Highlights

- Sichuan Province has invested RMB 630 million in geological surveys.

- Discoveries include:

- 2.8 million tons of lithium ore

- Six phosphate deposits

- Three graphite finds

- Sichuan controls:

- 76% of China’s titanium resources

- 33% of China’s vanadium resources

- The Panxi Strategic Resource Innovation and Development Pilot Zone aims to create the world’s most vertically integrated vanadium-titanium ecosystem.

- The zone will feature:

- Hydrogen-metallurgy projects

- Vanadium-battery energy storage systems

- Sichuan’s mineral consolidation gives China unprecedented control over multiple critical metals under one provincial umbrella.

- This poses challenges to Western decoupling strategies, which must now address a diversified regional industrial cluster rather than single-metal risks.

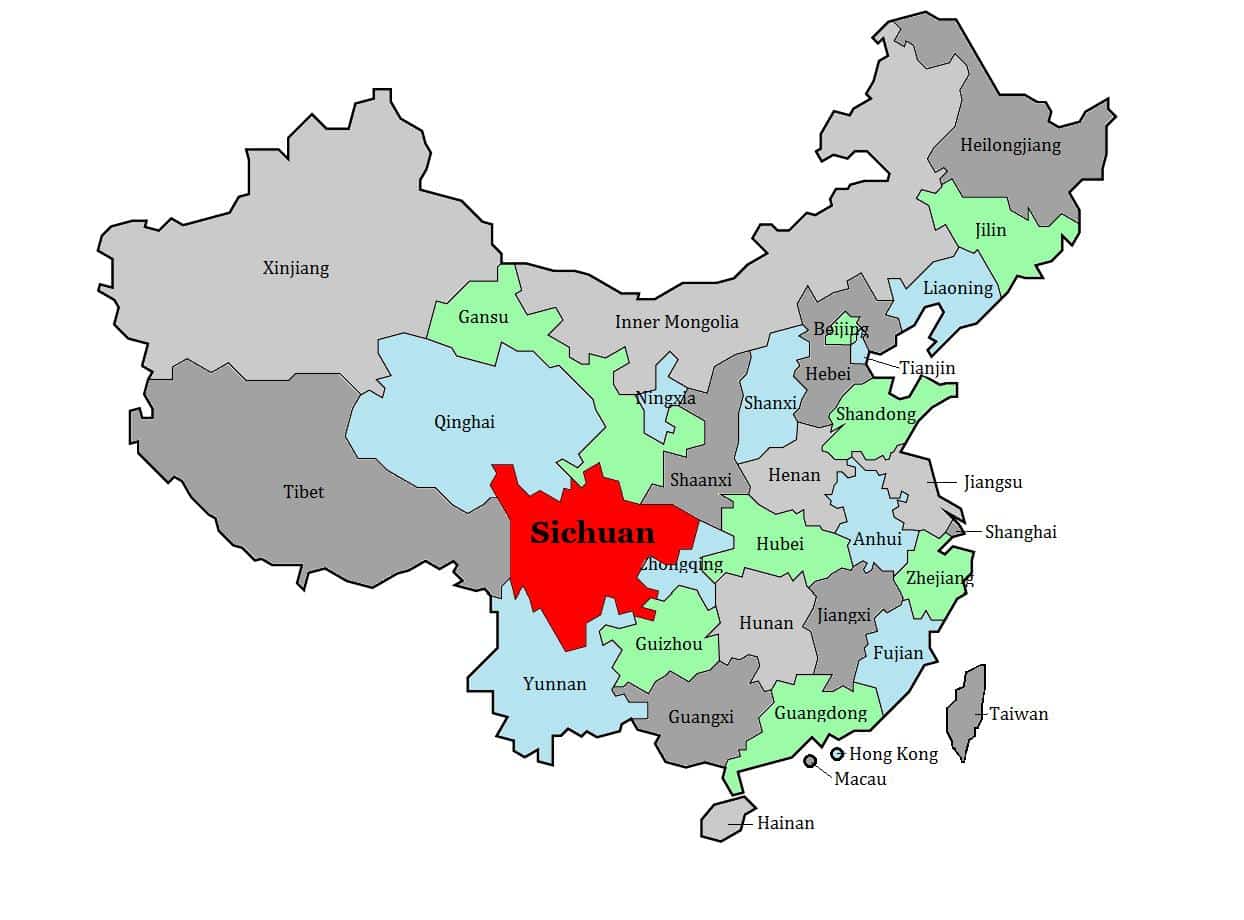

A place where titanium, vanadium, and rare earths converge. Sichuan Province, long famed for pandas and peppercorns, is now roaring to life as one of China’s most strategically important mineral strongholds. Since the start of the 14th Five-Year Plan, the province has poured RMB 630 million (≈ USD 88.7 million) into geological surveys—quadruple its previous five-year spend—and the results are staggering: three new graphite deposits, six phosphate finds, and 2.8 million tons of spodumene (lithium ore) have been confirmed. Rare-earth, gold, and oil-gas reserves are rising in tandem.

Sichuan already controls 76.2 % of China’s titanium resources and nearly a third of its vanadium, producing 80 % of national titanium concentrate, 60 % of vanadium output, and 20 % of hard-rock rare earths. These numbers cement its role as Beijing’s mineral insurance policy at a time when global supply chains remain brittle and Western projects face permitting fatigue.

The Panxi Pivot—Engineering a Mineral Future

At the heart of this strategy lies the Panxi Strategic Resource Innovation and Development Pilot Zone—China’s only comprehensive resource-utilization pilot. It’s being cast as a crucible for vanadium-titanium materials, energy storage, and metallurgical innovation. The plan calls for pilot hydrogen-metallurgy projects in Panzhihua and Neijiang, titanium-slag extraction from blast-furnace waste, and new vanadium-battery energy-storage systems—all aligning with China’s dual carbon and industrial-tech agendas.

If executed, Panxi could become the world’s most vertically integrated vanadium-titanium ecosystem—from ore to alloy to battery. For U.S. policymakers and Western producers struggling to finance similar integration, that’s a wake-up call.

What Rings True, and What’s Projection

Accurate: Sichuan’s dominance in titanium and vanadium is well-documented by multiple Chinese geological surveys and industry data. The investment figures and resource percentages match historical baselines.

Speculative: Claims of Sichuan’s imminent “global hub” status should be read through a policy lens. The province’s infrastructure is formidable, but export restrictions and domestic consumption priorities mean much of this output may stay onshore.

Bias Check: The state-aligned narrative emphasizes technological self-reliance and “green metallurgy,” glossing over environmental and local-community costs that typically accompany such rapid industrialization.

Why Investors Should Care

For global markets, Sichuan’s surge consolidates China’s grip not only on rare-earth separation but on upstream critical-metal diversity—lithium, vanadium, titanium, phosphate, and graphite all under one provincial umbrella. Western decoupling strategies must now factor not a single-metal risk, but a regional industrial cluster capable of feeding everything from EV cathodes to hypersonic alloys.

Disclaimer: This report is based on Chinese media (Asian Metal News (opens in a new tab)) and should be independently verified.

©

0 Comments