Highlights

- China's MOFCOM Notification No. 62/2025 formalizes existing export barriers rather than creating new restrictions on rare earth magnet technology.

- The NdFeB magnet manufacturing process is not a Chinese secret—Western equipment can replicate it, but China dominates through ecosystem maturity and scale.

- Rebuilding Western rare earth supply chains requires long-term industrial commitment and vertical integration, not just acquiring technology or equipment.

When China’s Ministry of Commerce (MOFCOM) issued Notification No. 62/2025, headlines screamed of a new “rare earths weaponization.” Pundits declared a “technological iron curtain.” Yet as rare earth magnet veteran John Ormerod (opens in a new tab) points out, this may be far more regulatory theater than tectonic shift.

Beijing’s new export controls on rare earth–related technologies—from mining and separation to alloying and magnet recycling—are largely formalizations of existing barriers. For years, the export of rare earth magnet know-how—especially for sintered NdFeB (neodymium-iron-boron) magnets—has required case-by-case government approval. The technology has been classified as “dual-use” for over a decade.

In short: what’s presented as a new policy is, in practice, a reassertion of the status quo.

What’s Real and What’s Rhetoric

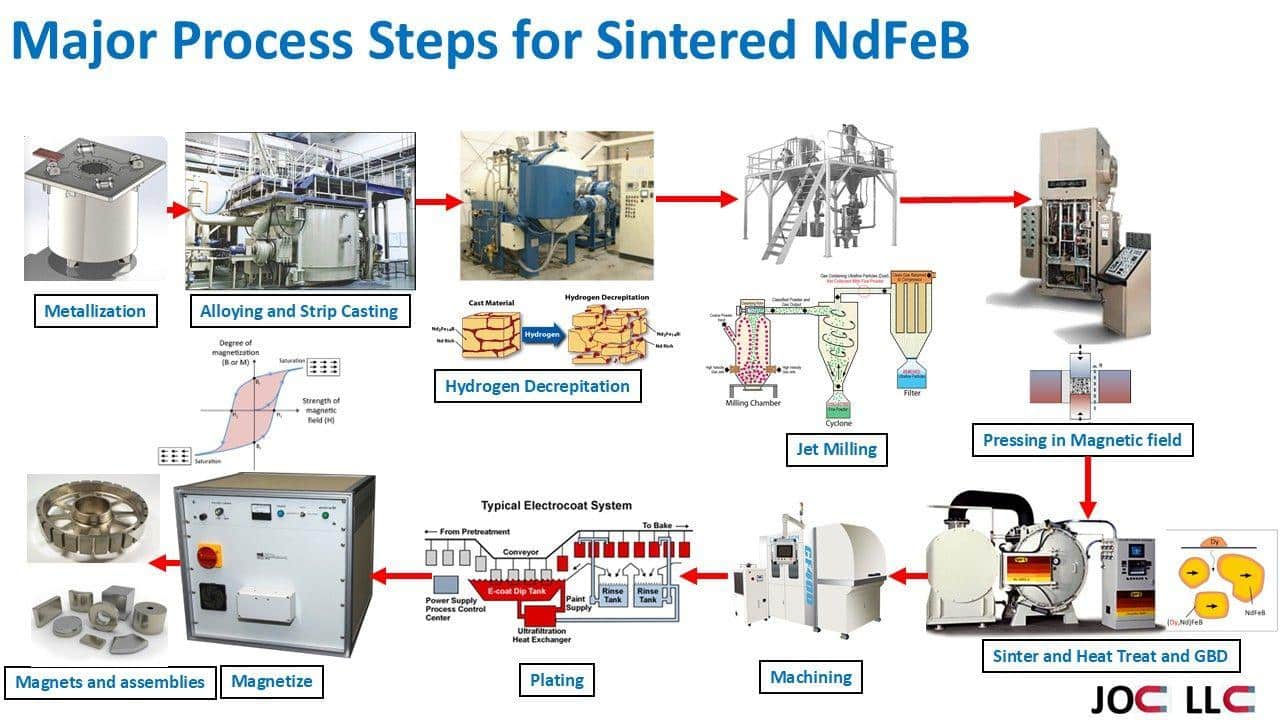

Ormerod’s core message is that the process of making high-performance NdFeB magnets—metallization, strip casting, hydrogen decrepitation, jet milling, magnetic pressing, sintering, machining, plating, and magnetization—is not a Chinese secret.

The image he shared (above) outlines these steps clearly, all of which can be replicated with Western or Japanese equipment. German firms like ALD Vacuum Technologies, Japan’s Tsubame, and the U.S.’s Neo Performance Materials all possess similar process capabilities.

Where China’s advantage lies is not in mysterious technology but ecosystem maturity and integration. Although we have noted that their pace of patents in the rare earth supply chain has accelerated.

Chinese producers command the entire value chain—from oxide feedstock to finished magnet assemblies—at a massive scale and with formidable cost efficiency. This creates an economic moat, not a technological one.

Yet here’s some food for thought about all of this:

| Challenge | Description | Implication for the West |

| Critical Process Know-How | While the equipment may be Western, process optimization—such as powder alignment precision, grain boundary diffusion (GBD), and defect control—is still highly experience-dependent. Much of this tacit expertise remains concentrated in China and Japan. | Western producers face steep learning curves and yield inefficiencies without decades of accumulated operational knowledge. |

| Supply Chain Entrenchment | Western reindustrialization isn’t just about machinery—it requires synchronized investment across mining, refining, alloying, and magnet manufacturing. | The absence of full vertical integration limits scalability, competitiveness, and supply resilience. |

| Economic Fragility | Rebuilding an integrated NdFeB ecosystem in the U.S. or EU would require accepting temporarily higher production and capital costs. | Political impatience and investor risk aversion threaten long-term commitment to domestic rare earth value-chain rebuilding. |

Reading the Tea Leaves

MOFCOM’s move is better understood as strategic signaling. Beijing is reminding the world that it remains the indispensable hub of rare earth magnet production—controlling roughly 90% of global sintered NdFeB output.

It’s a shot across Washington and Brussels’ bows: a quiet warning that any escalation in trade or tech sanctions will have consequences. But it’s not an isolationist gesture—China still profits from global magnet demand. The Chinese need global trade to fuel their economy.

For investors, this means stability with a warning label. The message is: “We can close the gate anytime—but for now, we prefer to keep it ajar.”

Final Take

John Ormerod is right to dismiss the “new tech iron curtain” narrative as hype—but perhaps too quick to suggest the West can simply rebuild. Rare Earth Exchange (REEx) suggests more industrial policy must be embraced by an alliance of allies led by America.

The challenge isn’t knowledge—it’s commitment. The technology cat escaped long ago; what the West needs now is long-term industrial willpower and financial endurance. Unfortunately, consultants can’t solve this particular problem. But they can surely help advise best practices, technology, and the lie. For such advice, see JOC LLC (opens in a new tab).

In the global magnet chessboard, Beijing’s latest move isn’t checkmate—it’s a reminder that China still holds the queen.

Citation: MOFCOM Notification No. 62/2025

©!-- /wp:paragraph -->

0 Comments