Highlights

- Hard-rock rare earth projects face higher costs ex-China but remain viable.

- Ion-adsorption clay deposits face existential execution risk due to China's decades of operational expertise.

- China's true advantage isn't in chemicals or equipment access—it's in undocumented process memory, separation tuning, and operational know-how developed over decades.

- Ion-adsorption clay projects deserve materially higher risk weighting than conventional deposits.

- No large-scale commercial operations exist outside China with proven ESG-compliant processes for ion-adsorption clay projects.

When investors and policymakers talk about China’s dominance in rare earths, the conversation usually fixates on export controls, quotas, or sudden regulatory shocks. That framing is comforting—and incomplete. The deeper exposure is not legal or transactional. It is structural, operational, and unevenly distributed across deposit types.

Most rare earth projects outside China are not blocked by Chinese supply chains. One category, however, remains fundamentally constrained in ways that capital alone cannot easily solve.

Table of Contents

Chemicals and Hardware: Expensive ex-China, Not Impossible

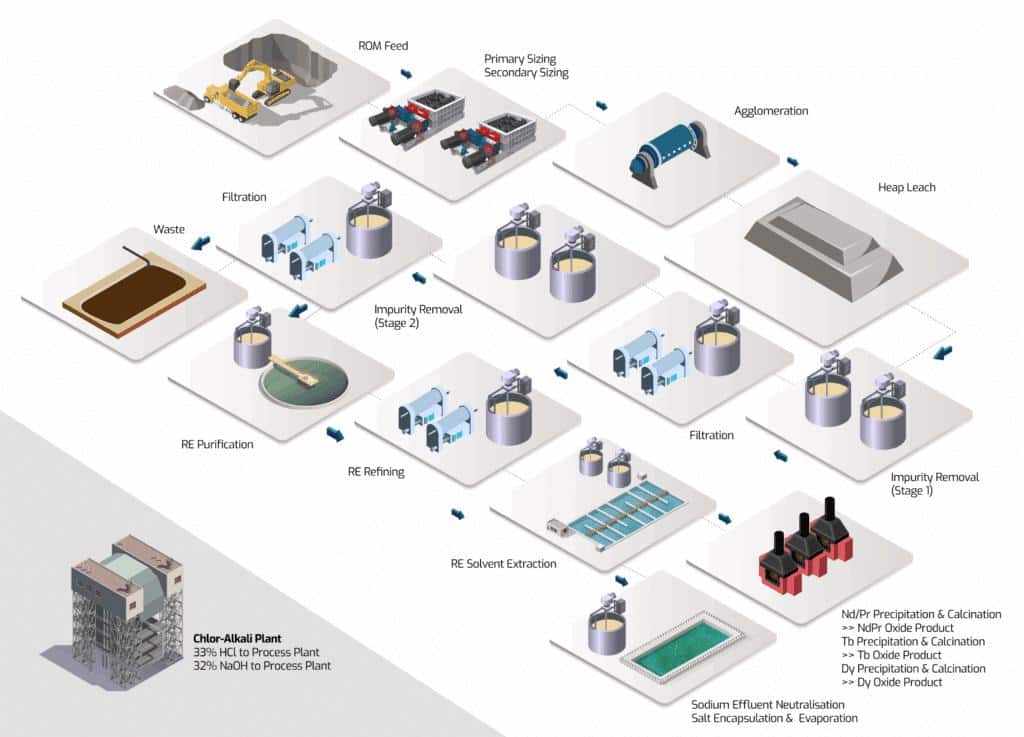

For conventional hard-rock rare earth projects—carbonatites, monazite sands, alkaline intrusives—the core processing inputs are globally available.

Solvent-extraction reagents such as D2EHPA, P507 / PC-88A families, and scrub/wash chemicals are not patented or legally restricted to China. Western and Japanese suppliers exist. Likewise, pumps, filters, mixer-settlers, and hydrometallurgical plant hardware can be engineered and built by non-Chinese EPCs.

The trade-off is not access. It is economics.

- Ex-China reagent capacity issmaller

- Custom blends cost more

- Lead times are longer

- EPC delivery is materially more expensive

- Operating costs are structurally higher

The result is margin pressure—not project infeasibility. Hard-rock rare earth projects outside China will not vanish because of supply chain access. They will simply require higher breakeven prices, strategic offtakes, and, in many cases, government co-investment to clear the hurdle.

Where China Exposure Becomes Structural: Ion-Adsorption Clays

Ion-adsorption clay (IAC) deposits—the source of much of the world’s dysprosium, terbium, and yttrium—are different in kind, not degree.

These deposits do not rely on conventional crushing, grinding, and flotation. Instead, production depends on:

- In-situ or heap leaching

- Low-cost chemical circulation

- Highly site-specific fluid control

- Informal, experience-driven operating practices

This production system was developed, scaled, and refined almost entirely in southern China over decades.

Outside China, the gaps are stark:

- No large-scale commercial IAC operations

- No standardized EPC designs

- ESG-compliant process variants remain experimental

- Separation yields and environmentalperformance are unproven

Even where pilot programs exist, developers are effectively rebuilding an industry from first principles—without China’s labor pool, cost base, or accumulated operational muscle memory.

Know-How, Not Molecules, Is the Real Moat

China’s most durable advantage in rare earths is not chemistry. It is process memory.

That advantage includes:

- Stage-by-stage solvent-extraction tuning

- Recovery optimization under razor-thin margins

- Rapidtroubleshooting of separation instability

- Experience managing thousands of SX stages

- Decades of trial-and-error learning that is rarely documented

Western plants can buy Western reagents and Western equipment and still struggle to achieve stable purity, recovery, and uptime. For ion-adsorption clays, that performance gap widens dramatically.

What This Means for Project Risk

The implications are uncomfortable but clarifying:

- Hard-rock rare earth projects face higher capex and opex ex-China—but remain viable

- Ion-adsorption clay projects outside China face existential execution risk, not just higher costs

Treating all rare earth projects as carrying the same “China risk” obscures where fragility truly lies.

Why This Matters for Rankings and Capital Allocation

At Rare Earth Exchanges™, this distinction is central. Deposit type, processing pathway, and China substitution risk must be assessed explicitly—not assumed.

Ion-adsorption clay projects deserve a materially higher risk weighting than conventional hard-rock projects, regardless of headline grades or heavy rare-earth content.

The next phase of ex-China rare earth supply chain development will be expensive—but achievable. The exception remains ion-adsorption clays, where China’s advantage is structural, operational, and deeply embedded.

Understanding that difference is not academic. It is decisive—for investors, offtakers, policymakers, and anyone serious about building a resilient rare earth supply chain outside China.

1 Comment

1 reply

Loading new replies...

New member

Join the full discussion at the Rare Earth Exchanges Forum →