The rare earth industry is a veritable treasure trove of geopolitical intrigue and economic significance. As the world's leading producer of these vital elements, China's rare earth market holds the key to unlocking the future of high-tech innovation. In 2024, this dynamic landscape is poised for remarkable transformations - and we're here to uncover the 5 most crucial insights you need to know. Buckle up, because this deep dive into the China rare earth market is about to reveal the secrets that will shape global industries for years to come.

Table of Contents

What is the Current State of the China Rare Earth Market?

China's rare earth market continues to dominate global production and reserves, shaping the industry's landscape. Recent data from the U.S. Geological Survey indicates that China accounts for approximately 58% of global rare earth production and holds about 36% of the world's reserves.

- China produced an estimated 168,000 metric tons of rare earth oxides in 2022.

- The country's reserves are estimated at 44 million metric tons.

The supply and demand dynamics of the rare earth market are complex and evolving. While China maintains its position as the leading producer, demand for rare earth elements is growing globally, driven by their critical applications in high-tech industries and renewable energy technologies.

- Global demand for rare earths is projected to reach 315,000 tons by 2030, up from 210,000 tons in 2019.

- The electric vehicle industry is a significant driver of demand growth.

Geopolitical factors play a crucial role in shaping the rare earth market. China's strategic control over the supply chain has raised concerns among other nations, leading to efforts to diversify sources and reduce dependence on Chinese exports.

Impact of Geopolitical Factors

- Trade tensions between China and the United States have highlighted the vulnerability of rare earth supply chains.

- The Chinese government has implemented export quotas and restrictions in the past, influencing global prices and availability.

- Other countries, such as Australia and the United States, are working to develop their rare earth production capabilities.

Emerging Trends Shaping the Future of Rare Earths

The rare earth industry is undergoing significant transformations driven by environmental concerns, supply chain risks, and technological advancements.

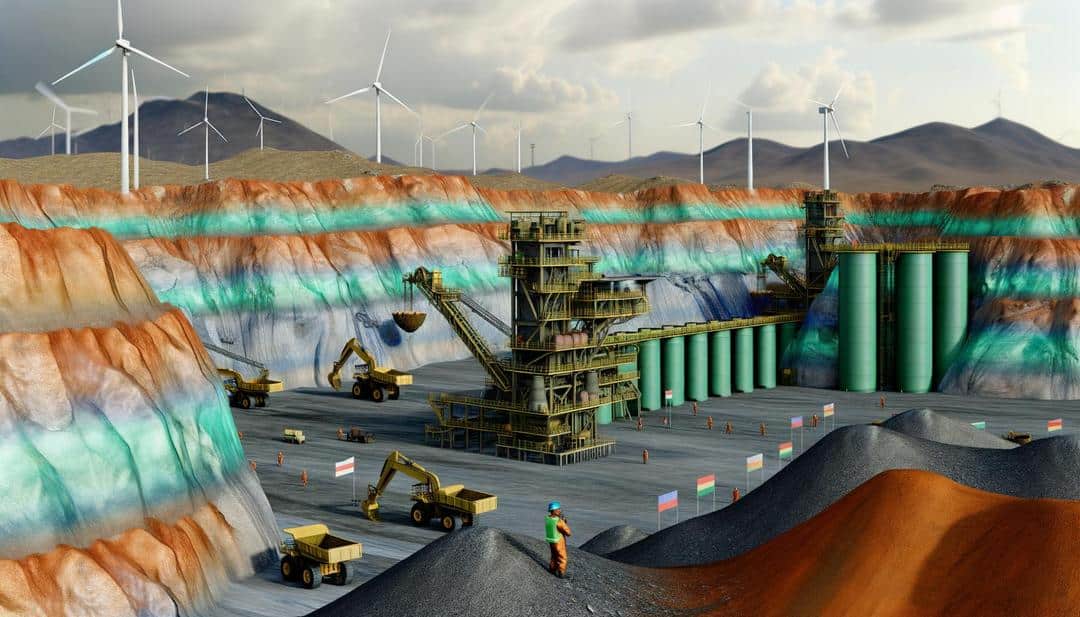

Shift Towards Sustainable Mining and Processing Techniques

Environmental sustainability has become a key focus in rare earth production, with efforts to reduce the ecological impact of mining and processing operations.

- Implementation of more efficient extraction methods to minimize waste and environmental damage.

- Development of cleaner processing techniques to reduce pollution and water consumption.

- Increased emphasis on the rehabilitation of mining sites and responsible land management.

Diversification of Rare Earth Supply Chains Beyond China

Countries and companies are actively pursuing strategies to diversify rare earth supply chains and reduce dependence on Chinese production.

- The United States has reopened the Mountain Pass mine in California, once the world's largest rare earth producer.

- Australia has increased its rare earth production, with companies like Lynas Corporation expanding operations.

- Japan has invested in rare earth projects in countries such as Vietnam and Kazakhstan.

Advancements in Rare Earth Recycling and Alternative Sources

Innovations in recycling technologies and exploring alternative sources open new avenues for rare earth production.

- Development of more efficient recycling processes for electronic waste and magnets.

- Exploration of unconventional sources, such as coal ash and phosphate rock.

- Research into synthetic substitutes for rare earth elements in certain applications.

Geopolitical Implications and Trade Policies

The rare earth market is deeply intertwined with global politics and trade relationships, influencing both supply and pricing dynamics.

Examination of Global Trade Dynamics

- China's export policies have a significant impact on global rare earth availability and prices.

- The establishment of the Rare Earth Industry Association (REIA) in 2019 aims to promote global cooperation and stable supply chains.

- Increased focus on rare earth trade in international negotiations and agreements.

Impact of Trade Tensions and Regulatory Changes

In recent years, fluctuations in rare earth prices and supply have been observed due to geopolitical factors and policy shifts.

- The U.S.-China trade war led to concerns about potential rare earth export restrictions.

- China's consolidation of rare earth companies has implications for global supply and pricing.

- Environmental regulations in China have affected production levels and costs.

Strategies for Navigating Geopolitical Risks

Businesses and governments are developing strategies to mitigate risks associated with rare earth supply chain vulnerabilities.

- Stockpiling of critical rare earth elements by some countries and companies.

- Investment in research for alternative materials and technologies.

- Formation of international partnerships and alliances to secure stable supplies.

Key Players and Market Dynamics

The rare earth market in China is characterized by a mix of state-owned enterprises and private companies, with significant market concentration.

Profiles of Major Rare Earth Producers and Processors in China

- China Northern Rare Earth Group: The largest rare earth producer in China, controlling the majority of light rare earth element production.

- China Minmetals Corporation: A state-owned enterprise with significant rare earth mining and processing operations.

- Shenghe Resources Holding Co., Ltd.: A leading private company in rare earth mining, processing, and trading.

Analysis of Market Concentration and Competitive Landscape

- The top six state-owned enterprises control approximately 85% of China's rare earth production quotas

- Consolidation efforts have reduced the number of rare earth companies from over 100 to about 20 major players

- Increased competition from emerging producers outside China is beginning to impact market dynamics

Role of State-Owned Enterprises and Private Companies

- State-owned enterprises play a strategic role in implementing government policies and controlling production quotas.

- Private companies are increasingly involved in downstream processing and product development.

- Collaboration between state-owned and private entities is becoming more common in research and development efforts.

Outlook and Strategic Considerations

Various factors, including technological advancements, environmental concerns, and geopolitical developments, shape the future of the rare earth market.

Projections for Rare Earth Supply and Demand

- Global demand for rare earths is expected to grow at a CAGR of 10.4% from 2021 to 2028.

- Supply is projected to diversify, with non-Chinese sources accounting for an increasing share of global production.

- Prices are likely to remain volatile due to supply-demand imbalances and geopolitical factors.

Potential Disruptors and Their Impact

- Breakthrough recycling technologies could significantly reduce the need for primary rare earth production.

- Development of alternatives to rare earth elements in key applications, such as electric vehicle motors.

- Shifts in global trade policies and alliances may reshape supply chains and market dynamics.

Recommendations for Stakeholders

For investors:

- Diversify investments across the rare earth value chain.

- Monitor geopolitical developments and their potential impact on the market.

- Consider opportunities in recycling and alternative technologies.

For policymakers:

- Develop comprehensive strategies to secure rare earth supplies and reduce vulnerabilities.

- Invest in research and development of sustainable production methods and alternatives.

- Foster international cooperation to ensure stable and responsible rare earth supply chains.

For industry leaders:

- Invest in sustainable production practices and circular economy initiatives.

- Explore partnerships and vertical integration opportunities to secure supplies.

- Stay ahead of technological advancements and market trends to maintain competitiveness.

Conclusion

The rare earth market is a complex and ever-evolving landscape with far-reaching implications for global industries and geopolitics. By unpacking these insights we've explored, you now have a comprehensive understanding of the current state of this strategic market and the trends shaping its future. As you navigate the rare earth landscape, remember to stay informed, adaptable, and ready to seize the emerging opportunities.

FAQs

What are the main applications of rare earth elements?

Rare earth elements are essential for a wide range of high-tech applications, including electronics, renewable energy, and advanced manufacturing. They play a crucial role in producing powerful magnets used in wind turbines and electric vehicles, phosphors for LED lights and screens, catalysts for refining oil, and components in medical imaging devices. The unique properties of rare earths, like high magnetic strength and conductivity, make them indispensable for many modern technologies.

How does China's dominance in rare earth production impact the global market?

China's control over rare earth production and processing gives it significant leverage in the global market, as it supplies over 80% of the world's rare earths. This dominance allows China to influence global pricing, availability, and trade policies around rare earths, creating potential vulnerabilities for other nations dependent on these elements for critical industries. Additionally, China’s export restrictions and quotas on rare earths can lead to supply chain disruptions, impacting industries worldwide.

What are the environmental concerns surrounding rare earth mining and processing?

Rare earth mining and processing can have significant environmental impacts, such as soil and water pollution from toxic chemicals and radioactive elements released during extraction. The process often generates large amounts of waste, which can contaminate nearby ecosystems. Additionally, the energy-intensive nature of rare earth processing contributes to greenhouse gas emissions, raising concerns about the industry’s environmental footprint and highlighting the need for sustainable practices.

How are countries and companies diversifying their rare earth supply chains?

To reduce reliance on China, various strategies are being explored, including developing rare earth mines in the United States, Australia, and Canada. Companies are investing in research to recycle rare earths from electronics and end-of-life products, while governments are supporting initiatives to build domestic processing facilities. International collaborations and partnerships are also underway to secure alternative sources and create a more resilient supply chain.

What are the key factors driving the future demand for rare earths?

The growing demand for rare earths is primarily driven by factors such as the rise of clean energy technologies, including wind turbines and electric vehicles, which require rare earth magnets. Additionally, advancements in consumer electronics, defense applications, and automation are contributing to increased demand. As global efforts to reduce carbon emissions intensify, the need for rare earth elements to support these technologies is expected to grow significantly.