinforces the Rare Earth Exchanges™ (REEx) view: the strategic battlefield is midstream processing + recycling, not just ore bodies.

Limitations—What’s Missing

Most evidence remains bench- or pilot-scale, often using synthetic leachates rather than messy real scrap streams; techno-economic analysis and full LCAs are still thin. Some “green solvent” systems may face reagent degradation or complicated waste streams. And while the review discusses industrial readiness, it does not provide a single “plug-and-play” flowsheet with verified costs.

Any IP?

The ScienceDirect record lists a Declaration of Competing Interest stating the authors report no known competing financial interests or personal relationships influencing the work. Two authors are noted as equal contributors.

Because this is a review, it does not introduce a proprietary process with new patent claims. However, many technologies discussed (ionic liquids, DES formulations, solvent-extraction systems) may be subject to third-party IP in the underlying literature—an important due diligence step for any commercialization effort.

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →