Nigeria’s announcement of a $400 million rare earth and critical minerals processing plant in Nasarawa State (opens in a new tab) has ignited headlines and hopes. The story—job creation, formalized mining, and a leap into strategic minerals—sounds right for a country eager to diversify beyond hydrocarbons. And as Rare Earth Exchanges explains herein, a legacy of hydrocarbon refining (albeit with struggles) potentially positions Nigeria to translate such know-how into rare earth processing capability, accelerating its entry into the global critical minerals value chain rather than starting from zero. In rare earths, ambition must meet chemistry, capital discipline, and governance. That will be the test.

While Nigeria historically struggled with refining its massive crude oil output, importing most refined fuels despite being Africa's largest crude producer, this is changing rapidly with the huge new Dangote Refinery (opens in a new tab) in operation, which significantly boosts capacity and aims to meet all domestic needs, turning Nigeria into a potential net exporter of refined products.

The Signal Worth Taking Seriously

Nasarawa’s approach—state participation, formal permitting, and downstream aspirations—stands in sharp contrast to the destructive informality seen in places like Zamfara. Rare Earth Exchanges™ has argued that formalization is the first gate to value. Nigeria’s willingness to anchor processing, not just extraction, is notable in a global market where processing—not mining—defines power, as covered previously.

Nigeria’s geology also warrants attention. Monazite-bearing sands are plausible hosts for light rare earths and thorium. That alone does not create a supply chain—but it does justify serious exploration, metallurgical testing, and phased investment. See “Nigeria’s Monazite Moment: Promise, Hype and the Hard Road to Rare Earth Reality.”

According to the company behind the refinery, Hasetins Commodities (opens in a new tab), there are multiple sites for potential feedstock. Rare Earth Exchanges™ has reached out to the company for an interview request to hopefully learn more.

Does Optimism Runs Ahead of Evidence?

Coverage such as in NewsDiary Online (opens in a new tab) moves quickly from a groundbreaking to 10,000 jobs and a full-stack rare earth future. That is where investors should pause. A $400 million budget is meaningful, but is it sufficient on its own to deliver solvent extraction at scale, radioactive waste handling, individual oxide separation, and compliance with global environmental standards? Rare earth processing is not a single plant; it is a system.

There is also a familiar conflation at work. Listing the 17 rare earth elements and citing Shanghai prices implies broad value capture. In reality, markets reward specificity—NdPr for magnets, Dy/Tb for high-temperature performance. Nigeria’s monazite potential skews light rare earths; heavy rare earths are neither guaranteed nor cheap to separate.

Governor Speaks

As reported via ADBN TV (opens in a new tab) last month, Nigeria’s Nasarawa State indeed broke ground on the $400 million rare earth and critical metals processing plant, marking what state officials describe as the country’s first major rare-metal processing facility. Led by Governor Abdullahi Sule (opens in a new tab), the project—developed in partnership with Hasetins—follows engagements that began in 2024 and is intended to position Nasarawa within the global rare earth value chain.

Governor Sule Goes on the Record

According to Governor Sule at the November ceremony:

“For first time in Nigeria we will have a rare metal processing plant. This is critical matter that includes platinum, uranium, chromium and so many other metals that are coming into our state. And so this is a huge investment that we should all be proud of.”

At the ceremony, the CEO of Hasetins, Prince Jidai Ejudigal, also emphasized their plans to process rare earth elements.

The facility, located in Karu Local Government Area (opens in a new tab), is designed for an annual processing capacity of roughly 12,000 tons and is scheduled for completion in 2026. Federal ministers, including Nigeria’s Minister of Solid Minerals Development (opens in a new tab) and Minister of Foreign Affairs, attended the groundbreaking and praised the project for its potential to drive job creation, revenue generation, and responsible mineral development under President Bola Tinubu’s (opens in a new tab) economic reform agenda.

Project proponents emphasized Nasarawa’s secure investment climate, while labor officials highlighted commitments to global occupational safety and environmental standards. Local traditional leaders and government officials framed the plant as a catalyst for regional development, with expectations of thousands of direct and indirect jobs and broader economic spillovers across the state.

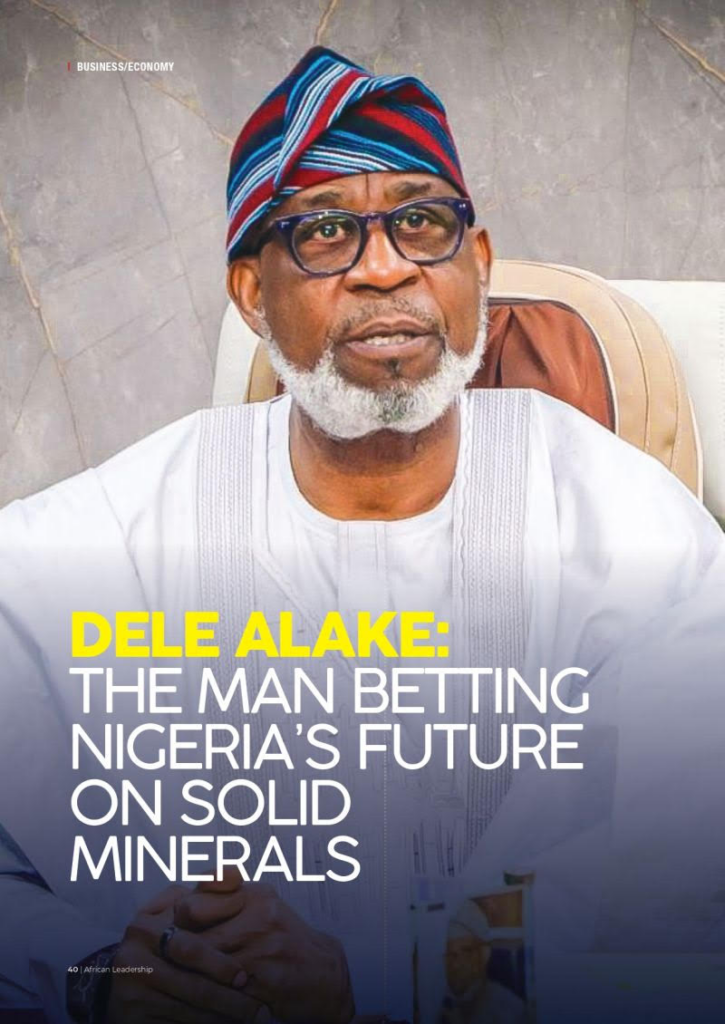

Henry Dele Alake: Nigeria’s Head of Solid Minerals

Any Missing Chapters

Absent—and decisive—are details on feedstock grade, mineralogy, separation flowsheets, tailings management, and offtake.

But to be fair, the company behind the processing, Hasetins Commodities, is privately held and under no obligation for disclosure. Rare Earth Exchanges was pounded online via LinkedIn for suggesting there is such an obligation. Fair enough. Yes, without these and an on-site tour, the project remains more elusive. But there is certainly sufficient high-level data to suggest this potentially emerges as a bankable asset: capital in the West just needs to learn more. Training local talent to move beyond oxides into alloys and magnets is laudable—yet, historically rare without long-term partners and IP transfer. Although, as we discuss below, Chinese companies are in the areas focusing on other critical minerals.

Nasarawa State

Any Chinese Capital?

Has Chinese capital been mobilized in this part of Nigeria? The answer depends on what sort of mineral we are talking about, for some critical minerals absolutely. For rare earth elements, we cannot find any evidence of this.

Hasetins Commodities Limited is described in official reports as an “indigenous” or local private company, incorporated in Abuja in 2019. It is spearheading Nigeria’s $400 million rare earth and critical metals processing plant in Nasarawa State, and it has been lauded by government officials as a patriotic, locally-led investment. Importantly, no Chinese ownership or partnership has been disclosed in Hasetins’s shareholding or financing to date.

The Nigerian Ministry of Solid Minerals, in statements and press releases, credits Hasetins as the sole project funder and does not mention any foreign JV partner, according to multiple news sources. Xinhua (Chinese state media) likewise reported that the “project, funded by Hasetins Commodities Limited, ”aligns with Nigeria’s value-add campaign – again implying Hasetins itself is financing it. If Chinese state or corporate investors were behind this venture, it would likely be publicized as foreign direct investment (FDI) from China, but all public messaging so far frames it as a Nigerian-driven FDI project.

In-depth industry analysis notes that Hasetins has not published details on its “capital stack” or external financiers. Again, to our critics online, they are under no obligation to do so. The entire $400 million is frequently referred to as FDI, yet the specific investors or lenders remain opaque.

Analysts at both Ecofin and Rare Earth Exchanges have pointed out that for a specialized chemical processing project of this scale, outside technical or financial partners are likely to be involved eventually – but no such partners (Chinese or otherwise) have been named publicly as of now.

There is no evidence of Chinese financial or technical involvement in Hasetins Commodities or its $400 million rare earth and critical metals processing plant in Nasarawa State, based on all publicly available disclosures. Again, Hasetins is presented by Nigerian officials as an indigenous, privately held company, and project messaging emphasizes a domestically led effort to build Nigeria’s first rare-metal processing facility.

Available information suggests the company has engaged non-Chinese private capital and advisers, including Western investors and technical experts, consistent with Nigeria’s stated goal of developing a non-China-dependent midstream capability for global technology and magnet markets. No Chinese equity stake, joint venture, equipment contract, or technical partnership has been publicly disclosed for the Hasetins rare earth project to date.

That said, Chinese capital is highly active elsewhere in Nasarawa State’s (and beyond) mining sector (opens in a new tab), particularly in lithium and other battery and industrial minerals. Chinese firms have financed and built multiple large-scale lithium processing plants in the state since 2023, with total Chinese investment in Nigeria’s lithium value chain now exceeding $1 billion, according to Nigerian government statements.

According to a report from the Nanyang Technological University in Singapore (opens in a new tab), “two Chinese-backed lithium processing plants are set to start production in Nigeria later this year, as the West African country moves to enforce a policy requiring miners to refine minerals locally rather than export them in raw form.”

According to this assessment, a growing demand for lithium prompts this push. After al,l the critical mineral remains a key raw material for electric vehicle (EV) batteries. Purportedly, “China is reportedly exploring further moves up the EV value chain, including the potential establishment of EV manufacturing facilities in Nigeria.” This would make sense given thatthe nation’s need to overcome an overproduction crisis in the EV sector.

Apparently, one of the processing plants is a US$600m project by Jiuling Lithium Mining Company (opens in a new tab), located on the boundary of Kaduna and Niger States in northern Nigeria. Production is slated to begin this year. The second, a US$200m facility by Canmax Technologies (opens in a new tab) in Nasarawa State, near the capital Abuja, is scheduled to come online in the third quarter.

Additional Chinese-backed projects targeting tin and other solid minerals have also been announced in Nigeria.

Crucially, however, these Chinese investments do not appear to overlap with the Hasetins rare earth initiative, which remains the notable exception in an otherwise China-linked regional mining landscape. Although if we learn the contrary, we will report.

For investors, this distinction matters: Nasarawa’s rare earth project is being positioned—at least for now—as a strategic effort to diversify Nigeria’s minerals sector away from both oil and Chinese rare earth dominance, even as Chinese capital continues to shape other parts of the state’s mining economy.

Final Thoughts

Nigeria is a potentially strong location for rare earth refining precisely because it already possesses growing, hard-earned experience in complex, capital-intensive processing industries, most notably oil refining and petrochemicals. Refining crude oil into usable fuels required Nigeria to build and operate large-scale chemical plants, manage hazardous by-products, enforce environmental controls, develop skilled technical labor, and coordinate logistics across ports, pipelines, and power infrastructure—many of the same competencies required for rare earth separation and refining.

While Nigeria’s refining history has been uneven, they struggled to develop the institutional knowledge, regulatory frameworks, engineering talent, and service ecosystems around hydrocarbons to the extent that they completely offers a non-trivial industrial foundation that many emerging rare earth source nations lack. If paired with modern governance, transparent project execution, and credible technical partners, this legacy position positions Nigeria to translate refining know-how into rare earth processing capability, accelerating its entry into the global critical minerals value chain rather than starting from zero.

So Nigeria’s recent announcements are directionally right and geopolitically timely. And the state’s Governor is on the record via Nigerian news on the matter. That is, the criticality of Nigeria moving down the value chain from merely extracting to processing hard mineral/element commodities. Let us not forget, rare earths punish shortcuts. The real test will be transparent data, staged financing, and the right partners who understand that processing is where nations win—or stall. The Hasetins endeavor remains a mission-critical initiative, apparently domestically financed, and according to speeches, ready sometime in 2026 should the project remain on track.

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments