Highlights

- China's official rare earth price index rose to 265.4 in early February 2026, representing 165% above the 2010 baseline, with heavy rare earths showing the strongest momentum.

- The U.S., EU, and Japan announced a coordinated critical minerals strategy, including price-floor mechanisms.

- The U.S. has already established a $110/kg floor for NdPr oxides.

- The intersection of China's domestic price strength and Western policy intervention marks the opening of a price-floor era where competing benchmarks will increasingly collide.

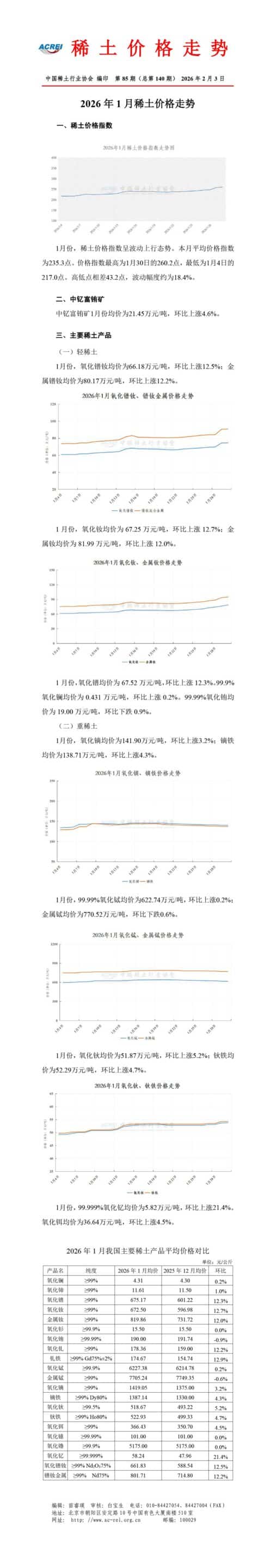

China’s rare earth prices extended a clear upward trend into early February 2026, according to official index data released (opens in a new tab) on February 6 by the Association of China Rare Earth Industry (ACREI). The Rare Earth Price Index closed at 265.4, confirming sustained price strength across both light and heavy rare earth categories within China’s domestic market.

For non-specialist readers, this means average domestic rare earth transaction prices in China are roughly 165% above the 2010 baseline, which is set at an index level of 100. Importantly, this index reflects real onshore transactions, not futures, exports, or offshore speculation.

This chart shows the trend of China’s official rare earth price index, compiled by the Association of China Rare Earth Industry, indicating a steady rise through 2025 followed by a sharp upward acceleration into early 2026, culminating around the 265 level.

Inside the Index: What Is Actually Being Measured

ACREI calculates the index using daily average transaction prices reported by domestic rare earth enterprises, benchmarked against full-year 2010 transaction data. It captures physical domestic market activity.

Translated and summarized from the Chinese bulletin and charts:

- January 2026 prices trended upward overall

- The index rose from roughly 235 in early January to above 260 by month-end

- Heavy rare earth oxides—notably dysprosium- and terbium-linked products—showed the strongest momentum

- Light rare earth oxides also rose, but more gradually

The charts below show a mid-January acceleration, not a one-day spike.

Policy Shock Meets Market Reality: Washington Enters the Pricing Debate

What makes this moment notable is that China’s domestic price strength now intersects with an unprecedented Western policy response. At the Critical Minerals Ministerial held February 4 in Washington, hosted by U.S. Department of State and led by Marco Rubio and J.D. Vance, the United States confirmed it will pursue price-floor mechanisms for critical minerals to stabilize investment and counter market manipulation as covered by Rare Earth Exchnages™.

This approach is not theoretical. Under the Trump administration, the U.S. has already established a $110/kg price floor for NdPr oxides through a long-term offtake and financing arrangement with MP Materials—a benchmark well above recent Chinese domestic prices.

Yet the February 4th ministerial produced a clear consensus among the U.S., EU, and Japan to coordinate demand support, stockpiling, project financing, and information sharing across mining, refining, processing, and recycling, with a memorandum of understanding expected within 30 days.

In plain terms, the West is no longer pretending rare earths are a free market.

Where the Data Is Solid—and Where Narratives Drift

Firmly supported by facts:

- China’s domestic rare earth prices are rising materially.

- Tightness is more acute in heavy rare earths than in light rare earths.

- Licensing and export controls add friction, especially for Japan-facing, magnet-grade supply chains (and remember, time is ticking on the reprieve for the USA).

Where commentary can overreach:

- The index does not prove global record highs; it reflects China only (though China is obviously very influential in global markets).

- Price moves cannot be pinned to geopolitics alone—restocking, defense demand, seasonality, and supply discipline all matter.

- Gallium is not a rare earth, despite frequent media bundling in business media.

Why This Matters for the Supply Chain

The real lesson is not “prices are up.” It is that China still sets reference pricing for magnet-grade materials, while the U.S. and allies are now openly constructing parallel price signals (outside China) to make non-China supply economically viable.

Mining diversification without separation, metal-making, and magnet manufacturing does not break dependency. A licensing delay can still function like a soft embargo—without a ban on any shipments.

The REEx Read

This index confirms tightening fundamentals, not panic. It also marks the opening chapter of a price-floor era in which China’s domestic index and Western policy benchmarks will increasingly collide.

Disclaimer: ACREI states the data is for industry reference only and does not constitute investment advice.

Sources: Association of China Rare Earth Industry (ACREI), Rare Earth Price Index Release (Feb 6, 2026); U.S. State Department, Critical Minerals Ministerial Readout (Feb 4, 2026).

0 Comments

No replies yet

Loading new replies...

Moderator

Join the full discussion at the Rare Earth Exchanges Forum →