Highlights

- Brazil's rare earth exports to China have tripled, but the $6.7 million figure is minimal in the global market.

- Brazil has significant rare earth reserves and emerging projects, but lacks full processing and magnet-making capacity.

- China is diversifying upstream sources.

- Brazil positions itself as a neutral critical mineral player open to multiple strategic alliances.

“The Rio Times (opens in a new tab)” claims Brazil’s rare earth exports to China have “tripled,” signaling a supposed geopolitical pivot away from the U.S. But here’s the fine print: that $6.7 million export figure, while up from prior years, is a drop in the global rare earth bucket. China’s rare earth imports total in the billions, mostly in refined or value-added form. Brazil’s raw export surge—still under $10M—is noteworthy but hardly a tectonic shift in global supply chains. This is likely a headline in search of a hinge.

What’s Real? Resource Potential, Not Market Power (Yet)

The article accurately notes that Brazil has the second-largest known reserves of rare earths, according to USGS estimates. What it fails to underscore is that Brazil’s actual production is minimal, with no major fully integrated rare earth processing or magnet-making capacity—at least not yet. There are definitely emerging projects and seriously rich deposits such as Brazilian Rare Earths (opens in a new tab). Situated on the Atlantic coast near a port and a petroleum refining zone, the publicly traded early-stage group shows promise—but American industrial policy could help accelerate the realization of value, Rare Earth Exchanges (REEx) has suggested.

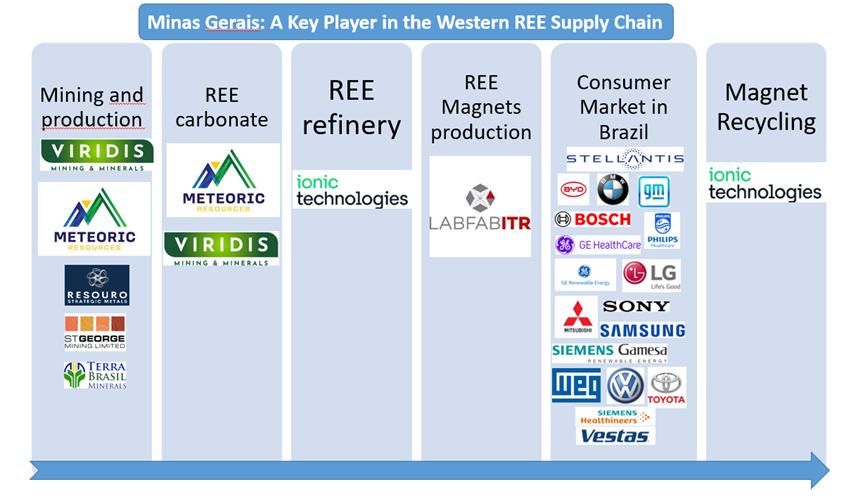

Most rare earth projects, including those in Minas Gerais and Bahia, remain exploration-stage or early pilot operations. In short, China may be buying Brazilian ore or concentrates as part of a broader hedge—but Brazil is not yet a strategic swing producer.

See REEx “Minas Gerais On the Move, Developing a Vertically Integrated Rare Earth Complex.”

Emerging Complex in Minas Gerais? A significant amount of work to go---American industrial policy could help.

U.S.–Brazil Cooling: More Tariffs, Less Ties?

The article injects geopolitical color, claiming that “U.S.–Brazil ties have cooled.” While Washington has launched some trade probes and President Lula has courted Beijing, the notion of a wholesale break from U.S. alignment is overstated and undersourced. U.S. companies remain among the top foreign investors in Brazil’s mining and energy infrastructure, and the U.S. remains a major buyer of Brazilian iron ore, soybeans, and oil. And Brazilian prospectors, on condition of anonymity, have conveyed to Rare Earth Exchanges that while they are in business to provide their shareholders returns, if offers are comparable, they do deals with American interests. Ideologically, the Brazilian mining complex is far more aligned with Washington, DC than Beijing.

Does Uncle Sam want Brazilian rare earth access? He should!

The Real Signal: China Secures Supply, Brazil Still Unaligned

The important takeaway is this: China is hedging, not replacing. With Myanmar’s dysprosium supplies disrupted and trade tensions with the U.S. escalating, China is diversifying its upstream sources, including small flows from Brazil, Africa, and Central Asia. Brazil, meanwhile, is positioning itself as a neutral player in the critical mineral sector, open to both Chinese capital and Western strategic alliances. There’s no clear pivot yet—just quiet hedging on both sides. However, as REEx knows from direct conversations, if American rare earth industrial policy forms an alliance with Brazil, offering comparable prices to China, the miners and processors will move toward America—no question. If they are left to fend for themselves with no American interest, they will eventually align with Beijing.

I****nvestor Takeaway

Brazil’s rare earths story is still in its early chapters. Smart money should watch whether Brazil transitions from mining and mineral shipping to magnet-making—and which geopolitical bloc helps them get there. Remember a Laissez-faire mindset will likely lead to Beijing ownership.

0 Comments