Highlights

- Burkina Faso shows early-stage rare earth element (REE) potential with geological showings in multiple provinces, particularly in pegmatite formations.

- The country's 2024 Mining Code signals increased state involvement and strategic interest in developing critical minerals beyond traditional gold mining.

- Global demand for rare earth elements is projected to increase four-fold by 2030, positioning Burkina Faso to potentially become a new strategic REE supplier.

Global demand for rare earth elements (REEs) is surging, projected to increase fourfold by 2030 due to the clean energy transition and industrial growth. Africa, with its largely untapped rare earth reserves, is racing to capitalize on this trend. Up to eight rare earth projects are slated for commissioning across the continent by 2029, potentially boosting Africa’s share of global supply to 10%. Major investments underscore this momentum: for example, an $80 million financing of Angola’s Longonjo mine aims to supply 5% of the world’s “magnet metal” rare earths (contingent on assumptions) – crucial for wind turbines and electric vehicles. This backdrop highlights why Burkina Faso, better known for gold, but does this French-speaking African nation, in a dynamic flux, also show REE potential? The government and investors alike are keen to explore whether Burkina’s soil could host the next rare earth discovery amid a global push to diversify supply chains away from China.

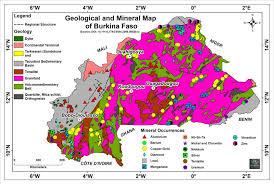

Geological Potential in Burkina Faso

Burkina Faso’s geology (opens in a new tab), part of the West African craton, is traditionally rich in gold and base metals. Recent surveys indicate it also harbors “transitional minerals” like rare earth elements. While no rare earth mine exists yet, several REE showings have been identified in different regions. Notably, occurrences of rare earths have been found at Zoungou in Ganzourgou province (Plateau-Central region) and at Mangodara and Kangounadeni in Comoé province (southwest), often in association with columbite-tantalite (a niobium-tantalum mineral). This association suggests the REE are likely hosted in granitic pegmatites or related igneous intrusions, which can concentrate exotic metals. The showings are early-stage and not yet delineated as economically viable deposits. In fact, Burkina’s 2023 mining review noted that, unlike what was an active zinc mine, “research is still ongoing” for rare earths and other non-ferrous minerals.

Burkina Faso

Such anomalies and mineral indices were detected through regional prospecting campaigns led by the Bureau of Mines and Geology of Burkina (opens in a new tab) (BUMIGEB). These initial finds are encouraging – they place Burkina on the map of REE-bearing countries – but much work remains. Thus far, the identified rare-earth occurrences have not been quantified in terms of ore grade or tonnage. Geological experts stress that Burkina Faso is still “at the upstream stage, defining targets and conducting prospecting” rather than development. The hope, as BUMIGEB’s Director Docteur Hermann Ilboudo notes (opens in a new tab), is that true REE deposits will be discovered in the coming years, unlocking a new mining sub-sector for the country.

Rare Earth Elements of Interest

If Burkina Faso’s exploration advances, which REEs would be most sought after? Investors and policymakers are especially interested in those needed for high-tech and green industries. Neodymium (Nd) and Praseodymium (Pr) stand out – these light rare earths form the neodymium-iron-boron magnets critical for electric vehicle motors and wind turbine generators. Growing renewable energy markets have made Nd-Pr some of the world’s most in-demand REEs. Meanwhile, certain heavy rare earths like Dysprosium (Dy) and Terbium (Tb) are prized for their role in heat-resistant magnets (adding Dy/Tb improves magnet performance at high temperatures, essential in EV motors and wind turbines). Other REEs like Europium and Yttrium have niche uses in lighting, lasers, and alloys.

In practice, the “magnet metals” – a term often referring to Nd, Pr (and by extension Dy, Tb) – are the economic drivers of most rare earth projects. For example, the Longonjo project in Angola is expected to supply a notable share of the world’s magnet REE demand reports (opens in a new tab) the African Chamber of Commerce.

Any REE deposit in Burkina Faso would likely be evaluated on its content of these critical magnet elements. If the pegmatite-associated showings (Zoungou, Mangodara, etc.) prove to contain significant heavy REEs (like Dy or Yttrium-bearing minerals such as xenotime) alongside more common light REEs (like Cerium and Nd from monazite), they could attract considerable interest. For Burkina Faso’s development goals, the focus would be on those REEs that align with global supply gaps – notably for clean energy technologies – making the country a potential participant in the strategic supply chains of the future.

Emerging Exploration Efforts

As of 2025, no major mining company is yet drilling (at least not reported) specifically for rare earths in Burkina Faso, but the groundwork is being laid. The identification of REE indices by BUMIGEB has set the stage for more detailed exploration. The geological authority plans to conduct detailed follow-up surveys on the most promising targets to confirm and delineate any REE mineralization. Burkina Faso's government has openly prioritized critical minerals mapping – including lithium, niobium-tantalum, and rare earths – to broaden its mineral portfolio beyond gold. This reflects a strategic shift: the country recognizes that future mineral wealth may lie in supporting the global energy transition, not just in precious metals.

A few international juniors have historically held exploration permits in Burkina that incidentally covered rare earth or lithium-bearing pegmatites. (For instance, Australia’s Vital Metals (opens in a new tab) – primarily focused on Canadian rare earth mining – also had gold exploration ventures in Burkina Faso, indicating cross-interest in the region’s geology.)

However, recent security challenges and political changes have somewhat tempered foreign appetite for greenfield exploration.

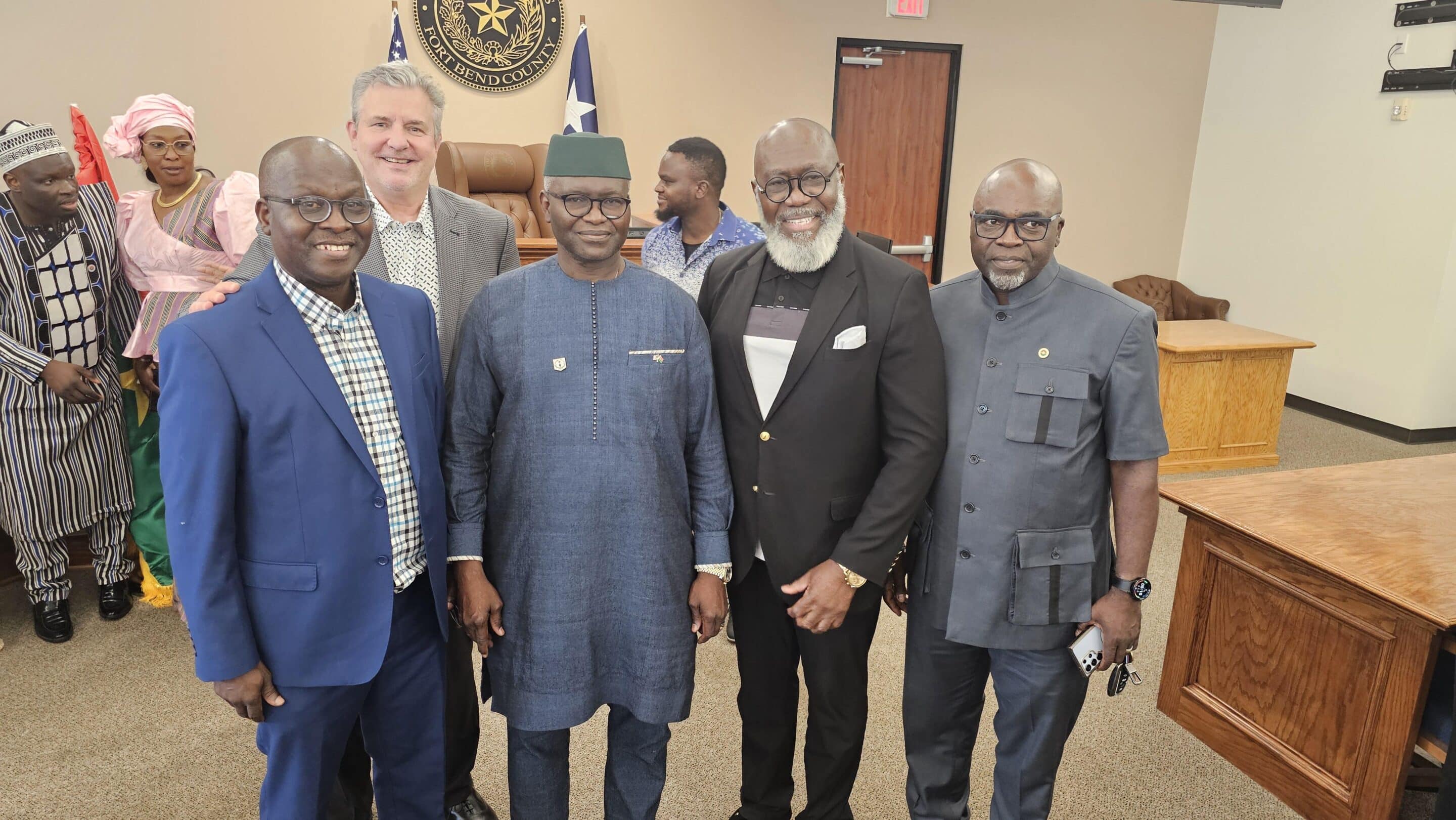

Team Meets with Ambassador Kassoum Coulibaly (third from left)

However, on Friday, August 15, 2025, Rare Earth Exchanges co-founder and CEO Daniel O’Connor (opens in a new tab) and colleagues met in Houston with a delegation from Burkina Faso led by Kassoum Coulibaly (opens in a new tab), Ambassador Extraordinary and Plenipotentiary of Burkina Faso to the United States. The delegation conveyed a clear and constructive openness to partnering with U.S. firms.

Exploration spending in Burkina fell sharply after the 2022 coup, reflecting investor caution in high-risk environments, according to the Center for Strategic and International Studies (opens in a new tab) (CSIS).

Still, rising rare earth prices and Western efforts to find non-Chinese sources may spur partnerships. Government-backed initiatives, possibly with support from partners like the U.S. or EU, could also emerge to de-risk exploration. In Africa, countries like Uganda and Malawi saw tenfold increases in rare earth exploration investment once promising deposits were identified, reports CSIS– a trajectory Burkina Faso could emulate if stability improves and a discovery is confirmed.

An Evening with the Ambassador and Team

Policy and Investment Climate

Developing rare earth projects requires a conducive policy environment, and here Burkina Faso is undergoing important shifts. The country adopted a new Mining Code in 2024 that significantly changes the terms for investors and the state. Key provisions of the code according to a REEx review:

| Provisions | Summary |

|---|---|

| Increased State Equity | The government’s free-carried stake (opens in a new tab) in mining projects was raised from 10% to 15% in 2024. This means for any future REE mine, the state would automatically hold at least 15% ownership without cost. The change aligns with the government’s push for greater revenue sharing and was applied first to gold projects (e.g., Australia’s West African Resources agreed to the 15% state stake at its Kiaka gold project). For investors, this represents a dilution of project equity, but from the state perspective it “enhance[s] national revenue and ensures more benefits flow directly to the country.” |

| Local Ownership & Processing | The new code mandates local participation and in-country value addition (opens in a new tab). It “requires local mineral processing and partial local ownership” in mining ventures. In practice, a rare earth developer in Burkina would need plans to process a portion of concentrates domestically (at least initial beneficiation) and possibly partner with Burkinabè investors or the state mining firm. This aligns with a broader resource nationalism trend, aiming to avoid simply exporting raw ore. Given that REE refining is complex, this requirement could push for joint ventures to build local separation facilities or for special exemptions if local processing is not immediately feasible. |

| State Oversight and Control | State Oversight and Control: A new state-owned mining company, SOPAMIB, was created to enable government participation in strategic projects as cited (opens in a new tab) in Reuters. Already, SOPAMIB has taken over two major gold mines from foreign owners (Boungou and Wahgnion) as part of this policy. The Prime Minister signaled that “this will continue” in pursuit of greater national control. Such moves, alongside rhetoric about a “revolution” in managing mineral wealth, indicate that any significant REE deposit may be developed with substantial state involvement. While this ensures Burkina Faso captures more value, it has worried some investors, who fear contract instability or expropriation. The government counters that these changes are needed to “maximize revenue... and reboot an economy hit by insecurity”, emphasizing sovereignty and local benefit. |

| Regulatory Stringency | The licensing process now involves tighter scrutiny – including thorough technical, environmental, and community development plans before approval. This could lengthen timelines but also improve sustainability. Additionally, the state has pre-emptive rights on any transfer of mineral titles, meaning the government can veto or buy into any sale of a REE project stake, further asserting control over strategic resources. |

| Mining-Friendly or Not? | From an investor perspective, these policies are a mix of pros and cons. On one hand, clearer rules on local content and state equity provide upfront certainty on what a project must accommodate. On the other hand, increased state share and mandatory processing can affect project economics. As Burkina Faso seeks to balance attracting investment with retaining value, maintaining dialogue with industry will be crucial. Notably, some mining firms have publicly supported the reforms, framing them as fostering a more equitable and sustainable sector. Investors eyeing REEs will factor in that the government is eager for critical minerals development (which could mean support and facilitation), but they will also weigh the recent coup-related instability and relations with Western partners. Burkina’s pivot towards new alliances (the transitional government has grown closer to non-traditional partners like Russia, evident in a Russian firm (Nordgold) gaining a new gold license) might influence which foreign companies feel comfortable investing. For example, interest from Chinese or other BRICS investors in a rare earth project might be welcomed under the current administration’s geopolitical orientation. |

Challenges and Outlook

Bringing a rare earth deposit to production in Burkina Faso faces several challenges. First is the geological uncertainty – the known REE occurrences need extensive drilling, metallurgical testing, and feasibility studies to prove they can be economically mined. Rare earth deposits often require significant capital and technical expertise to develop, especially because the ore typically contains many elements that must be separated through complex processing. The fact that Burkina’s showings are associated with coltan pegmatites might mean any eventual operation could co-produce niobium, tantalum, or even lithium, adding multi-commodity opportunities but also technical complexity.

Secondly, the security situation cannot be ignored. Parts of Burkina Faso, particularly in the north and east, have been affected by insurgent violence in recent years. While areas like Comoé (where Mangodara is located) have been relatively calmer, any mining project must consider logistics and staff safety. The drop in exploration spending since 2021 attests to how instability deters the early-stage risk-taking that mineral discovery requires, according to CSIS (opens in a new tab). The government’s efforts to improve security and its establishment of a national gold reserve (to store bullion, presumably enhancing financial stability) are steps toward creating a more secure and self-reliant mining sector. However, attracting foreign junior explorers for REEs may require mechanisms like political risk insurance or partnerships with state entities to mitigate risk.

On the regulatory front, policy consistency will be key. Frequent or abrupt changes in mining law can raise the perception of risk. The 2024 code is still new, and how it is implemented (e.g., the process for negotiating the state’s 15% stake or enforcing local processing) will be watched closely. A transparent, fair application of these rules could actually build investor confidence over time.

The government’s messaging is that it wants win-win partnerships (opens in a new tab) – ensuring “the population benefits” while also welcoming responsible investment. For critical minerals like REEs, Burkina Faso may even find support from international initiatives aimed at securing supply chains. Programs from the U.S. Development Finance Corporation or EU’s Global Gateway might offer funding or expertise, as seen in other countries, if a promising REE project emerges.

In terms of opportunities, the upside is significant. Tapping rare earth resources would diversify Burkina Faso’s export base beyond gold (which currently makes up ~70% of exports) and zinc. It aligns with the government’s strategy of resource sovereignty – developing critical minerals could feed local industries (for example, a portion of rare earth output could potentially be used in refining and regional manufacturing of batteries or wind turbines if industrialization plans advance). There is also a potential regional synergy: neighboring countries like Niger and Mali have known uranium and lithium resources, respectively, and Ghana and Côte d’Ivoire have infrastructure that could aid exports. A Burkina Faso—and surrounding regional rare earth and critical mineral industry could thus form part of a broader West African critical minerals hub, especially if stability and cooperation improve.

Final Thoughts

In conclusion, Burkina Faso’s rare earth prospects are in the early days – marked more by hope and high potential than proven reserves. The ingredients for future success are present: geological indications of REE, a government prioritizing critical minerals, and a global market hungry for new suppliers.

However, converting potential into reality will require sustained exploration investment, technical capacity building, and carefully balancing the government’s rightful desire for national benefit with the need to attract and retain experienced development partners.

For investors and policymakers, the next few years will be important. If even one of the showings at Zoungou, Mangodara, or Kangounadeni evolves into a viable deposit, Burkina Faso could emerge as an unexpected player in the rare earth arena – contributing to both its own economic diversification and the security of global critical mineral supply. With prudent governance and successful drilling, the country may well position itself as a future supplier of neodymium, dysprosium, and other vital REEs, turning what is presently a prospect into a thriving strategic industry. As REEx cited above, the nation in transformation is keen on meeting American and Western firms to explore partnerships.

Sources

- Energy Capital & Power (2025). African Rare Earth Projects Advance Amid Rising Global Demandeu-africa-chamber.org (opens in a new tab)eu-africa-chamber.org (opens in a new tab)

- Mines Actu Burkina (2023). #SAMAO2023: Focus on Burkina Faso’s Mining Potentialminesactu.info (opens in a new tab)minesactu.info (opens in a new tab)

- Mines Actu Burkina (2024). Entretien avec Dr. Hermann Ilboudo, DG BUMIGEBminesactu.info (opens in a new tab)minesactu.info (opens in a new tab)

- African Leadership Magazine (2025). Burkina Faso Increases Government Stake in Gold Projectsafricanleadershipmagazine.co.uk (opens in a new tab)africanleadershipmagazine.co.uk (opens in a new tab)

- UNCTAD Investment Policy Monitor (2024). New Mining Code enhances State participation and oversightinvestmentpolicy.unctad.org (opens in a new tab)investmentpolicy.unctad.org (opens in a new tab)

- Reuters (2025). Burkina Faso to nationalise more industrial mines, PM saysreuters.com (opens in a new tab)reuters.com (opens in a new tab)

- Rare Earth Exchanges original research and meeting with Embassy delegation

0 Comments