Highlights

- Arafura Rare Earths has seen significant stock price growth.

- Growth is driven by strategic global partnerships and strong potential in the rare earth market.

- The Nolans Project in Australia is ranked #5 globally.

- Plans to produce 4,400 tonnes of NdPr oxide annually and secure critical mineral supply chains.

- The company has secured nearly A$1 billion in funding.

- Shows potential for substantial long-term growth in the critical minerals sector.

Arafura Rare Earths’ (ARU.AX (opens in a new tab)) share price has surged over the past week, hitting a 52-week high of A$0.285 on October 8, 2025. In the first week of October, the stock jumped roughly 25-30% – including a significant increase over the past few days – reflecting growing investor optimism. This rally extends Arafura’s strong year-long uptrend (about +48% over the past 52 weeks), significantly outpacing the broader market. The bullish momentum appears driven by positive news flow and sentiment around the company’s strategic progress and future prospects.

Rare Earth Exchanges (REEx) interviewed (opens in a new tab) Arafura Rare Earths CEO Darryl Cuzzubbo for more detailed insight on the Nolans project execution (opens in a new tab) plan, and why investors should pay attention.

Global Strategic Engagement

International discussions and partnerships underscore Arafura’s importance in non-Chinese rare earth supply chains. The company’s leadership has engaged with officials in Washington D.C. amid a U.S.-led push to secure critical minerals. Notably, U.S. institutional investors (e.g. Vanguard, Fidelity) have been quietly building positions in Arafura –a signal often linked to high-level confidence and potential U.S. government backing in the future. Analysts suggest Arafura’s A$200 million infusion from Australia’s National Reconstruction Fund in 2025 was “likely tied to future U.S. supply chain participation or off-take agreements not publicly disclosed”, hinting at behind-the-scenes coordination with Washington.

In Europe, Arafura is similarly on the radar. The German government’s Raw Materials Fund has taken Nolans into an appraisal phase for a potential equity investment (opens in a new tab). This comes after Arafura actively sought German support for the project, as reported (opens in a new tab) in Strategic Metals Invest, aligning with Europe’s strategy to diversify critical mineral sources. Meanwhile, South Korea – another major allied economy – has also shown support. As chair of the multilateral Minerals Security Partnership, South Korea welcomed a A$200 million investment into Arafura’s Nolans Project by Australia’s National Reconstruction Fund. The Nolans project was added to the MSP’s roster in late 2024, reflecting strong cooperation among partners like Korea (opens in a new tab), Australia, Germany, and the U.S.

This global engagement is further evidenced by offtake interest from major companies across regions. Arafura has reported non-binding offtake agreements or interest with South Korea’s Hyundai and Kia, as well as U.S.-based General Electric – indicating that end-users in the EV and aerospace industries are eager to secure Nolans’ output. Collectively, these international discussions and partnerships underscore Arafura’s strategic value in Western supply chains, suggesting that the company could benefit from diplomatic support, export financing, and future customer contracts spanning the U.S., Europe, and Asia.

Project Strengths and #5 Global Ranking

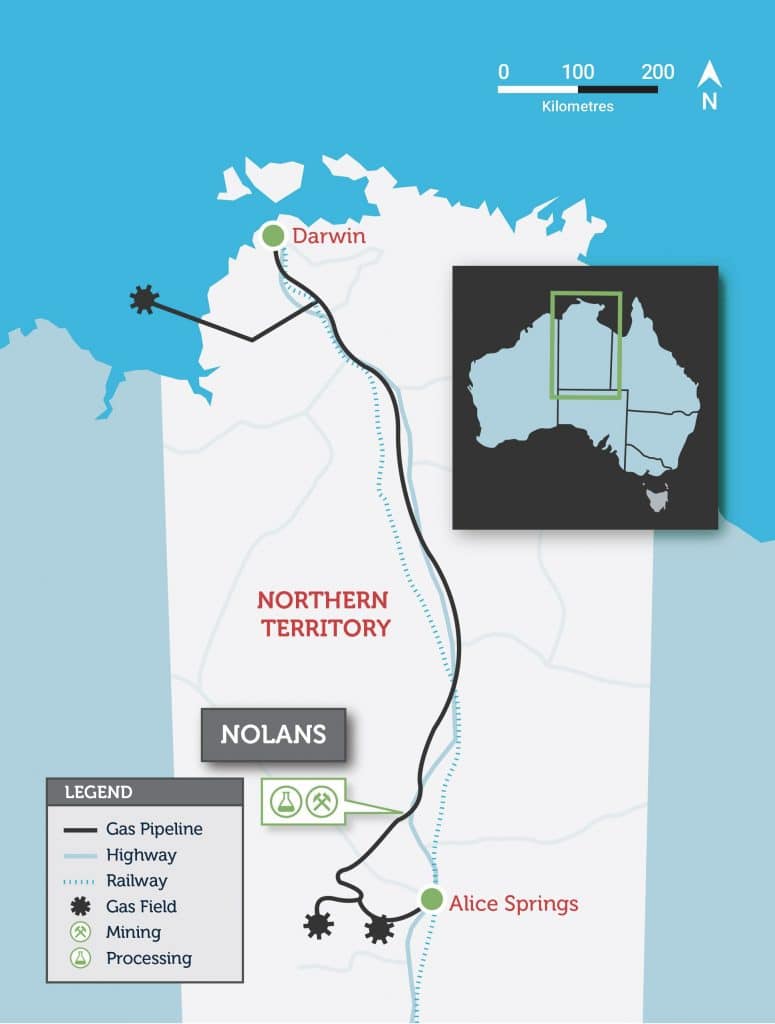

Arafura’s flagship Nolans Project in Australia’s Northern Territory is widely recognized as a world-class rare earth asset. Rare Earth Exchanges ranks Nolans #5 among all light rare earth (LREE) deposits/projects globally, reflecting its combination of size, grade, and advancement. The deposit contains a massive endowment of neodymium-praseodymium (NdPr) – the key magnet metals for EV motors and wind turbines – with plans to produce about 4,400 tonnes of NdPr oxide per year once operational. This output (over a projected 38-year mine life) would account for roughly 4% of the world’s NdPr demand, a very significant contribution from a single mine.

Importantly, Nolans is poised to be one of the few fully integrated “mine-to-oxide” rare earth facilities outside China. Unlike many projects that only mine concentrate, Arafura will perform onsite processing to produce separated rare earth oxides (including NdPr), thereby capturing more value and ensuring end-users a secure, ex-China supply of refined product.

The project is already fully permitted across mining and processing, de-risking one of the major hurdles for new rare earth operations. Additionally, the deposit’s favorable mineralogy and the company’s plans for onsite separation align with stringent ESG and sustainability goals, which is attractive to governments and manufacturers seeking “clean” supply chains.

Key positive attributes of Nolans include: a very large resource base (over 340,000 tonnes of contained NdPr according to REE Exchanges), high annual production scale (4.4 kt NdPr oxide, plus other REEs), a long project life (providing supply stability for decades), and location in a low-risk jurisdiction (Australia) with strong rule of law and environmental standards. The project has drawn major stakeholders – notably Australian mining magnate Gina Rinehart (Hancock Prospecting), who is Arafura’s largest shareholder, ~8.6%, signaling confidence from industry experts.

Financial Position and Upside Potential

As of today, Oct 8, 2025, Arafura’s stock trades around A$0.2850 (market cap A$822 million). Traditional valuation metrics show little current revenue or earnings (no trailing P/E) because Nolans is still in development, not yet producing revenue. The company’s balance sheet reflects a development-stage profile: moderate cash on hand (A$27M) and minimal debt, supplemented post-quarter by large equity infusions (e.g., A$200M NRF investment in early 2025). Crucially, Arafura has secured or lined up approximately A$1 billion in public funding support for Nolans – including government grants, equity investments, and low-interest loans. This includes up to A$840 million from the Australian government, announced in 2024, and additional export credit agency support (~A$100 million from EFA), currently under due diligence. Such backing not only reduces financing risk but also validates the strategic importance of Arafura’s project.

From a long-term investment perspective, the upside potential for Arafura is substantial. If Nolans comes online as planned (analysts speculate first production by ~2027), Arafura would transition into a globally significant NdPr producer akin to today’s industry leaders. For context, established rare earth producers Lynas Rare Earths and MP Materials each command market capitalizations on the order of US$12–13 billion. Lynas (Australia) and MP (USA) are currently among the only major ex-China suppliers; Arafura’s projected output (4.4 kt NdPr) is in the same league as Lynas’ ~6–7 kt and MP’s planned output, yet Arafura’s market cap (≈US$540) is a small fraction of those peers. In other words, Arafura is valued at perhaps 1/20th – 1/30th of the incumbents despite having a comparable resource and product in the pipeline. This valuation gap suggests that, should Arafura successfully execute its project and secure lucrative offtake contracts, its stock price could appreciate multiples over the long term to approach peer valuations. Even accounting for the remaining development risks (financing closure, construction, ramp-up), the risk-reward skew appears favorable given the surging strategic demand for non-Chinese rare earth supply.

Market sentiment around Arafura has indeed been improving as these milestones are achieved. Positive news – such as government funding deals, offtake MOUs, and inclusion in geopolitical initiatives – has boosted confidence that Arafura will bridge the gap from explorer to producer. There is also a strong secular tailwind: global demand for NdPr oxides is forecast to grow steadily (at a high single-digit CAGR) through the next decade, driven by increasing demand for electric vehicles, renewable energy, and robotics and drones, among other factors. The criticality of rare earths for clean tech and defense has prompted nations to support projects like Nolans, which bodes well for Arafura’s long-term market and pricing. Notably, in the U.S., policies such as the Department of Defense-imposed $110/kg NdPr price floor (to encourage domestic supply) and Department of Energy grants are creating a more favorable economic backdrop for new producers. Such developments could indirectly benefit Arafura by firming up magnet supply chain investments globally.

Conclusion

Arafura Rare Earths presents a compelling long-term growth story in the critical minerals sector. Over the past week, its stock price spike underscores a rising optimism that this junior miner is on the cusp of a breakthrough. Backed by robust fundamentals – a top-tier resource (ranked #5 globally in REEx) with integrated processing, government funding nearing $1B, and strong prospective customer interest – Arafura is strategically positioned to become a key non-China source of rare earth magnets.

The company’s active discussions with U.S., European, and Asian stakeholders reflect its central role in Western plans to secure supply chains. While still in the development stage (and thus carrying typical project execution risks), Arafura’s huge upside potential is evident when comparing its modest current valuation to rare earth peers like Lynas and MP Materials.

REEx points out that if the Nolans project delivers as expected, Arafura RareEarths could see transformative growth in the coming years, potentially rewarding patient long-term investors with substantial returns. The recent momentum in the share price and high-level strategic interest suggest that many are beginning to recognize Arafura’s potential as a future rare earth powerhouse.

See Arafura Rare Earths ranking at Rare Earth Exchanges.

©!-- /wp:paragraph -->

0 Comments