Highlights

- China's 15th Five-Year Plan intensifies CCP oversight across critical minerals and rare earth industries through embedded Party cells in industrial parks, supply chains, and industry associations, particularly targeting new economic organizations and employment models.

- Using Zibo City as a model, Beijing is merging social governance with industrial strategy by centralizing Party oversight, expanding control over flexible labor, and implementing digital management systems to preemptively manage disputes in strategically sensitive sectors.

- Western firms sourcing critical minerals from China face higher compliance expectations, deeper engagement with Party-affiliated bodies, and reduced operational autonomy as the boundary between social policy and business operations continues to dissolve.

A policy commentary circulated on February 9, 2026, offers a window into how Chinese local governments are preparing to implement the Chinese Communist Party’s (CCP) 15th Five-Year Plan (2026–2030)—and why this matters for sectors central to China’s economic power, including rare earths and critical minerals.

Published by the China Rare Earth Industry Association and sourced from China Social Work Daily, the article reflects official thinking following the Fourth Plenum of the 20th Communist Party Central Committee, which approved planning guidance emphasizing stronger social governance, deeper Party oversight, and tighter grassroots control.

Zibo City Example

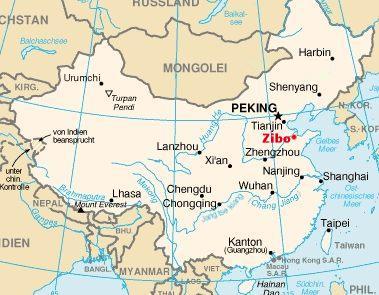

Using Zibo City, Shandong Province as a case study, the piece outlines how local authorities plan to intensify coordination among government agencies, industry associations, employers, and worker groups—particularly across industrial parks, supply chains, and new employment models. While framed as social governance, the approach closely overlaps with how China manages strategically sensitive industries.

What’s New—and Why It Matters

The clearest signal for international business is Beijing’s push to expand Party organization and supervision across “new economic organizations, new social organizations, and new employment groups.” This includes stricter oversight of industry associations and chambers of commerce, clearer rules governing leadership appointments, and standardized compliance and performance mechanisms.

For the rare earth and critical minerals sectors, this is especially relevant. These industries are heavily clustered in industrial parks, rely on specialized labor, and operate through state-linked associations that already coordinate pricing, standards, and capacity. Embedding Party structures more deeply into these ecosystems strengthens the state’s ability to align labor, production, and local governance with national industrial strategy.

Zibo’s framework highlights:

- Centralizing oversight of industry and social organizations under city-level Party committees

- Embedding Party cells into industrial parks, enterprise clusters, and supply chains

- Expanding governance of flexible and gig labor, including state-supported service hubs providing housing, transport, training, and legal support

While presented as worker-friendly initiatives, they also enhance state visibility (and by extension CCP) into workforce organization, labor mobility, and enterprise operations—critical levers in sectors China considers strategically indispensable.

Community Governance as Industrial Infrastructure

The article stresses community-level governance tools—digital management systems, property-management reforms, and structured dispute resolution—to reduce friction and preserve stability. For capital-intensive industries like rare earths, where environmental, labor, and safety disputes can disrupt output, this model serves as risk-management infrastructure as much as social policy.

Volunteer networks, public feedback channels, and formalized grievance systems further signal a preference for preemptive, institutional control over reactive enforcement.

Implications for Western Firms and Policymakers

This is not a commercial announcement, but it is a strategic signal. China is further dissolving the boundary between social governance and industrial policy, particularly in sectors tied to national power.

For U.S. and European firms—especially those sourcing rare earths or critical minerals from China—the message is clear:

- Higher compliance expectations embedded in local governance frameworks

- Deeper interaction with Party (CCP)-affiliated bodies inside industrial ecosystems

- Reduced separation between social policy and business operations, affecting transparency, labor flexibility, and operational autonomy

The City

Zibo is a prefecture-level city in central Shandong Province, China, covering about 5,938 square kilometers and bordering Jinan, Tai’an, Linyi, Weifang, Dongying, and Binzhou. According to China’s 2020 census, Zibo has a population of 4.70 million, with roughly 4.41 million residents living in the metropolitan area, which includes five urban districts—Zhangdian, Zichuan, Boshan, Zhoucun, and Linzi—along with parts of Huantai, Gaoqing, and Yiyuan counties. Historically, the area was the heart of the ancient State of Qi, whose capital Linzi was among the most populous cities in the world more than 2,000 years ago, giving Zibo enduring cultural significance as the birthplace of Qi culture. Today, Zibo remains an important industrial city, anchored by manufacturing, especially ceramics, alongside petrochemicals, pharmaceuticals, metallurgy, machinery, and textiles, while newer sectors such as advanced materials, fine chemicals, electronics, IT, and biopharmaceuticals are expanding rapidly.

Disclaimer: This summary is based on reporting distributed through Chinese state-affiliated media and industry-linked channels. All claims and interpretations should be independently verified using third-party sources, regulatory analysis, and local legal counsel before being relied upon for investment, procurement, or policy decisions.

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →