Highlights

- Australia is positioning itself as a reliable alternative to China's near-monopoly on rare earth processing, which accounts for over 90% of the market.

- Australia proposes to offer Trump access to a $1.2 billion critical minerals stockpile amidst Beijing's tightening export controls.

- Despite having vast reserves, Australia ships 90% of its lithium to China for refining, demonstrating that resource abundance does not equate to supply chain independence.

- New processing capacity in Australia is not expected to come online until later this decade.

- Media narratives about Australia's role vary, from optimistic 'Outback rescue' stories to cautious warnings about balancing its relationship with its biggest ally, the U.S., and its biggest customer, China.

- Concrete deals in this sector remain speculative, and there is a concern that investor enthusiasm may outpace the reality of the situation.

Monday’s White House meeting between U.S. President Donald Trump and Australian Prime Minister Anthony Albanese has rare earth elements center stage. Albanese arrives touting his country’s abundant lithium and rare-earth resources as a solution to China’s chokehold on these critical minerals. With Beijing tightening exports of rare earths and related technology, Canberra is pitching itself as a reliable ally to fill the gap – but amidst the breathless headlines of an “Outback rescue,” it’s worth separating the solid facts from speculation in this high-stakes supply chain drama.

Outback to Oval Office: Rare Earths Take Center Stage

This long-awaited summit comes at a critical time. China controls nearly 70% ofglobal rare earth mining and over 90% of processing – leverage ithas not hesitated to use. Just last week, Beijing expanded export controls to 12 of the 17 rare earth elements and even restricted refining equipment exports, citing national security. Washington is scrambling: these minerals are indispensable for EVs, wind turbines, and advanced weapons, and the U.S. is determined to break China’s dominance to secure its industrial base. Enter Australia – a close ally rich in mineral deposits – as an obvious partner. Albanese is expected to offer the U.S. access to a proposed A$1.2 billion critical minerals stockpile as a bargaining chip. Australian officials are talking up their role: “American companies desperately need critical minerals, and Australia is very well placed to service that need,” Treasurer Jim Chalmers proclaimed in Washington (opens in a new tab). In other words, Canberra is signaling it can be the dependable supplier of rare earths and lithium that the West urgently requires.

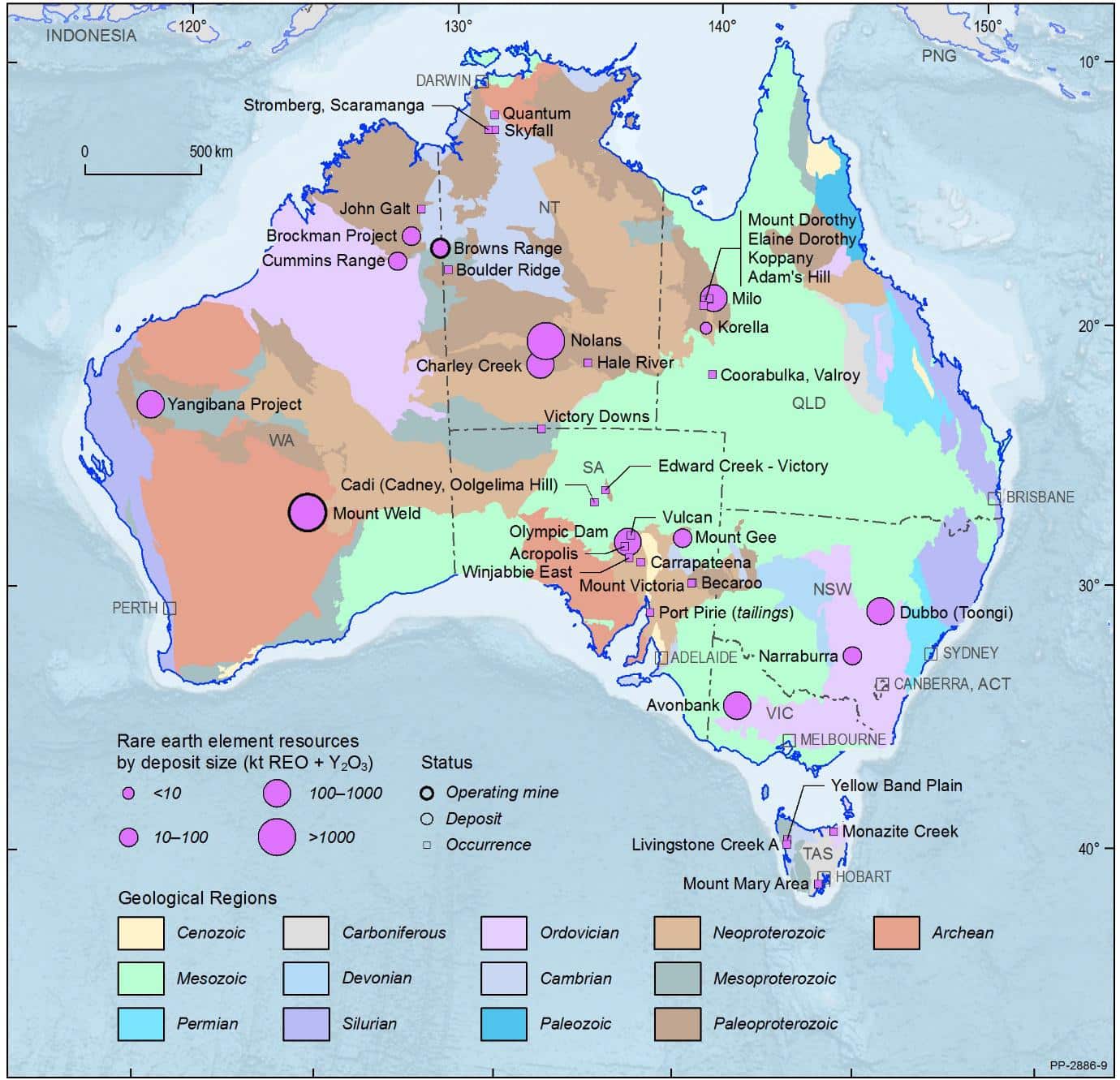

Australia Rare Earth Deposits

Boom or Boomerang? Sorting Facts from Fiction

Amid the optimism, a reality check is in order. Fact: Australia indeed has vast reserves – from lithium to rare earths – but it has historically shipped most of these raw materials to China for processing. In fact, 90% of Australia’s lithium exports go straight to China for refining, underscoring that resource abundance alone doesn’t equal an independent supply chain (opens in a new tab).Australia’s downstream capacity for processing remains limitedtoday, and new refining projects (bolstered by government incentives) won’t come online until later this decade.

Speculation: Media chatter about a grand “critical minerals deal (opens in a new tab)” includes ideas like U.S.-backed price floors for rare earths or Washington taking equity stakes in Aussie mining ventures. These ideas have been floated, but no concrete agreements have been announced – they remain bargaining-room talk at best. Even the much-touted Australian strategic reserve is still on the drawing board (what to stockpile isn’t even decided yet). In short, any breakthroughs from this meeting will likely be memoranda and political promises, not immediate game-changers in the market.

Investor excitement, nevertheless, is running high. Just the hint of U.S.–Australia cooperation sent shares of Lynas Rare Earths – Australia’s largest rare-earth miner – to a 14-year high after it inked a supply deal with a U.S. firm. Other firms such as Arafura Rare Earths (opens in a new tab). That market euphoria reflects hopes that non-Chinese rare earth supply lines will strengthen. But it also hints at possible boomerangs: if promises don’t translate into timely projects and policies, today’s hype could whipsaw into disappointment.

Media Minefield: One Story, Many Angles

The rare earth rivalry has become a Rorschach test for media narratives. Some outlets frame Australia as swooping in to save the day. A Bloomberg headline even cast Albanese as pitching Australia to be “Trump’s fix” for China’s rare earth squeeze – a dramatic framing that implies a near-term solution. On the other hand, Australian and UK coverage has struck a more cautious tone. _The Guardian (opens in a new tab), for instance, highlighted that Australia could be caught “in a really compromised position_” between its biggest ally and its biggest trading partner. Experts there noted that Trump’s “Make America Great Again” focus on U.S. jobs may make him reluctant to invest in processing plants abroad – a “hard sell” for any deal that doesn’t locate manufacturing on American soil. This contrast hints at a subtle bias: business-centric news emphasizes opportunities and quick fixes, while others stress geopolitical friction and long-term obstacles.

Notably, U.S. officials’ fiery rhetoric has also colored coverage. Trump’s treasury secretary Scott Bessent accused Beijing of pointing “a bazooka at the supply chains and the industrial base of the entire free world (opens in a new tab)”, language widely echoed in reports. Such metaphors amp up the sense of urgency (and alarm) around China’s moves, but can veer into hyperbole. Meanwhile, Chinese state media (and some skeptics online) portray Australia’s enthusiasm as opportunistic or even as taking sides in a new Cold War over resources.

In truth, Australia’s government insists it can deepen U.S. mineral ties without provoking Beijing’s ire (a delicate balancing act that remains to be tested). The key for readers is to read between the lines. Each source – from upbeat investor newsletters to sober foreign policy explainers – has its angle, whether it’s cheerleading new supply deals, warning of political pitfalls, or stoking nationalist flames. A savvy observer will recognize speculation or slant (“fix for China’s curbs!”) and look for the underlying facts on capacity, timelines, and commitments.

The Long Game: Rare Earth Supply Chain Stakes

Stepping back, what’s truly notable is how this meeting underscores a larger tectonic shift in the rare earth supply chain. China’s recent export curbs have “sparked global pushback,” with the U.S. and its G7 allies vowing a coordinated response and a drive to diversify suppliers.

Efforts that were once abstract talk are now accelerating. In Washington, Trump’s administration has been striking critical-minerals deals from Ukraine to South Asia. Australia – with 43 of the 55 minerals on the U.S. critical list – is a logical piece of this puzzle. For Australia, the opportunity is huge: new investment, new processing facilities, and a chance to move up the value chain beyond just digging ore. But the risks are evident too: about 90% of Australia’s lithium and muchof its rare earth output still go to China, and Beijing is not shy abouteconomic retaliation if its interests are threatened. Canberra will have to execute a high-wire act, advancing a U.S. partnership that secures Western supply lines without turning its No.1 customer into an adversary overnight.

Investor POV

For investors and industry watchers, the bottom line is that reshaping the rare earth ecosystem is a long game. High-profile meetings and headline-grabbing quotes are one thing; building mines, processing plants, scalable magnet production and secure transport networks is another, often slower, endeavor. This week’s U.S.-Australia rare earth buzz is one chapter in a much larger story of supply chain realignment. The first inning.

It signals accelerating momentum toward a diversified, China-light supply chain – a trend with profound implications for technology, defense, and climate industries. However, patience and realism are warranted: the road from memorandum to metal is bumpy. Geopolitics can boost mining stocks one day and jolt them the next. As Rare Earth Exchanges emphasizes, cutting through the hype to the core facts is essential. The coming days may well bring announcements from Washington or Canberra – just remember that in the rare earth realm, actions (new production, funding deals, actual supply deliveries) will speak louder than words. And on that score, we’ll be watching closely, keeping the spin in check and the focus on what’s real in this critical minerals scramble.

©!-- /wp:paragraph -->

0 Comments