Hightlights

- New study reveals dynamics in the rare earth trade network.

- China, USA, Japan emerge as core competitive players.

- Study highlights dependency and competition forces in global trade.

What’s going on geo politically and economically in the world of rare earth element exchanges? Markets involving the extraction and mining, refining, distribution, and manufacturing involving rare earth inputs for high tech, biomedicine and defense end use products? Xin Zhao (opens in a new tab) affiliated with Anhui University of Finance and Economics in Bengbu, China, and colleagues report that cut-throat competitive forces may be less the norm than observers think. That’s because present analyses, when investigating total volume of rare earth trade, lack output showing competition and dependency dynamics. Enter the present Chinese-led study probing that gap. With the authors employing principles of trade preference and import similarity to construct dependency and competition networks, at least analytical models.

This recent analysis was funded by the Ministry of Education of the People’s Republic of China Humanities and Social Sciences Youth Foundation, the Social Sciences Planning Youth Project of Anhui Province and the Innovation Development Research Project of Anhui Province.

Once such models are in place, these quantitative focused researchers employ complex network analysis to evaluate the evolution of the global rare earth trade network from 2002 to 2018 as reported in Geoscience Frontiers (opens in a new tab).

Source: Geoscience Frontiers

What are the findings?

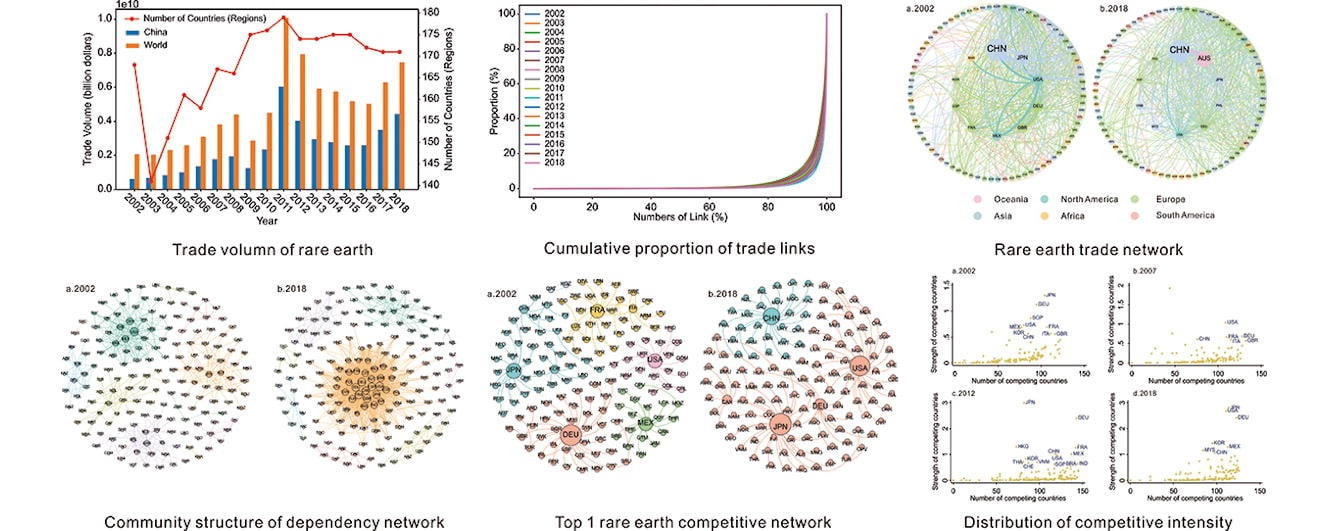

Following the Pareto principle, that is the 80/20 rule the trade network developed evidence of a scale-free distribution, a network whose degree distribution follows a power law, at least asymptotically (approaching a value or curve as closely as possible, or continuously without ever reaching it).

With China as the world’s largest importer and exporter of rare earth since 2017, what happens with the simulated dependency network?

It turns out “China has become the most dependent country since 2006.” What? Is this not a surprise? This outcome is a consequence of community division demonstrating that “China has separated from the American community and formed new communities with the Association of Southeast Asian Nations (ASEAN) countries.”

A powerful rare earth element network block emerged led by the United States of America tied to both European and Asian countries. And in this competitive network, Zhao and colleagues find that “the distribution of competition intensity follows a scale-free distribution.” While a majority of nations are involved with what the authors cite as “low-intensity competition” they also note the emergence of myriad competing countries.

Xin Zhao, PhD, Corresponding Author

Source: ResearchGate

With competition related to China intensifying over the past few years, the rare earth element value chain and corresponding supply chain feeding the United States shifts from Mexico to China of all places. The result: China, the USA, and Japan emerge as core players in the competition network.

What’s the market look like for the duration of the study term?

The global rare earth trade’s scale can be shown to be “fluctuating upward trend of expansion–contraction-expansion” with revenues from this economy growing from $2 billion to $7.5 billion.

Zhao and colleagues point out that “the global rare earth trade follows the Pareto principle (opens in a new tab), where 20% of trade links account for more than 80% of the total trade volume, and the trade network presents a scale-free distribution.” When analyzing all of this data the truly ironic outcome centers on the reality that this global rare earth element exchange represents a “small world”. If key participants such as China, the USA, Japan, and others were to withdraw from the market, the structure of the global rare earth trade network would undergo significant changes, possibly collapsing.

When reviewing the number of dependent relationships, China, the USA, Germany, Japan, and Australia have established the greatest number of dependencies.

With competition intensity following scale-free distribution, a majority of countries face (opens in a new tab) low-intensity competition, with intensifying competitive realities. The Chinese authors point out:

“The competition related to China has increased significantly, and the USA, Japan, and Germany have begun to compete with each other due to their rare earth imports from China. The source of competition for the USA has shifted from Mexico (opens in a new tab) to China, resulting in China, the USA, and Japan becoming the core of the competition network.”

Many questions ensue. What’s the differentiation between different types of rare earth elements and establishing a multi-level trade network that covers various rare earth elements?

What are the externalities of trade networks, including the impacts of rare earth trade on environmental pollution (opens in a new tab) and the upgrading of industrial structure?

Also and importantly a number of other issues need to be studied, from social and community externalities (displacement of local communities, social conflicts, human rights (opens in a new tab) abuses, and labor issues, should also be investigated) all to offer improved insights into the broader implications and consequences of rare earth trade.

0 Comments