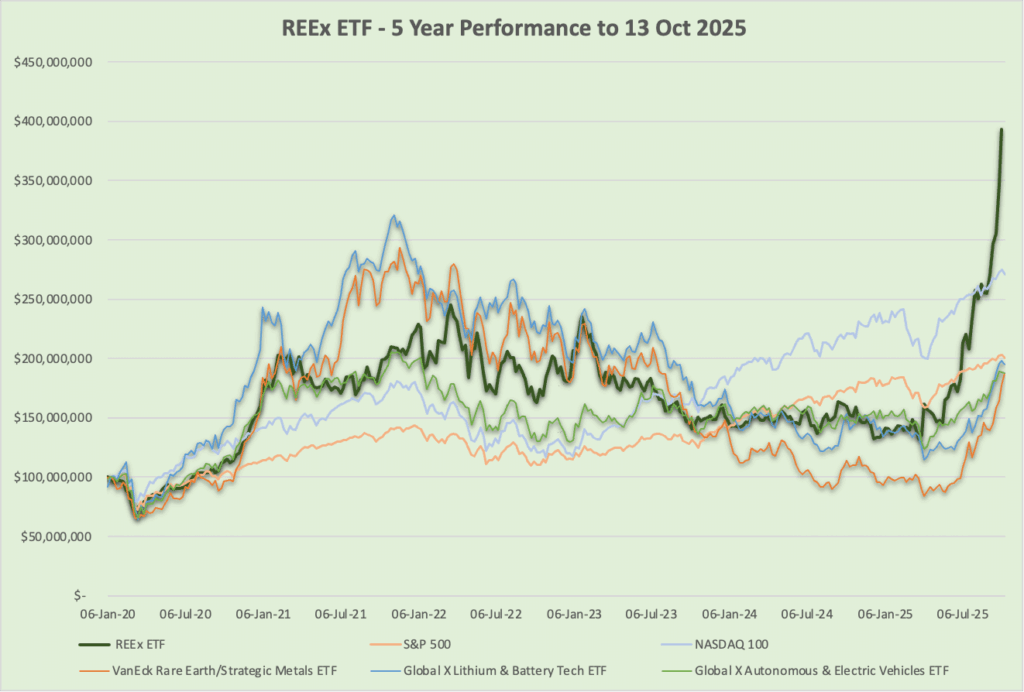

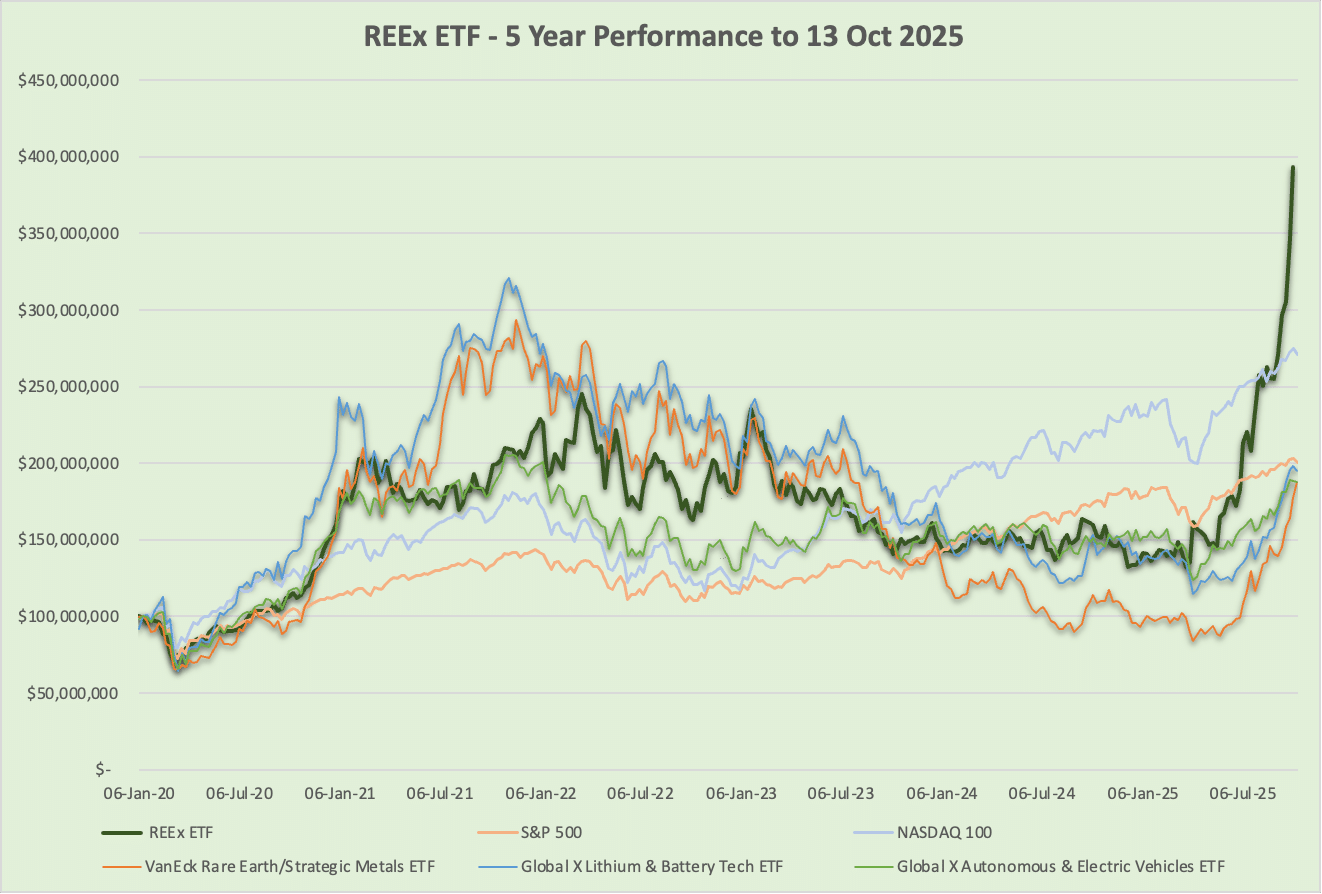

The Rare Earth Exchange (REEx) ETF model continued to show momentum this week, building on the excitement sparked by the recent feature article, “REEx ETF: The Pure-Play Gateway to a Strategic Global Shift.” While the REEx ETF remains an educational tool and model not yet available to the market, its simulated performance offers a glimpse into how a dedicated vehicle focused on the ex-China rare earth element supply chain shows tremendous potential. Multiple financial institutions have planned discussions in the weeks ahead.

| Weekly | Monthly | 1 Year | 5 Year | All Time | |

|---|---|---|---|---|---|

| REEx ETF | 13.5% | 32.6% | 146.8% | 248.5% | 293.3% |

| S&P500 | -1.2% | 0.8% | 13.9% | 90.8% | 100.4% |

| NASDAQ100 | -1.4% | 1.4% | 22.5% | 107.5% | 170.8% |

| NYSEARCA:REMX | 5.9% | 18.3% | 72.3% | 93.6% | 87.5% |

| NYSEARCA:LIT | -1.5% | 4.1% | 39.4% | 36.4% | 95.0% |

| NASDAQ:DRIV | -0.2% | 3.8% | 27.7% | 59.7% | 87.9% |

REEx ETF Leads the Week with Strong Simulated Returns

According to the most recent performance table, the REEx ETF posted a 13.5% simulated gain for the week, outperforming both major market indices and comparable thematic ETFs. This rise highlights the growing investor interest in sectors tied to electrification, renewable energy, and advanced manufacturing — industries that depend heavily on the rare earth supply chain.

By comparison, the S&P 500 and NASDAQ 100 both showed more modest weekly movements, reflecting a cautious tone in broader equity markets. Even among targeted thematic peers, REEx stood out. The VanEck Rare Earth/Strategic Metals ETF (REMX) recorded a smaller gain, while Global X Lithium & Battery Tech (LIT) and Global X Autonomous & Electric Vehicles (DRIV) were mixed, showing how performance can diverge even among resources linked to the same long-term energy transition story.

When does the REEx go live, for us to invest??