Highlights

- REEs are broadly abundant in Earth's crust, but their nearly identical chemical properties make separation extraordinarily complex—explaining why China dominates processing, not just mining.

- The Oddo-Harkins rule shows even-numbered REEs are more abundant than odd-numbered ones, while heavy rare earths critical for magnets remain naturally scarce, magnifying geopolitical leverage.

- Diversifying supply requires mastering midstream separation at scale, not merely opening new mines—demanding process innovation, patient capital, and integrated planning from ore to magnets.

A foundational scientific analysis by Pieter Thyssen (opens in a new tab) and Koen Binnemans (opens in a new tab)—originally published in Handbook on the Physics and Chemistry of Rare Earths—helps explain a paradox that continues to shape today’s critical-minerals geopolitics: rare earth elements (REEs) are broadly abundant in Earth’s crust, yet the world remains overwhelmingly dependent on China to process them. By unpacking why REEs occur together, why some are plentiful while others are scarce, and why separating them is so technically demanding, the study offers a clear scientific backdrop to China’s enduring dominance in rare-earth processing.

Rare Earth Exchanges credits Professor Binnemans for recently raising the subject to continue to educate new generations pursuing rare earth element supply chain resilience.

Oddo–Harkins rule

The Science, in Plain Terms: Abundant—but Uneven

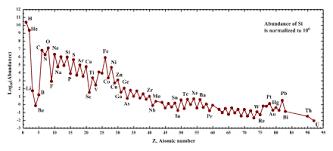

Plot the REEs by abundance and a distinctive zigzag curve appears. Elements with even atomic numbers (like neodymium) are more abundant than their odd-numbered neighbors (like praseodymium)—a pattern known as the Oddo–Harkins rule, (opens in a new tab) rooted in nuclear stability. Another key trend: light rare earths (LREEs) are far more abundant than heavy rare earths (HREEs). And one “missing” element—promethium (opens in a new tab)—doesn’t occur naturally in any stable or economically meaningful form because it lacks long-lived isotopes.

These patterns aren’t quirks of mining; they arise from stellar nucleosynthesis—the way elements form in stars and supernovae. In short, nature produces more of the lighter REEs and far less of the heavier, strategically vital ones.

Why Geology Becomes a Processing Problem

Crucially, REEs occur together in the same minerals and share nearly identical chemical properties. That similarity made them notoriously hard to separate historically—and it still does. While REEs are present across many regions, economic value depends on separation, not extraction alone. Producing high-purity oxides (and then metals) requires complex solvent extraction, ion exchange, and precise waste handling—steps that are capital-intensive, environmentally sensitive, and technologically demanding.

How This Explains China’s Processing Dominance

China didn’t achieve dominance because it has the only REE resources. It achieved it by building the world’s most complete processing ecosystem—from separation to refining to downstream materials—over decades. The scientific reality described by Thyssen and Binnemans explains why this matters:

- HREE scarcity magnifies leverage: elements like dysprosium and terbium are rare by nature and indispensable for high-performance magnets.

- Co-occurrence means you can’t selectively mine “just the valuable one.” You must separate everything.

- Process complexity rewards scale, experience, and tolerance for environmental risk—advantages China cultivated early, and frankly, continues to invest heavily to maintain.

The result is a structural bottleneck: many countries can mine REE-bearing ores, but few can separate them at scale.

Implications for Industry and Policy

This important paper from a decade ago underscores a hard truth for policymakers and investors: diversifying supply requires mastering separation, not merely opening new mines. Without domestic or allied processing capacity, new upstream projects risk reinforcing the same downstream dependency. It also explains why export controls or licensing changes in China reverberate so quickly through aerospace, EVs, semiconductors, and defense supply chains.

For Western strategies, the science implies three priorities:

- Process innovation (including alternative chemistries and recycling),

- Patient capital for midstream facilities,

- Integrated planning that links mining to magnets—not just concentrates to ports.

Limitations and Contested Interpretations

The paper is theoretical and historical, not a market forecast. It explains why the system looks the way it does; it does not prescribe the fastest fix. It also does not quantify environmental trade-offs of processing outside China—an issue central to public acceptance in the U.S. and Europe. Some critics argue that emerging technologies could compress timelines; others counter that scale, permitting, and cost remain binding constraints.

Bottom Line

Rare earths are not rare—but separating them is. The elemental physics described by Thyssen and Binnemans helps explain why China’s processing dominance persists despite global resource abundance. Until alternative processing ecosystems reach scale, the choke point remains firmly midstream.

Source: Thyssen, P., & Binnemans, K. Accommodation of the Rare Earths in the Periodic Table: A Historical Analysis. Handbook on the Physics and Chemistry of Rare Earths, Vol. 41 (Elsevier); HAL open-access version (submitted Feb 6, 2024).

© 2025 Rare Earth Exchanges™ – Accelerating Transparency, Accuracy, and Insight Across the Rare Earth & Critical Minerals Supply Chain.

0 Comments