Highlights

- Michael Thomsen argues value in rare earths is concentrated in high-priced heavy rare earth elements (HREEs).

- Despite premium pricing, HREEs face challenges in extraction, processing, and market volume compared to light rare earths (LREEs).

- Successful rare earth investment requires understanding beyond simple price per kilogram, considering processing costs, geopolitics, and scalability.

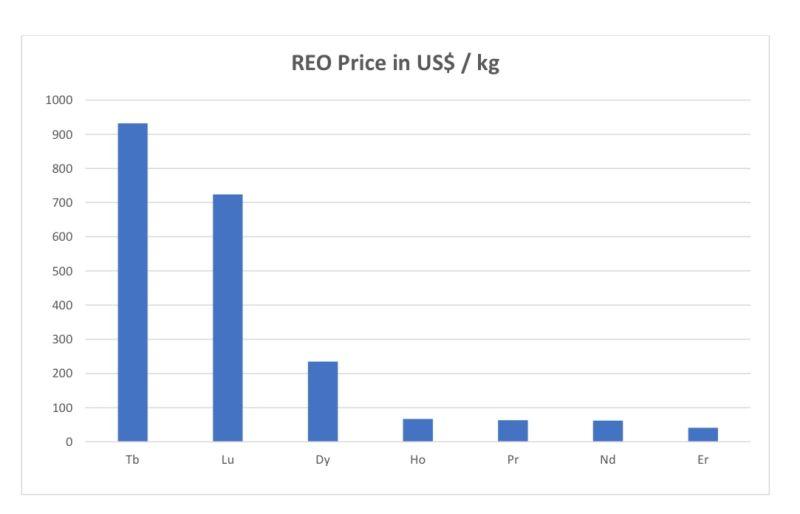

In a recent LinkedIn post, Michael Thomsen (opens in a new tab)—Chairman of American Terbium Corp and Benthos Metals Ltd—invites readers to reflect on a recurring mantra in the sector: “Where is the value in rare earths?” His answer, reinforced by a simplified April REO pricing chart, is direct: the value lies in the heavies.

The implication is clear: light rare earths (LREEs) like lanthanum and cerium, which dominate most global deposits by tonnage, are sub-$25/kg and of lesser economic interest, while high-value heavy rare earths (HREEs) such as terbium and dysprosium are scarcer and command significantly higher prices. But Thomsen’s commentary—delivered with brevity and a dose of caffeine-induced nonchalance—deserves a closer look.

What Tracks

Yes, HREEs like terbium, dysprosium, and lutetium command premium prices in the current market. They are critical for thermal-stable NdFeB magnets used in EVs, defense systems, and wind turbines. Market logic and periodic scarcity support Thomsen’s assertion that “value is in the heavies”—at least per kilogram.

But Hold On—What’s Missing?

- Value ≠ Volume: LREEs like neodymium and praseodymium are the workhorses of the permanent magnet industry by demand volume. While HREEs are expensive, their market size (in tonnage and dollars) is smaller. Investors must distinguish between price per kg and market opportunity.

- Cost to Extract Matters: HREEs are often found in low concentrations and in complex mineral matrices (e.g., ion adsorption clays, monazite, xenotime), requiring environmentally challenging separation processes. Thomsen doesn’t mention CAPEX, OPEX, or ESG liabilities.

- No Context for Prices: April prices cited in the post are not shown or benchmarked (e.g., FOB China vs. ex-works vs. spot), and without price trendlines, the post risks cherry-picking high points for effect.

- Mother Nature’s “Generosity” Is Geological Constraint: Framing HREE scarcity as “Mother Nature’s stinginess” masks the industrial challenge of co-dependency—most HREEs are byproducts of LREE mining, not standalone targets.

Final Take

Thomsen's post is sharp but too shallow. It invites the right question—“Where is the value?”—but offers a reductive answer that overlooks nuances surrounding demand dynamics, processing costs, and macro strategy. In rare earths, price isn’t everything. Processing, permitting, geopolitics, and scalability are more important.

Verdict: Thought-provoking, but not actionable without deeper data.

0 Comments