Highlights

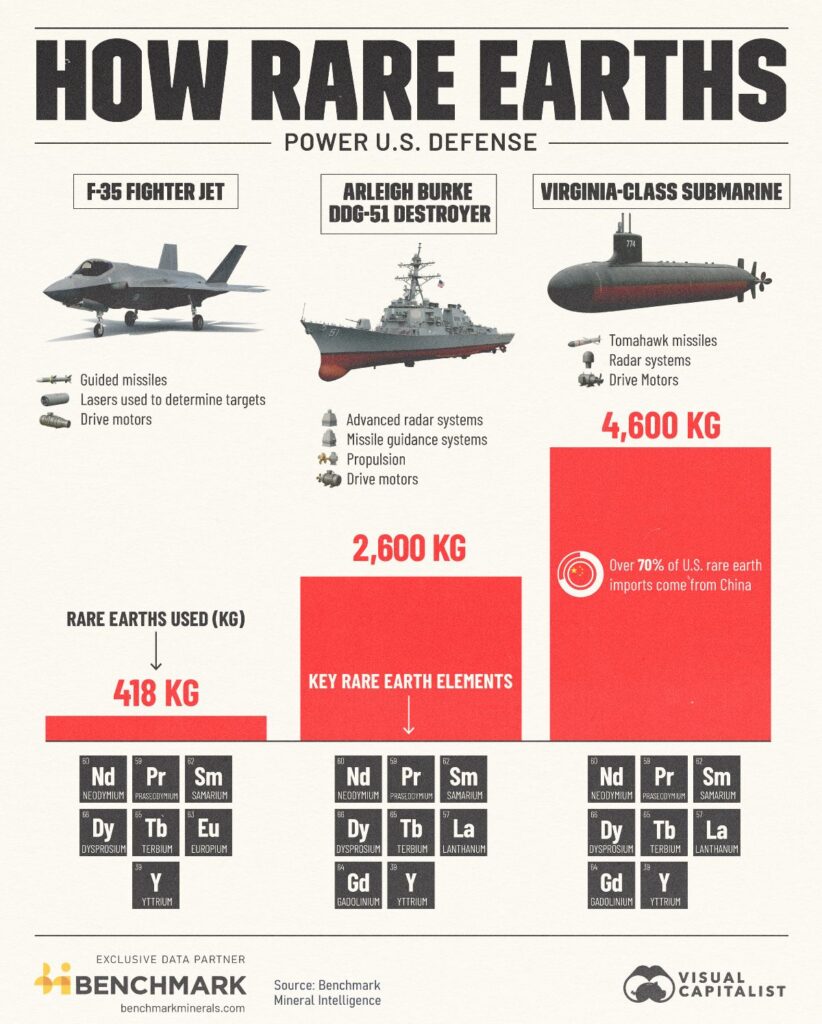

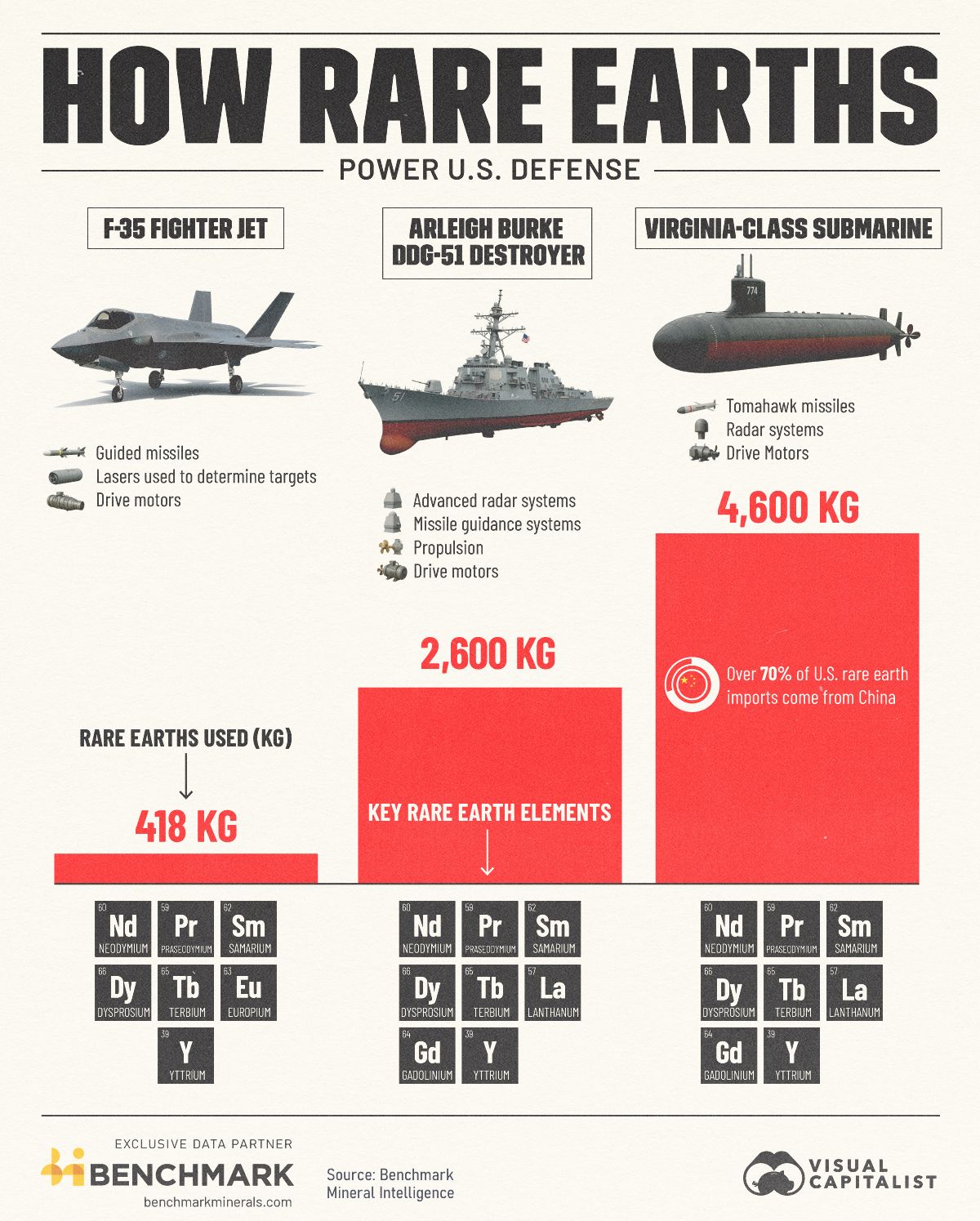

- U.S. military platforms heavily rely on rare earth elements, with specific quantities embedded in destroyers, submarines, and fighter jets.

- China currently dominates U.S. rare earth supply, with over 70% dependency despite ongoing domestic production initiatives.

- Military REE consumption is strategically critical but economically marginal, representing less than 5% of global rare earth demand.

The claim that U.S. military platforms are packed with rare earth elements (REEs) isn’t just true—it’s underscored by technical manuals and procurement specs. Arleigh Burke destroyers (2,600kg REEs), Virginia-class submarines (4,600kg), and F-35 fighter jets (418kg) all depend on REEs for guidance systems, stealth coatings, permanent magnets, and advanced optics. These aren't hypothetical uses—they’re embedded into every system from radar to propulsion.

Rare Earth Exchanges (REEx) reviews a Benchmark Minerals piece highlighting the criticality of defense-related rare earth needs.

The China Chokehold

The U.S. relies heavily on China for REEs—upwards of 70%, depending on the year and category. Despite growing stockpiles and initiatives like the National Defense Stockpile Modernization Act, the U.S. lacks robust domestic refining and magnet manufacturing. The DoD’s partnership with MP Materials, including a $400M preferred equity deal and price floors for NdPr, reflects this strategic urgency. That’s not spin—it’s the brass tacks of industrial policy.

Does Military Demand ≠ Market Salvation

Nuance matters based on our review of a recent Benchmark Mineral piece. Military consumption of REEs is strategically essential, but economically marginal. Even with aggressive DoD magnetization, defense still accounts for less than 5% of total global REE demand. Civilian uses—EV motors, wind turbines, smartphones—drive the lion’s share. So, framing defense demand as the primary growth lever risks misleading investors into overestimating the scale of military-driven market opportunity. But that’s again not to say from a security point of view, access to heavy rare earth elements is of utmost importance at this point.

Missing In Action: Downstream Deficiencies

The recent Benchmark Minerals article name-checks domestic production efforts but skips over a key reality: the U.S. has no commercial-scale rare earth separation or magnet manufacturing. The MP Materials partnership includes ambitions for such capacity, but actual domestic supply chain completion—from mine to magnet—is years away and still dependent on public-private capital and offtake traction. Although a three-year target has been established in the latest deal, that would equate to flawless execution.

Strategic Truth, Market Mythology

This piece isn’t misinformation—but it blurs strategic urgency with market-scale impact. Defense REE demand is real and rising, and DoD backing of MP Materials is a landmark shift. But defense will not—on its own—revive or sustain the U.S. rare earth industry. That lift must come from broader industrial policies and civilian markets. Investors should read between the laser-guided lines.

Source: Benchmark Mineral Intelligence LinkedIn post; REEx analysis of DoD contracts, MP Materials filings, and defense REE demand data.

0 Comments