Highlights

- America's AI infrastructure boom is driven by $375 billion in spending and Nvidia's dominance.

- Transformation of the economy into an 'Nvidia-state' is dependent on hyperscale data centers that consume massive energy and land resources.

- Every GPU and AI server relies on a fragile supply chain of rare earth elements like neodymium and dysprosium.

- China controls most refining capacity of these rare earth elements, creating strategic vulnerabilities for U.S. tech growth.

- The AI sector mirrors historical speculative bubbles with financial engineering and securitized leases.

- Infrastructure is outpacing utility, risking a correction that could impact both tech valuations and critical mineral investments.

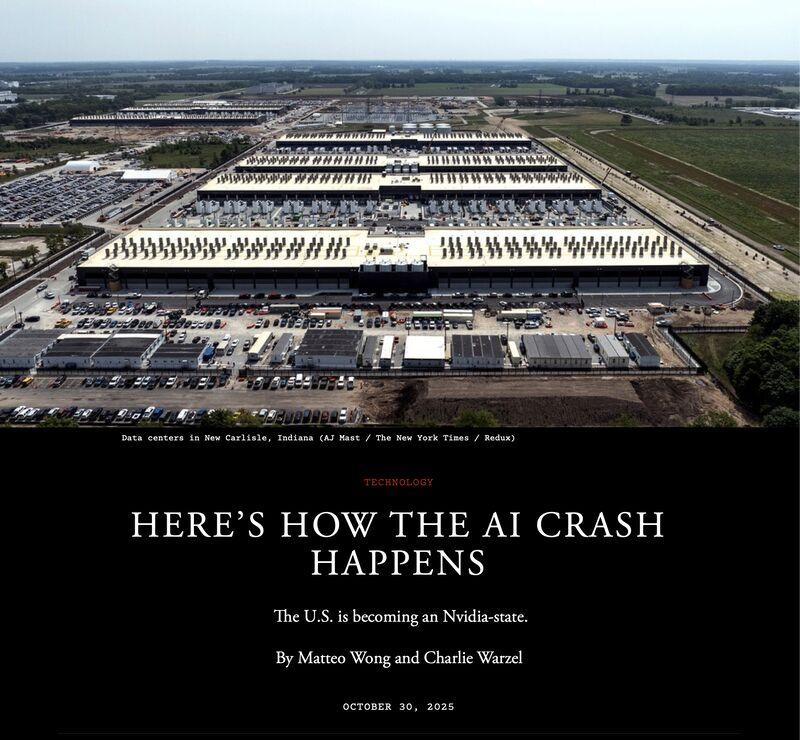

In New Carlisle, Indiana, the horizon is no longer dotted with grain silos but with cooling towers. The AI boom has turned farmland into factory-scale data centers — consuming gigawatts and concrete by the acre. These hyperscale complexes, such as those run by Amazon for Anthropic, represent America’s transformation into what analysts call an “Nvidia-state” — an economy increasingly dependent on a single firm’s chips to sustain growth, speculation, and political prestige.

Table of Contents

Behind this expansion lies a deeper truth: every GPU, AI server, and neural cluster depends on a vast, fragile supply chain of rare earth elements (REEs). From neodymium magnets in server fans to yttrium and europium in display phosphors, AI’s physical infrastructure is built atop minerals still overwhelmingly refined in China.

When Growth Becomes Gravity

The statistics dazzle: AI spending at $375 billion in 2025, heading toward half a trillion by 2026. Nvidia’s $5 trillion valuation now rivals the GDP of major nations. Yet the economic reality looks increasingly distorted. Ninety-two percent of U.S. GDP growth in early 2025 was AI-linked, while 22 states teetered near recession. Like the canal and railway booms of the 19th century—or the dot-com fiber surge of the 1990s—the infrastructure has outpaced utility.

For the REE sector, this creates both opportunity and peril. Demand for dysprosium, terbium, and neodymium is accelerating beyond mining capacity, but speculative capital—much like in AI equities—is pouring in faster than physical projects can mature. Recycling and refining ventures, from Canada’s Cyclic Materials to the U.S.’s ReElement, could benefit, yet the risk of overbuild looms large.

Circular Capital and Obsolescence

In “Here’s How the AI Crash Happens,” the authors correctly flag one of the system’s weakest links: financial engineering. Tech giants are securitizing data-center leases and passing risk through private-equity channels, mirroring pre-2008 tranching tactics. How about for mineral investors? Does a similar phenomenon emerge? That is, junior miners packaging projected magnet-metal yields into financial instruments before extraction even begins?

The other risk is technological decay. Each new Nvidia architecture renders billions in existing hardware obsolete. The same could happen in rare-earth processing as novel magnet chemistries or recycling breakthroughs displace today’s infrastructure, leaving stranded capital and rusting assets in their wake.

Truth, Spin, and the Rare Earth Reality

Matteo Wong and Charlie Warzel’s warning that the U.S. economy is becoming structurally dependent on Nvidia is directionally accurate. The speculative tone is deliberate but not misplaced. Where the article veers toward hyperbole is in suggesting total systemic collapse; the reality will likely be uneven correction. Still, their caution rings true: a fragile ecosystem built on critical minerals, capital rotation, and AI optimism can fall as fast as it rose.

Summary

This analysis bridges the AI-finance nexus with the rare earth supply chain, exposing how chip-driven growth leans on unstable mineral, energy, and financial foundations. For investors, the “AI crash” is not just about tech valuations—it’s about who controls the raw materials of intelligence itself.

©!-- /wp:paragraph -->

The question is, shouldn’t large AI companies, the defense industry, and others have invested long ago to secure their supply chain, as China has been doing for 30 years? It’s quite logical. Large companies will also control market prices.