Highlights

- Egypt's Minister of Electricity traveled to Beijing to meet with NORINCO, Norin Mining, and CNNC to accelerate rare earth extraction with Chinese capital and technology.

- Egypt has mineral deposits in the Golden Triangle region, but the announcement lacks critical data on reserve size, grade, economics, and feasibility studies.

- Partnership with Chinese state-linked entities offers technology access but raises concerns about downstream control and whether Egypt will export ore rather than build processing sovereignty.

Rare Earth Exchanges™ reviews a strategic pitch, carefully worded. Egypt is openly seeking Chinese partnerships to develop rare earths and other “strategic minerals,” according to a December 22, 2025 report (opens in a new tab) by Amwal Al Ghad. Mahmoud Esmat, Egypt’s Minister of Electricity and Renewable Energy, traveled to Beijing to meet executives from China North Industries Corporation (opens in a new tab) (NORINCO), Norin Mining Ltd (opens in a new tab)., and China National Nuclear Corporation (opens in a new tab) (CNNC), signaling Cairo’s intent to accelerate mineral extraction and processing with Chinese capital and technology.

Table of Contents

Mahmoud Esmat, Egypt’s Minister of Electricity and Renewable Energy

The framing is familiar: newly identified deposits, “minimal mining,” rapid processing, and technology transfer—packaged as part of a national strategy to maximize resource value and localize industry.

What’s Real—and What’s Still Aspirational

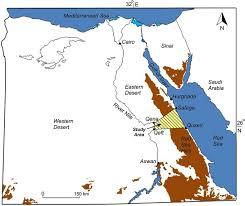

Egypt possesses a diverse mineral endowment, including phosphates, heavy mineral sands, and byproducts that can contain rare-earth elements. The Golden Triangle region (opens in a new tab) has long been cited by Egyptian authorities as underexplored and commercially promising. That much is grounded in reality.

What is not yet grounded is scale, grade, and economics. The article provides no data on reserve size, rare earth composition (light versus heavy), recovery rates, or downstream processing plans. “Ready for processing” is a political phrase, not a geological conclusion. Investors should note the absence of feasibility studies, development timelines, or named projects.

Intent has been announced; execution remains undefined.

The China Factor: Capability or Capture?

Partnering with Chinese firms offers clear advantages: mature separation technology, integrated supply chains, and access to financing. But it also raises a hard question for Egypt—and for investors watching the region.

China’s rare earth playbook is well established: upstream access paired with downstream control. NORINCO and CNNC are not neutral technology vendors; they are state-linked entities embedded in China’s strategic materials system, without enforceable terms covering processing location, offtake rights, and ownership. Egypt risks exporting ore or influence rather than building industrial sovereignty.

A Familiar Pattern in a New Geography

This announcement fits a broader global pattern: resource-rich states turning to China to accelerate development while Western alternatives remain slow, conditional, or absent. For the rare earth supply chain, the significance is not that Egypt is poised to become a major REE supplier—but that China continues to extend its processing footprint, one partnership at a time.

For now, this is intent, not execution.

Source: Amwal Al Ghad, December 22, 2025.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments