Highlights

- Critical minerals demand will double by 2030 and quadruple by 2050, driving industrial policy from EVs to defense, but Canada's permitting timelines and refinery gaps remain binding constraints.

- The UK sent its largest-ever delegation to Québec Mines + Énergie, signaling a strategic shift toward North American mineral partnerships to reduce reliance on China-backed processing.

- Québec's world-class lithium, graphite, and nickel deposits offer potential, but diplomatic optimism should be treated as aspirational—commercial-scale magnet supply by 2030 is not guaranteed.

Critical minerals are now the gravitational center of every industrial policy conversation—from aerospace to EVs to wind power. A United Kingdom investment officer’s (opens in a new tab) framing here is directionally correct: rare earths, lithium, nickel, graphite, copper, and allied inputs truly are the backbone of F-35 avionics, the EV battery ecosystem, and large offshore turbines. These numbers—450 kg for an F-35, 200 kg per EV battery, multi-ton offshore turbine inputs—are broadly accurate across industry benchmarks. They reinforce a simple truth: without critical minerals, the energy transition does not move.

Table of Contents

The International Energy Agency’s (opens in a new tab) projection of demand doubling by 2030 and quadrupling by 2050 is also consistent with publicly available IEA scenario modeling. So far, so solid.

Québec: A Geological Powerhouse—But Still a Work in Progress

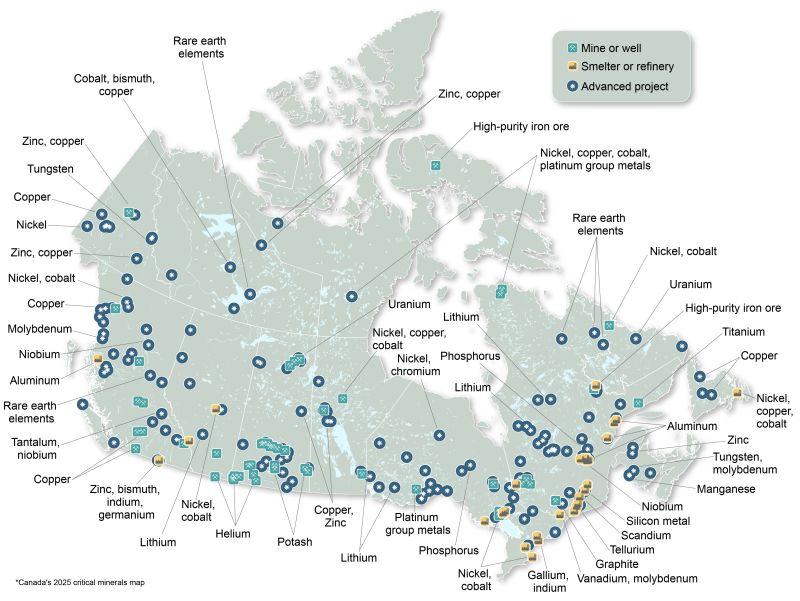

The recent perspective correctly notes that Canada hosts world-class deposits, especially in Québec, where hard-rock lithium, graphite, nickel, and rare earth prospects populate the Abitibi and Nord-du-Québec belts. Many remain in the exploration or early development stage, and investors should note that resource ≠ reserves and geology alone do not guarantee throughput.

What’s left unsaid—perhaps because it complicates the diplomatic cheerleading—is that Canada’s permitting timelines, First Nations partnerships, and refinery gaps remain binding constraints. Without midstream capacity, raw ore alone will not satisfy the UK’s ambition for a secure magnet supply chain.

Diplomacy, Delegations, and the Soft Power of Scarcity

The UK’s decision to send its largest-ever delegation to Québec Mines + Énergie—while serving as the event’s country of honor—is strategically meaningful. It signals a shift: London wants deeper footholds in North American mineral ecosystems, not just offtake agreements but technology exchanges and midstream partnerships.

This recent diplomatic tone is expected, but glosses over geopolitical realities. The UK currently relies almost entirely on China-backed midstream processing for rare-earth permanent magnets. Québec, meanwhile, is trying to position itself as a responsible, ESG-aligned alternative. Both goals are valid, but neither is as simple as the communiqué suggests.

Where the Story Leans Too Polished

The original text slips into marketing language—“realising this strategic opportunity,” “close cooperation,” “potential for both economies.” These phrases are harmless but obscure the deeper question: can UK–Canada collaboration actually deliver a commercial-scale magnet supply by the 2030s? Investors should treat such diplomatic optimism as aspirational, not guaranteed.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain

0 Comments