Highlights

- India's state-backed miners are ramping up critical minerals ambitions following China's rare-earth export restrictions.

- Companies like GMDC, HCL, and MOIL are developing strategies to enter rare earth and critical mineral markets.

- Despite assertive moves, significant challenges remain in technology, timeline, and commercial production of rare earth elements.

India’s state-backed miners are stepping up critical minerals ambitions following Beijing’s latest rare-earth export curbs. Companies such as Gujarat Mineral Development Corporation (opens in a new tab) (GMDC), Hindustan Copper (opens in a new tab) (HCL), and MOIL Ltd (opens in a new tab) are key players. While the reporting is broadly accurate, a closer look suggests execution challenges, frothy valuations, and timelines that may temper near-term expectations.

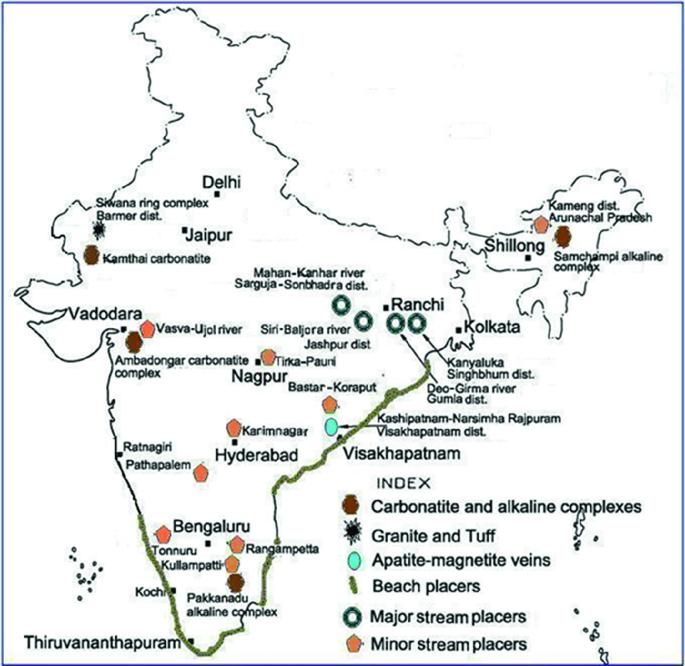

India Rare Earth Deposits

What’s New

| Company | Updates |

|---|---|

| GMDC | Developing its Ambadungar light rare earth deposit under “Project Shikhar.” Management has earmarked tens of billions of rupees for REE and critical-mineral ventures. Yet, production remains years away, and the company still relies heavily on lignite |

| HCL | India’s only vertically integrated copper producer. It is diversifying into strategic minerals via an MoU with Oil India and plans to bid on critical-mineral blocks. However, REE-specific progress is at the exploratory stage |

| MOIL | Dominant manganese miner with a niche in battery-grade electrolytic manganese dioxide (EMD). Plans to double ore production by 2030, but financial softness in FY26 raises questions about delivery. |

Macro Context (Why It Matters)

China’s restrictions have compelled India to accelerate its policy support, including block auctions, capital expenditure subsidies, and a national critical-mineral mission. Automakers and wind players are assessing domestic NdFeB sourcing. Strategically, India’s moves could complement U.S. and EU “friend-shoring” strategies, diversifying Asia’s supply base.

REEx Critical Lens

The article rightly captures India’s intent, but three risks stand out:

| Risk Factor | REEx Summary |

|---|---|

| Timeline Risk | From block auction to commercial oxide production typically spans 5–10 years. |

| Technology Gap | India lacks proven separation and magnet-making infrastructure. Partnerships with Japan, EU, or U.S. may be required. |

| Valuation Stretch | GMDC, HCL, and MOIL all trade at EV/EBITDA multiples well above historical medians, implying investors are pricing in rapid REE success not yet proven |

Unanswered, High-Impact Investor Questions

- GMDC: What concrete schedule exists for pilot separation, off-takes, and oxide qualification?

- HCL: Which minerals will be prioritized in block bids, and what capex will be allocated?

- MOIL: How fast can EMD capacity scale, and at what cost competitiveness?

Stock Lens (Fundamental/Technical)

- GMDC: Riding “rare-earth” headlines, technically extended, correction risk high.

- HCL: Strong FY25 earnings, but valuation premium demands flawless execution in expansion.

- MOIL: Solid long-term EMD story but short-term earnings weakness; investors should watch FY26 delivery closely.

Bottom Line

A recent piece in Financial Express is correct (according to REEx assessment) that India is moving assertively. But until oxide plants, partnerships, and contracts are inked, these PSU stocks should be viewed as policy-optionality plays—not yet true REE producers.

Source: Financial Express, “China’s export ban is fueling India’s new gold rush: 3 stocks to watch,” Madhvendra, Sept. 27, 2025.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments