Highlights

- Study reveals 38% of China’s rare earth exports are invisible in trade data—embedded in magnets, electronics, and manufactured goods that sustain global consumption, exposing hidden supply chain dependence.

- Between 2013-2020, indirect rare earth exports generated 27× more carbon emissions than direct exports, as downstream processing occurs within China before products reach Western markets.

- U.S., Japan, and Europe remain deeply exposed through embedded flows: by 2020, ~60% of China’s rare earth exports to the U.S. and ~68% to Europe were indirect, undermining claims of successful diversification.

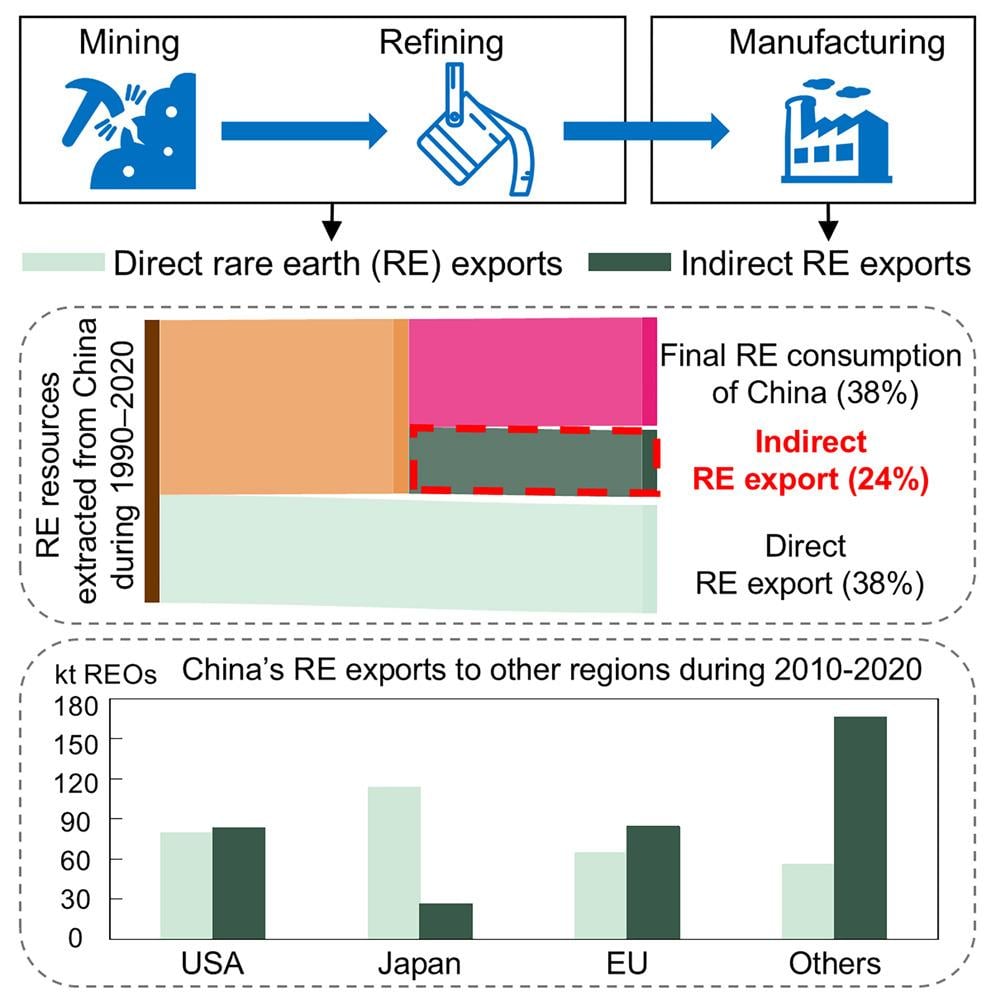

A new peer-reviewed study (opens in a new tab) led by Ling Shao, corresponding author at the China University of Geosciences and the Ministry of Natural Resources–affiliated Key Laboratory of Carrying Capacity Assessment for Resource and Environment, exposes a major blind spot in global rare earth (RE) strategy: a large share of China’s dominance never appears in customs data at all. Published in Cell Reports Sustainability, the study shows that from 1990–2020, over 60% of rare earths extracted in China were exported, and about 38% of those exports occurred indirectly, embedded in magnets, components, and manufactured goods that quietly sustain global consumption.

The implication is clear—many economies that believe they have reduced dependence on China’s rare earths remain deeply exposed through global value chains.

Investigation

The authors integrate material flow analysis (MFA) with environmentally extended multi-regional input-output (EEMRIO) modeling, global value chain (GVC) decomposition, and structural path analysis. Instead of tracking only ores, oxides, and metals crossing borders, the study follows rare earths through refining, functional materials (notably permanent magnets), downstream manufacturing, and final products, capturing both direct exports and indirect (“embedded”) exports that are invisible in trade statistics.

Ling Shao, corresponding author at the China University of Geosciences

Source: ResearchGate

Findings

- Export scale: From 1990–2020, China exported over 60% of the rare earths it extracted; roughly 62% were direct exports and 38% were indirect, embedded in traded goods

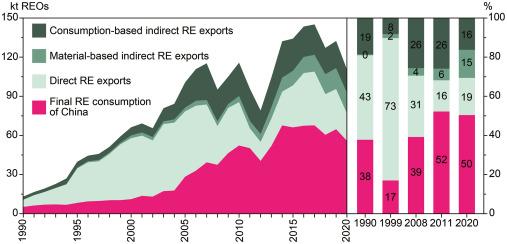

- Structural shift: Since the 2000s—and especially after 2010—China’s system shifted from direct exports toward indirect exports, with indirect flows exceeding direct ones in most years of the 2010s.

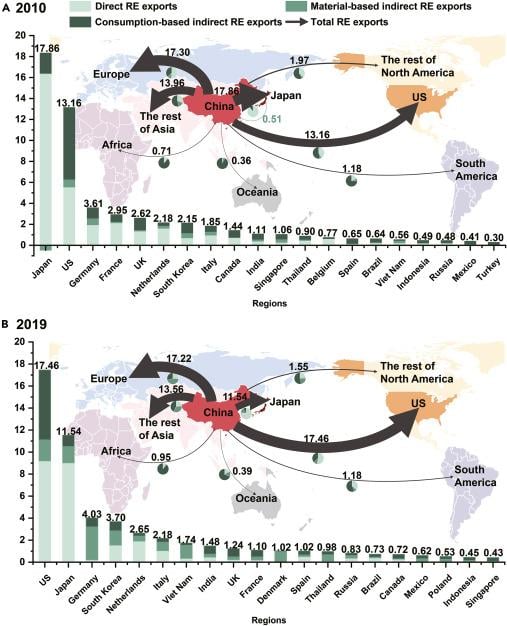

- Who benefits: The United States, Japan, and Europe are the largest destinations. By 2020, indirect exports accounted for ~60% of China’s total RE exports to the U.S., ~30% to Japan, and ~68% to Europe.

- Environmental paradox: Indirect exports are more carbon-intensive. Between 2013–2020, domestic carbon emissions linked to indirect RE exports were 2–7× higher than those from direct exports, because additional downstream processing occurs inside China.

China’s final consumption, direct exports, and indirect exports of REs during 1990–2020

Implications for the United States and the West

For U.S., European, and allied supply-chain strategies, the findings are unsettling but clarifying. Policies that focus narrowly on reducing imports of rare earth oxides or metals address only part of the exposure. Even when direct RE imports fall, dependence can persist—or even deepen—through magnets, motors, electronics, clean-energy equipment, and intermediate goods that embed Chinese rare earths.

Direct and indirect RE exports from China to other regions in 2010 and 2019

This means diversification strategies centered solely on mining or first-stage processing risk overstating resilience. The study implies that genuine supply-chain security requires downstream visibility: tracking embedded rare earth content, aligning industrial policy with magnet and component manufacturing, and coordinating with allies on full-chain transparency rather than just upstream substitution.

Limitations and controversies

The analysis ends in 2020, reflecting data constraints; it does not capture post-pandemic restructuring or the most recent export controls. Some re-export loops and downstream uses outside China cannot be fully traced due to data gaps. As with all MRIO-based studies, absolute volumes carry uncertainty, but the direction and scale of the trends are robust and cross-validated.

Disclosures and funding

The authors declare no competing interests and introduce no proprietary technology or patents. Funding comes from Chinese national research programs focused on resource systems and sustainability analysis.

Bottom line

China’s rare earth leverage is increasingly indirect, embedded, and harder to see—but no less real. Until Western governments and investors account for embedded rare earth flows, claims of diversification will remain partial and potentially misleading. Again one of the key limitations of study is data analyzed prior to COVID-19 supply chain crisis and of course the latest surge of USA and West rare earth investment.

Shao, L., et al. (2026). Tracing China’s unseen rare earth flows through direct and embedded exports, 1990–2020. Cell Reports Sustainability, [S2949-7906(25)00249-6]. Available at: https://www.cell.com/cell-reports-sustainability/fulltext/S2949-7906(25)00249-6# (opens in a new tab)

0 Comments